Question: Exercises 2 - 1 1 Computing and interpreting manufacturing unit costs. Massachusetts Office Products ( MOP ) produces three different paper products at its Vaasa

Exercises

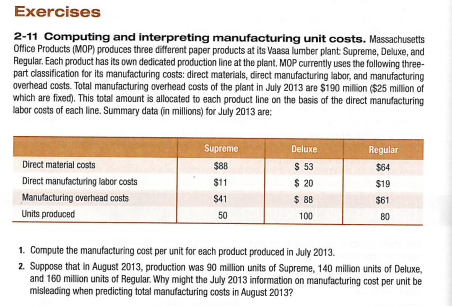

Computing and interpreting manufacturing unit costs. Massachusetts

Office Products MOP produces three different paper products at its Vaasa lumber plant Supreme, Deluxe, and

Regular. Each product has its own dedicated production line at the plant. MOP currently uses the following three

part classification for its manufacturing costs: direct materials, direct manufacturing labor, and manufacturing

overhead costs. Total manufacturing overhead costs of the plant in July are $ million $ million of

which are fixed This total amount is allocated to each product line on the basis of the direct manufacturing

labor costs of each line. Summary data in millions for July are:

Compute the manufacturing cost per unit for each product produced in July

Suppose that in August production was million units of Supreme, million units of Deluxe,

and million units of Regular. Why might the July information on manufacturing cost per unit be

misleading when predicting total manulacturing costs in August

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock