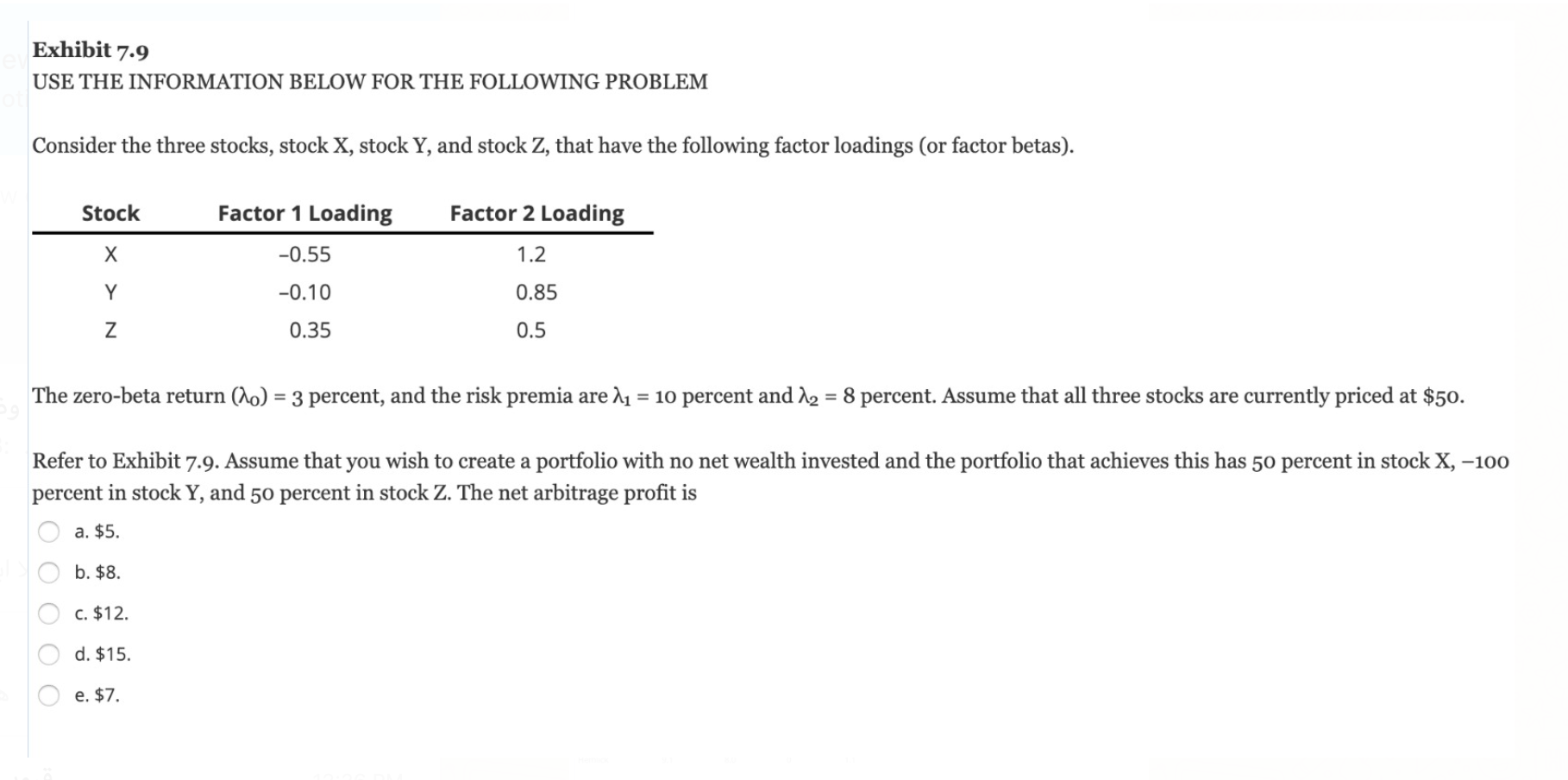

Question: Exhibit 7.9 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM Consider the three stocks, stock X, stock Y, and stock Z, that have the following

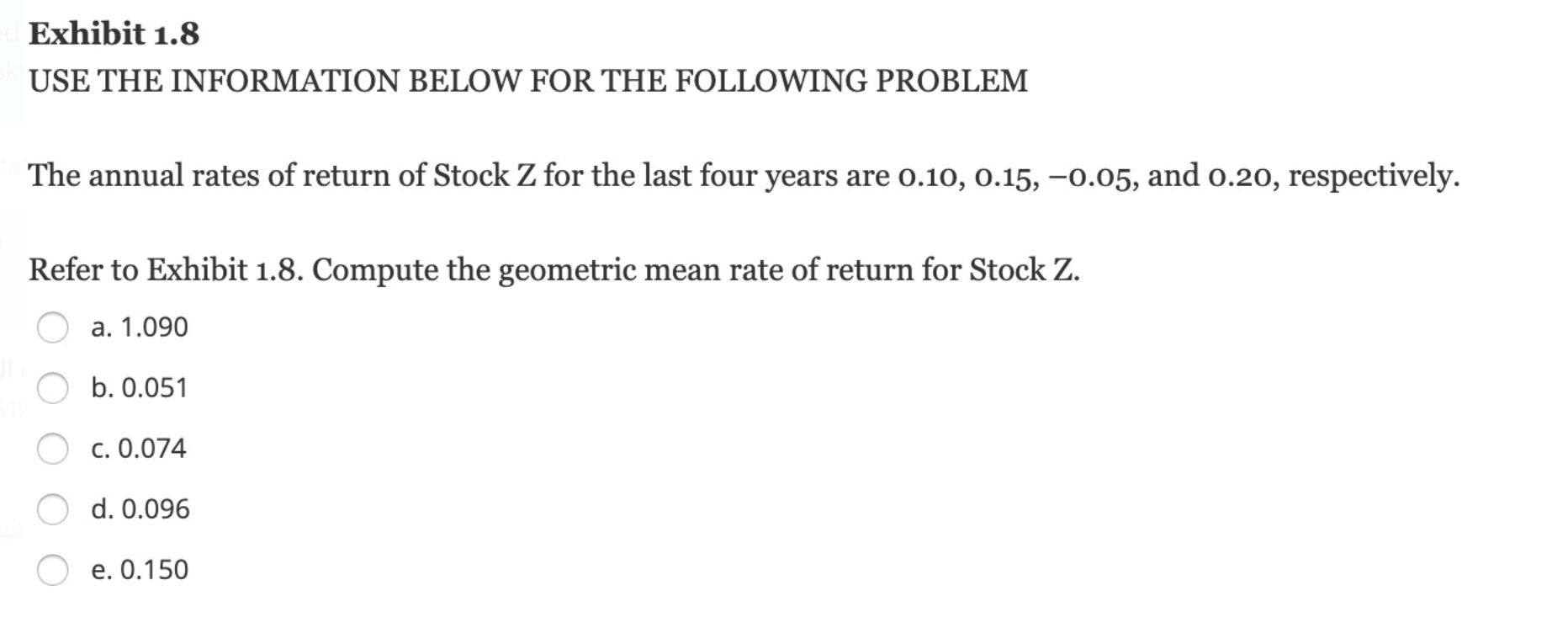

Exhibit 7.9 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas). Stock Factor 1 Loading Factor 2 Loading -0.55 1.2 Y -0.10 0.85 Z 0.35 0.5 The zero-beta return (20) = 3 percent, and the risk premia are 21 = 10 percent and 12 = 8 percent. Assume that all three stocks are currently priced at $50. Refer to Exhibit 7.9. Assume that you wish to create a portfolio with no net wealth invested and the portfolio that achieves this has 50 percent in stock X, -100 percent in stock Y, and 50 percent in stock Z. The net arbitrage profit is a. $5. b. $8. c. $12. d. $15. e. $7. Exhibit 1.8 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively. Refer to Exhibit 1.8. Compute the geometric mean rate of return for Stock Z. a. 1.090 b. 0.051 c. 0.074 d. 0.096 e. 0.150

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts