Question: Exercise: Techniques for hedging receivable: Assume that Coleman Co., Inc expects to receive 70 million euros. Coleman Co, Inc has to decide whether protect their

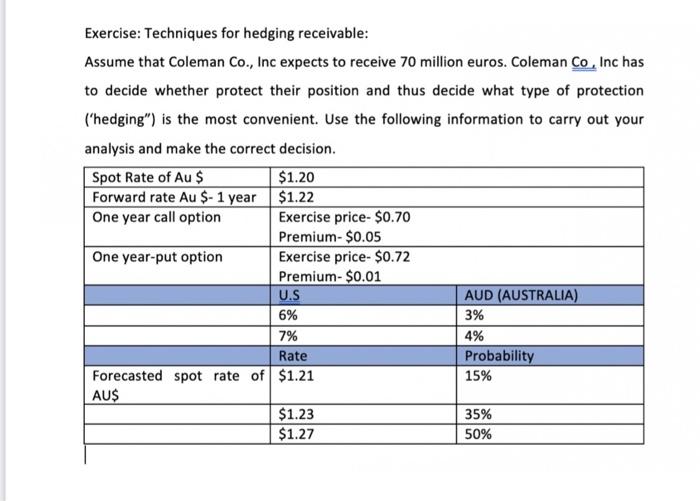

Exercise: Techniques for hedging receivable: Assume that Coleman Co., Inc expects to receive 70 million euros. Coleman Co, Inc has to decide whether protect their position and thus decide what type of protection ('hedging") is the most convenient. Use the following information to carry out your analysis and make the correct decision. Spot Rate of Au $ $1.20 Forward rate Au $- 1 year $1.22 One year call option Exercise price - $0.70 Premium - $0.05 One year-put option Exercise price - $0.72 Premium - $0.01 AUD (AUSTRALIA) 6% 3% 7% 4% Rate Probability Forecasted spot rate of $1.21 15% AUS $1.23 35% $1.27 50% U.S

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock