Question: Exhibit 1.8 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM The annual rates of return of Stock Z for the last four years are 0.10,

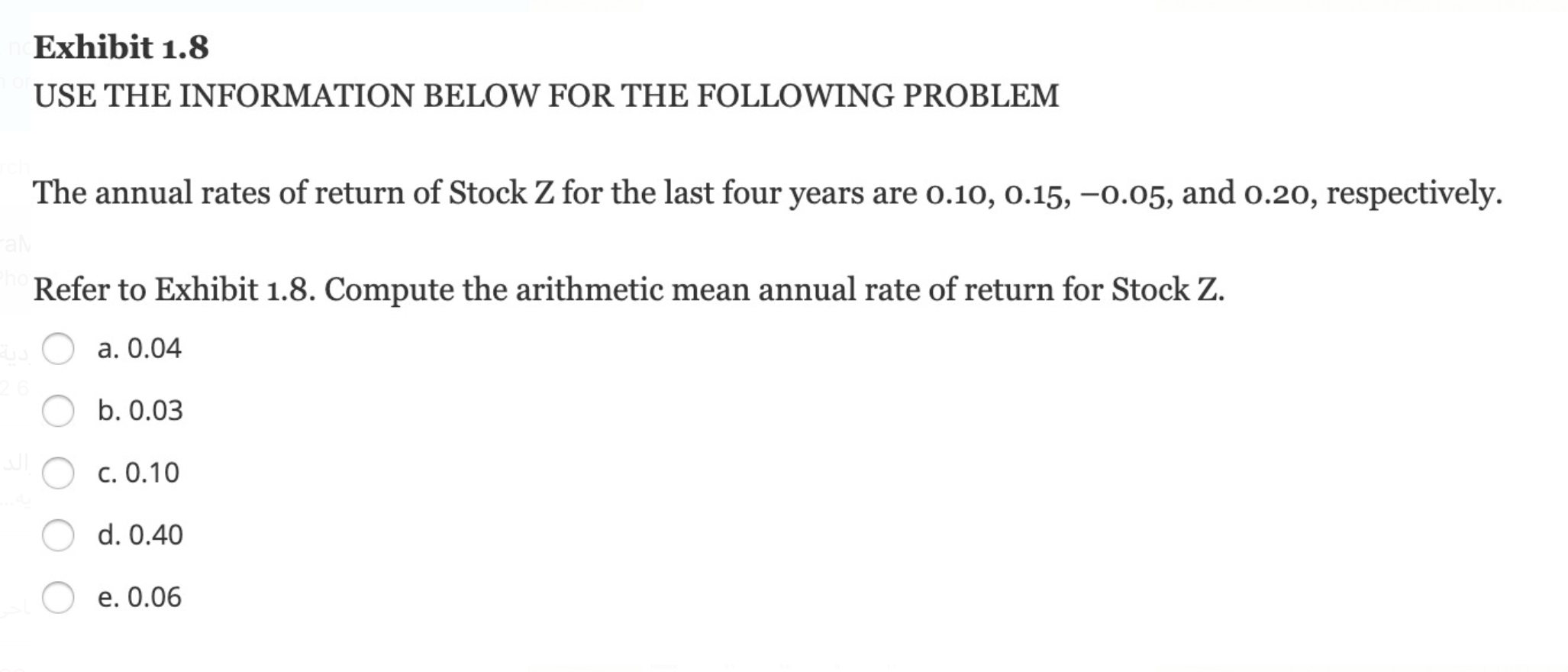

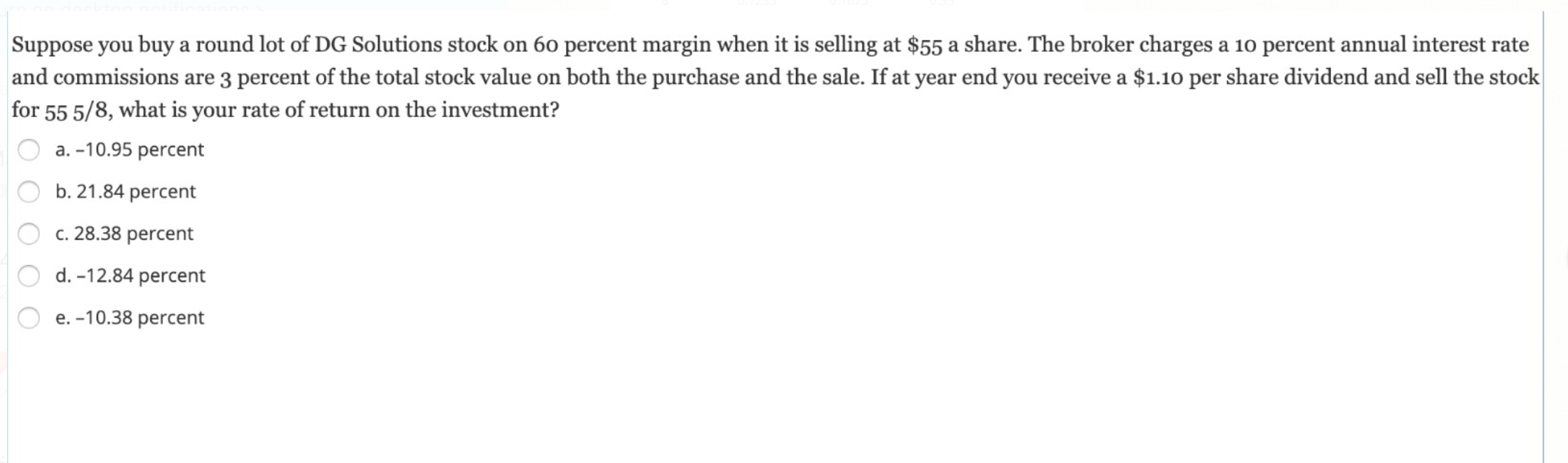

Exhibit 1.8 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively. Refer to Exhibit 1.8. Compute the arithmetic mean annual rate of return for Stock Z. a. 0.04 b. 0.03 C. 0.10 d. 0.40 e. 0.06 Suppose you buy a round lot of DG Solutions stock on 60 percent margin when it is selling at $55 a share. The broker charges a 10 percent annual interest rate and commissions are 3 percent of the total stock value on both the purchase and the sale. If at year end you receive a $1.10 per share dividend and sell the stock for 55 5/8, what is your rate of return on the investment? a. -10.95 percent b. 21.84 percent c. 28.38 percent d.-12.84 percent e. -10.38 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts