Question: EXHIBIT 2 - 5 Dickson Company: An Example Using Multiple Predetermined Overhead Rates Step 1 : Calculate the estimated total manufacturing overhead cost for each

EXHIBIT Dickson Company: An Example Using Multiple Predetermined Overhead Rates

Step : Calculate the estimated total manufacturing overhead cost for each department.

Milling Department Overhead Cost Y $$ per MH times MHs

$ $

$

Assembly Department Overhead Cost Y $$ per DLH times DLHs

$ $

$

Step : Calculate the predetermined overhead rate in each department.

Milling Department Overhead Rate $ machinehours

$ per machinehour

Assembly Department Overhead Rate $ direct laborhours

$ per direct laborhour

Step : Calculate the amount of overhead applied from both departments to Job

Milling Department: Overhead Applied to Job

$ per MH times MHs

$

Assembly Department: Overhead Applied to Job

$ per DLH times DLHs

$

Step : Calculate the total job cost for Job

Milling Assembly Total

Direct materials $ $ $

Direct labor $ $

Manufacturing overhead applied $ $

Total cost of Job $

Step : Calculate the selling price for Job

Total cost of Job $

Markup $times

Selling price of Job $ Required information

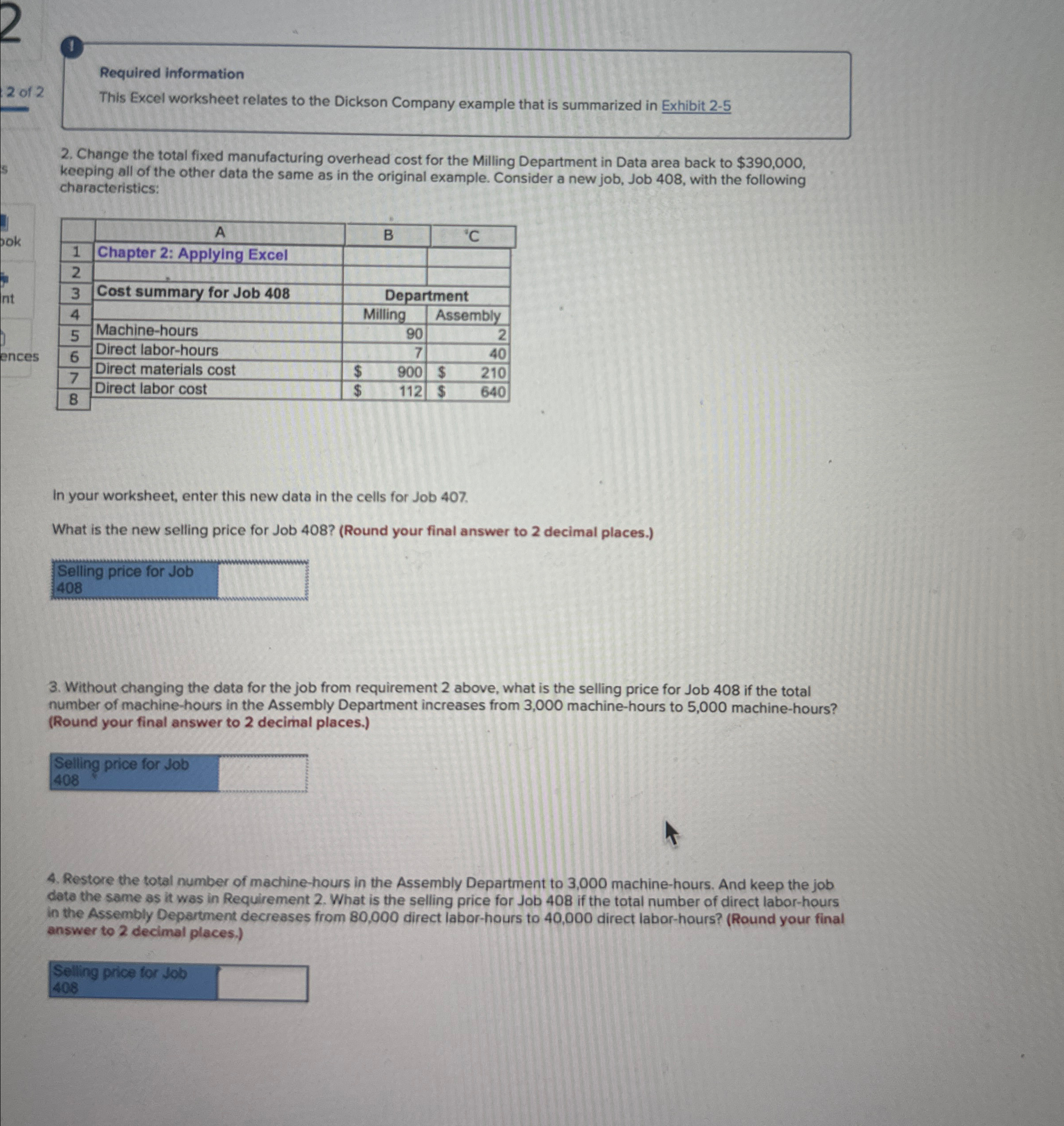

This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit

Change the total fixed manufacturing overhead cost for the Milling Department in Data area back to $ keeping all of the other data the same as in the original example. Consider a new job, Job with the following characteristics:

tableA

of

Required information

This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit

Change the total fixed manufacturing overhead cost for the Milling Department in Data area back to $ keeping all of the other data the same as in the original example. Consider a new job, Job with the following characteristics:

tableB

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock