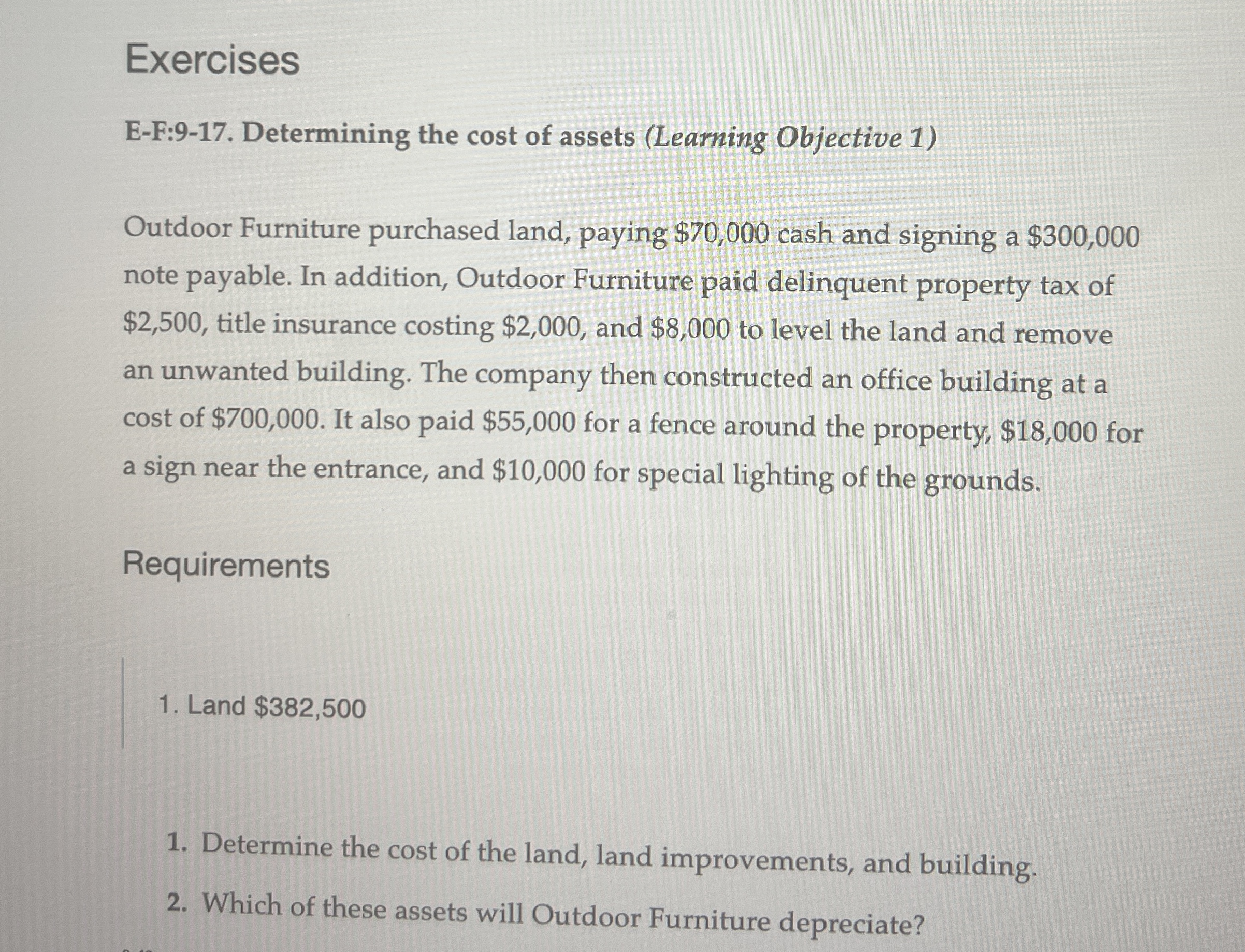

Question: Exercises E - F: 9 - 1 7 . Determining the cost of assets ( Learning Objective 1 ) Outdoor Furniture purchased land, paying $

Exercises

EF: Determining the cost of assets Learning Objective

Outdoor Furniture purchased land, paying $ cash and signing a $

note payable. In addition, Outdoor Furniture paid delinquent property tax of

$ title insurance costing $ and $ to level the land and remove

an unwanted building. The company then constructed an office building at a

cost of $ It also paid $ for a fence around the property, $ for

a sign near the entrance, and $ for special lighting of the grounds.

Requirements

Land $

Determine the cost of the land, land improvements, and building.

Which of these assets will Outdoor Furniture depreciate?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock