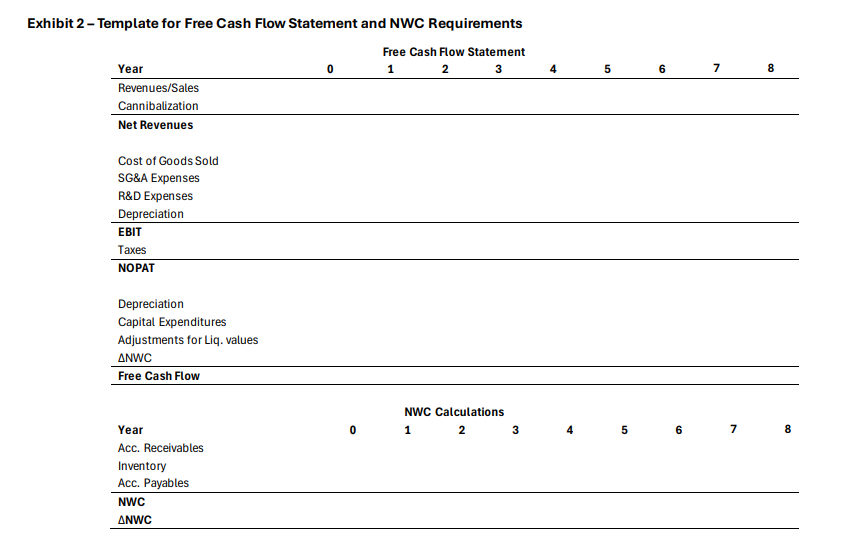

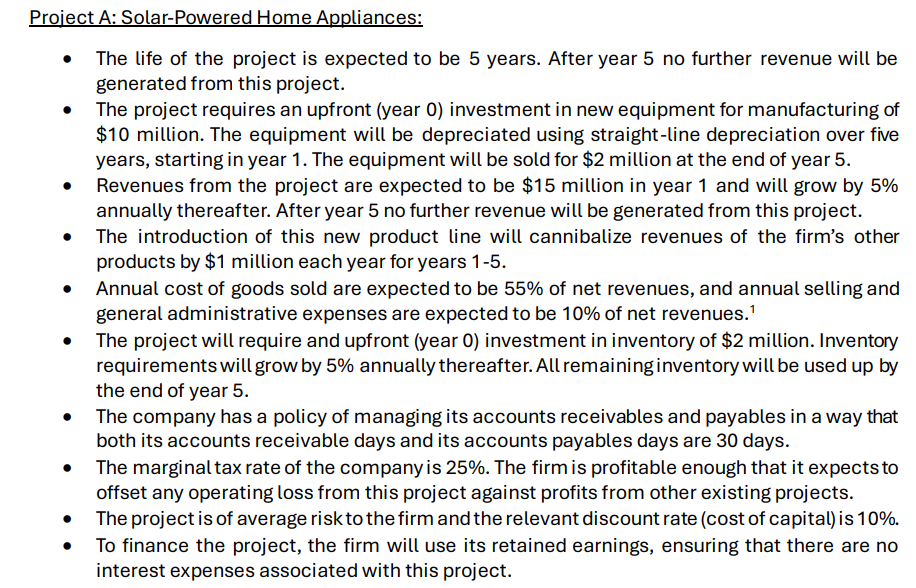

Question: Exhibit 2 - Template for Free Cash Flow Statement and NWC Requirements Free Cash Flow Statement Year 0 1 2 3 4 5 6 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts