Question: Exercise: Risk Return I Instructions: You are allowed to work in groups of 2-4 students, but you must submit the exercise individually on iLearn before

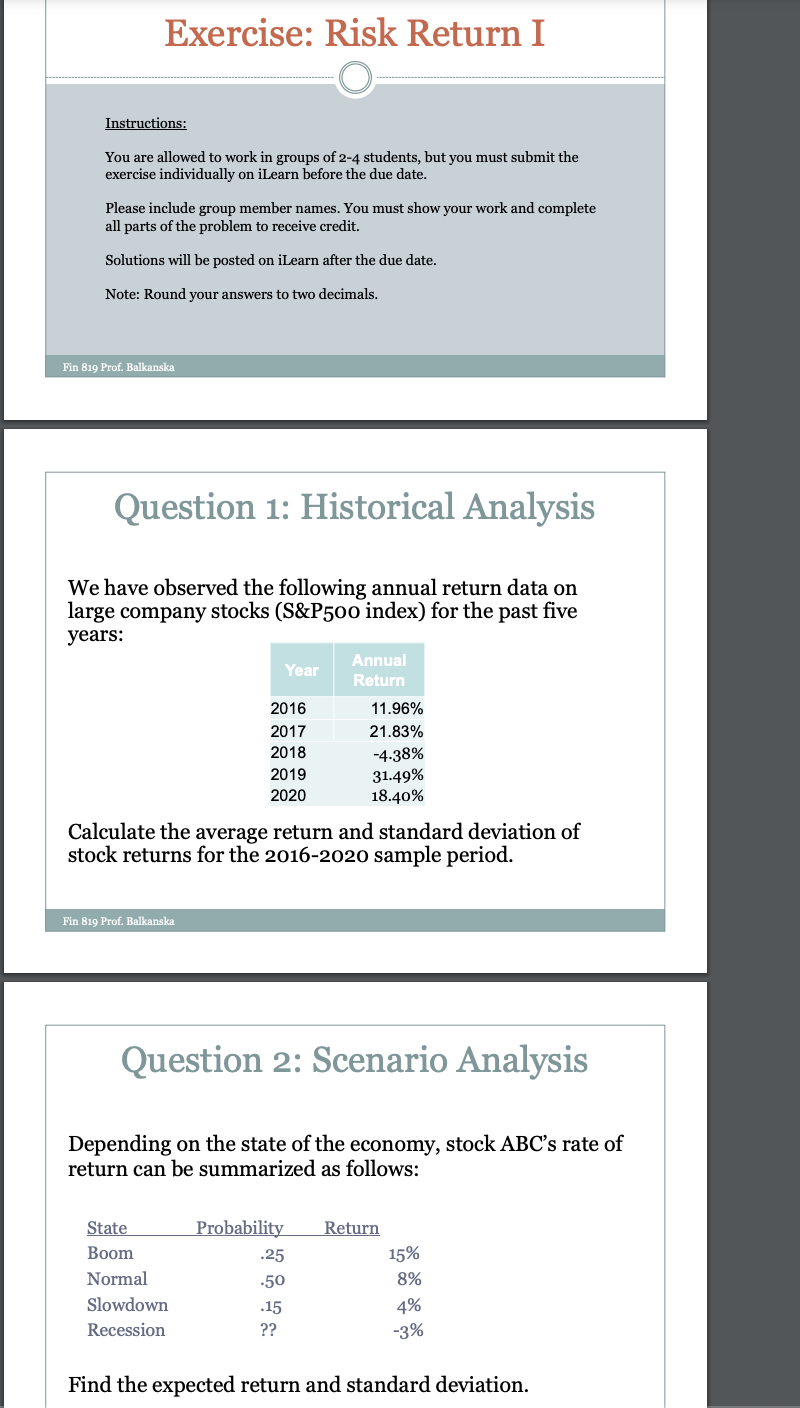

Exercise: Risk Return I Instructions: You are allowed to work in groups of 2-4 students, but you must submit the exercise individually on iLearn before the due date. Please include group member names. You must show your work and complete all parts of the problem to receive credit. Solutions will be posted on iLearn after the due date. Note: Round your answers to two decimals. Fin 819 Prof. Balkanska Question 1: Historical Analysis We have observed the following annual return data on large company stocks (S&P500 index) for the past five years: Annual Year Return 2016 11.96% 2017 21.83% 2018 -4.38% 2019 31.49% 2020 18.40% Calculate the average return and standard deviation of stock returns for the 2016-2020 sample period. Fin 819 Prof. Balkanska Question 2: Scenario Analysis Depending on the state of the economy, stock ABC's rate of return can be summarized as follows: Return Probability .25 State Boom Normal Slowdown Recession -50 .15 ?? 15% 8% 4% -3% Find the expected return and standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts