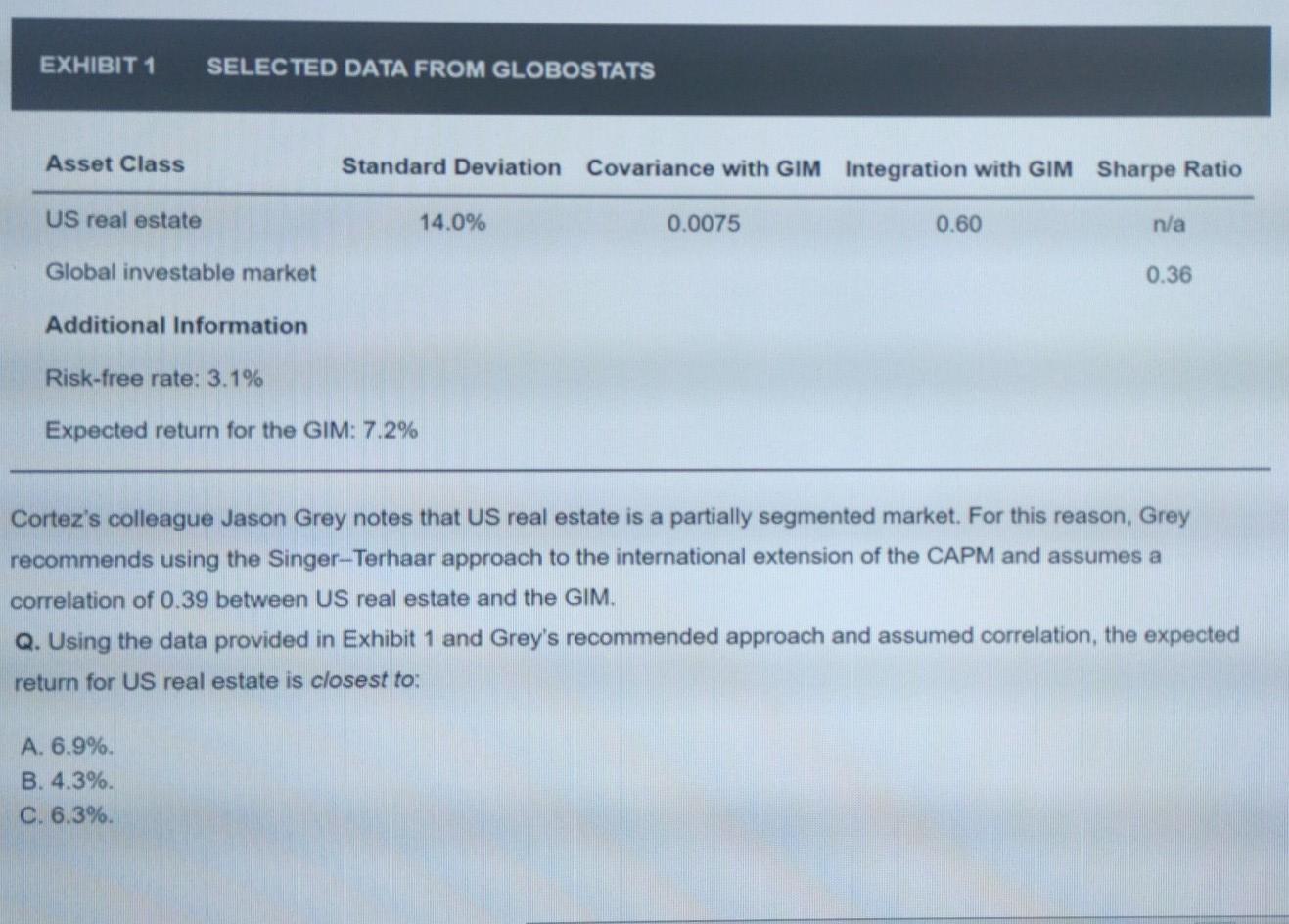

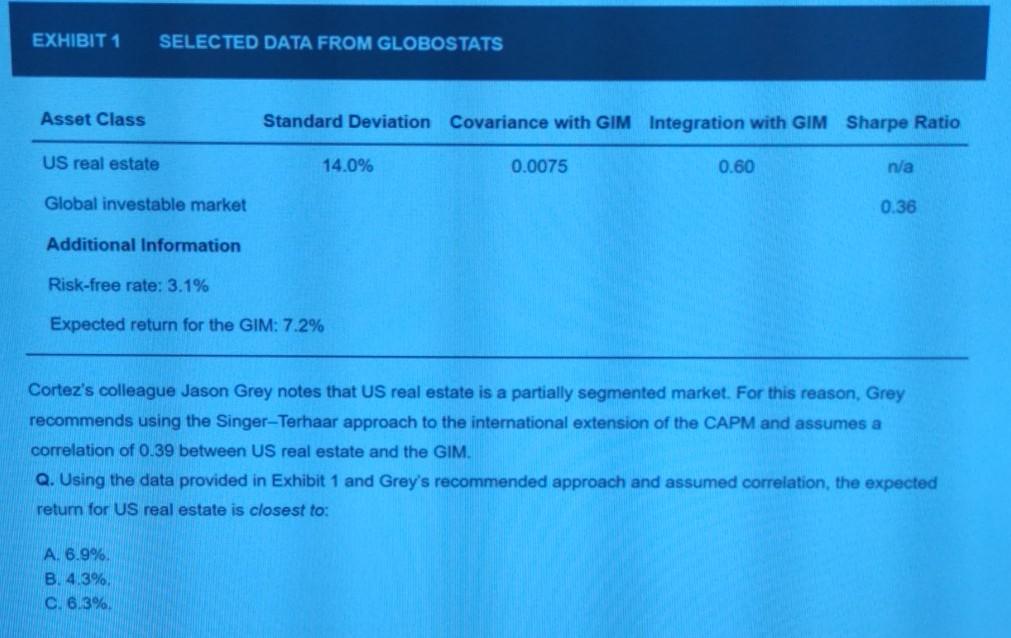

Question: EXHIBIT 1 SELECTED DATA FROM GLOBOSTATS Asset Class Standard Deviation Covariance with GIM Integration with GIM Sharpe Ratio US real estate 14.0% 0.0075 0.60 n/a

EXHIBIT 1 SELECTED DATA FROM GLOBOSTATS Asset Class Standard Deviation Covariance with GIM Integration with GIM Sharpe Ratio US real estate 14.0% 0.0075 0.60 n/a Global investable market 0.36 Additional Information Risk-free rate: 3.1% Expected return for the GIM: 7.2% Cortez's colleague Jason Grey notes that US real estate is a partially segmented market. For this reason. Grey recommends using the Singer-Terhaar approach to the international extension of the CAPM and assumes a correlation of 0.39 between US real estate and the GIM. Q. Using the data provided in Exhibit 1 and Grey's recommended approach and assumed correlation, the expected return for US real estate is closest to: A. 6.9% B. 4.3% C. 6.3%. EXHIBIT 1 SELECTED DATA FROM GLOBOSTATS Asset Class Standard Deviation Covariance with GIM Integration with GIM Sharpe Ratio US real estate 14.0% 0.0075 0.60 n/a Global investable market 0.36 Additional Information Risk-free rate: 3.1% Expected return for the GIM: 7.2% Cortez's colleague Jason Grey notes that US real estate is a partially segmented market. For this reason, Grey recommends using the Singer-Terhaar approach to the international extension of the CAPM and assumes a correlation of 0.39 between US real estate and the GIM. Q. Using the data provided in Exhibit 1 and Grey's recommended approach and assumed correlation, the expected return for US real estate is closest to: A. 6.9% B.4.3% C. 6.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts