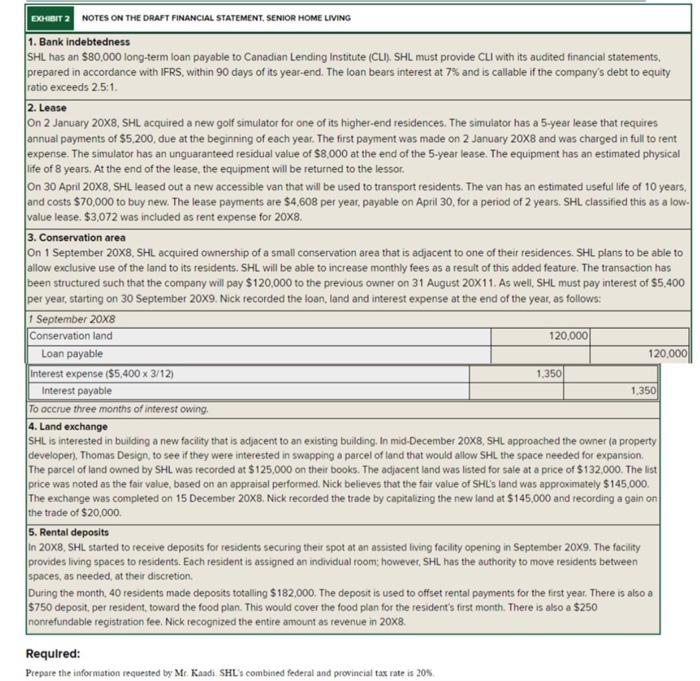

Question: EXHIBIT 2 NOTES ON THE DRAFT FINANCIAL STATEMENT, SENIOR HOME LIVING 1. Bank indebtedness SHL has an $80,000 long-term loan payable to Canadian Lending Institute

ECHERT 2 NOTES ON THE DRAFT FINANCIAL STATEMENT, SENIOR HOME LIING 1. Bank indebtedness SHL has an \$80,000 long-term loan payable to Canadian Lending Institute (CLI). SHL must provide CLI with its audited financial statements, prepared in accordance with IFRS, within 90 days of its year-end. The ioan bears interest at 7% and is callable if the company's debt to equity ratio exceeds 2.5:1. 2. Lease On 2 January 208, SHL acquired a new golf simulator for one of its higher-end residences. The simulator has a 5 -year lease that requires annual payments of $5.200, due at the beginning of each year. The first payment was made on 2 January 208 and was charged in full to rent expense. The simulator has an unguaranteed residual value of $8,000 at the end of the 5 -year lease. The equipment has an estimated physical life of 8 years. At the end of the lease, the equipment will be returned to the lessor. On 30 April 208,5HL leased out a new accessible van that will be used to transport residents. The van has an estimated useful life of 10 years, and costs $70,000 to buy new. The lease payments are $4,608 per year, payable on April 30, for a period of 2 years. SHL classified this as a low. value lease. $3,072 was included as rent expense for 208. 3. Conservation area On 1 September 208,SHL acquired ownership of a small conservation area that is adjacent to one of their residences. SHL plans to be able to allow exclusive use of the land to its residents. SHL will be able to increase monthly fees as a result of this added feature. The transaction has been structured such that the company will pay $120,000 to the previous owner on 31 August 2011. As well, SHL must pay interest of $5.400 per year, starting on 30 September 209. Nick recorded the loan, land and interest expense at the end of the year, as follows: 1 September 208 To occrue three months of interest owing. 4. Land exchange SHL is interested in building a new facility that is adjacent to an existing building. In mid-December 20x8, SHL approached the owner (a property developer). Thomas Design, to see if they were interested in swapping a parcel of land that would allow $HL the space needed for expansion. The parcel of land owned by $HL was recorded at $125,000 on their books. The adjacent land was listed for sale at a price of $132,000. The list price was noted as the fair value, based on an appraisal performed. Nick believes that the fair value of SHL's land was approximately $145,000. The exchange was completed on 15 December 208. Nick recorded the trade by capitalizing the new land at $145,000 and recording a gain on the trade of $20,000. 5. Rental deposits In 208,SHL started to receive deposits for residents securing their spot at an assisted iving focility opening in September 20x9. The facility provides living spaces to residents. Each resident is assigned an individual room; however, SHL has the authority to move residents between spaces, as needed, at their discretion. During the month, 40 residents made deposits totalling $182,000. The deposit is used to offset rental payments for the first year. There is also a $750 deposit, per resident, toward the food plan. This would cover the food plan for the resident's first month. There is also a $250 nonrefundable registration fee. Nick recognized the entire amount as revenue in 208. Requlred: Prepare the information requested by Mr. Kaadi. SHL's combined federal and provincial tax rate is 20N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts