Question: Exercise: WACC Instructions: You are allowed to work in groups of 2-4 students, but you must submit the exercise individually on iLearn before the due

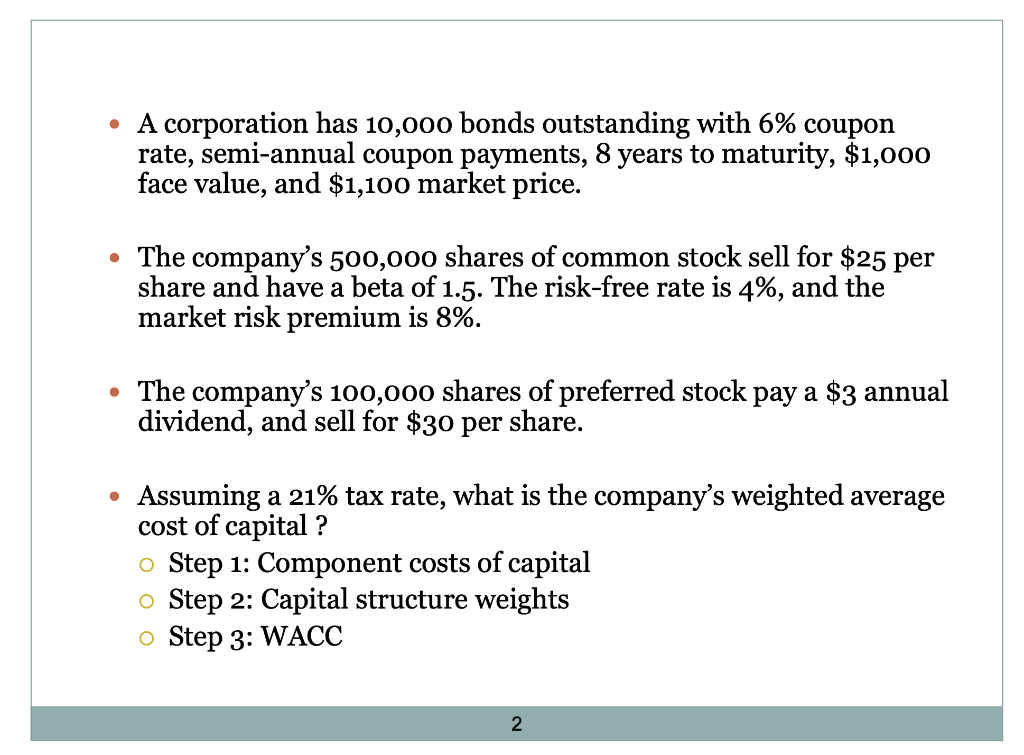

Exercise: WACC Instructions: You are allowed to work in groups of 2-4 students, but you must submit the exercise individually on iLearn before the due date. Please include group member names. You must show your work and complete all parts of the problem to receive credit. Solutions will be posted on iLearn after the due date. Note: Round your answers to two decimals. Fin 351 Prof. Balkanska A corporation has 10,000 bonds outstanding with 6% coupon rate, semi-annual coupon payments, 8 years to maturity, $1,000 face value, and $1,100 market price. The company's 500,000 shares of common stock sell for $25 per share and have a beta of 1.5. The risk-free rate is 4%, and the market risk premium is 8%. . The company's 100,000 shares of preferred stock pay a $3 annual dividend, and sell for $30 per share. . Assuming a 21% tax rate, what is the company's weighted average cost of capital ? o Step 1: Component costs of capital o Step 2: Capital structure weights o Step 3: WACC 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts