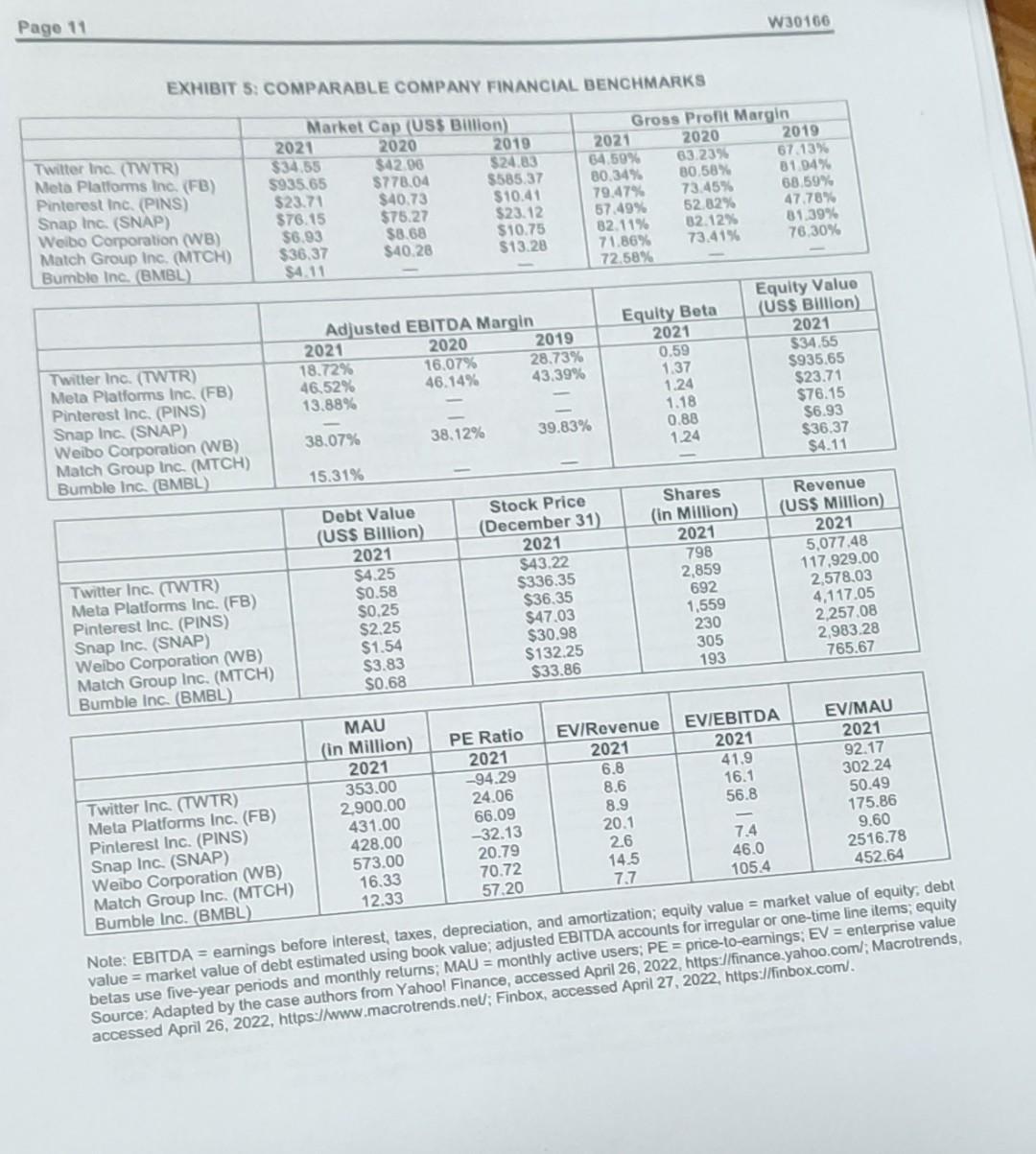

Question: EXHIBIT 5: COMPARABLE COMPANY FINANCIAL BENCHMARKS Note: EB ITDA = earnings before interest, taxes, depreciation, ana ain accounts for irregular oi un: EV= enterprise value

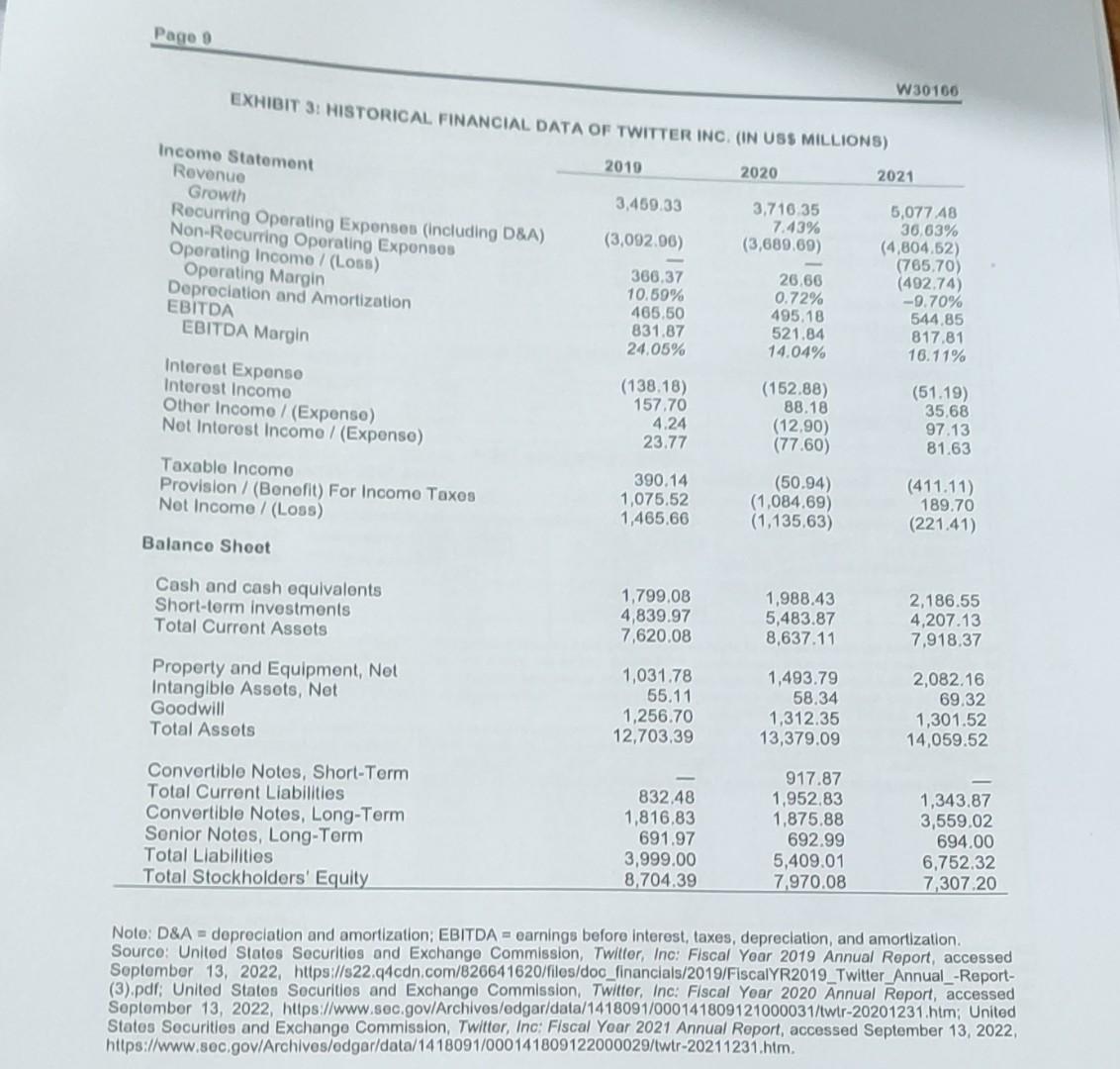

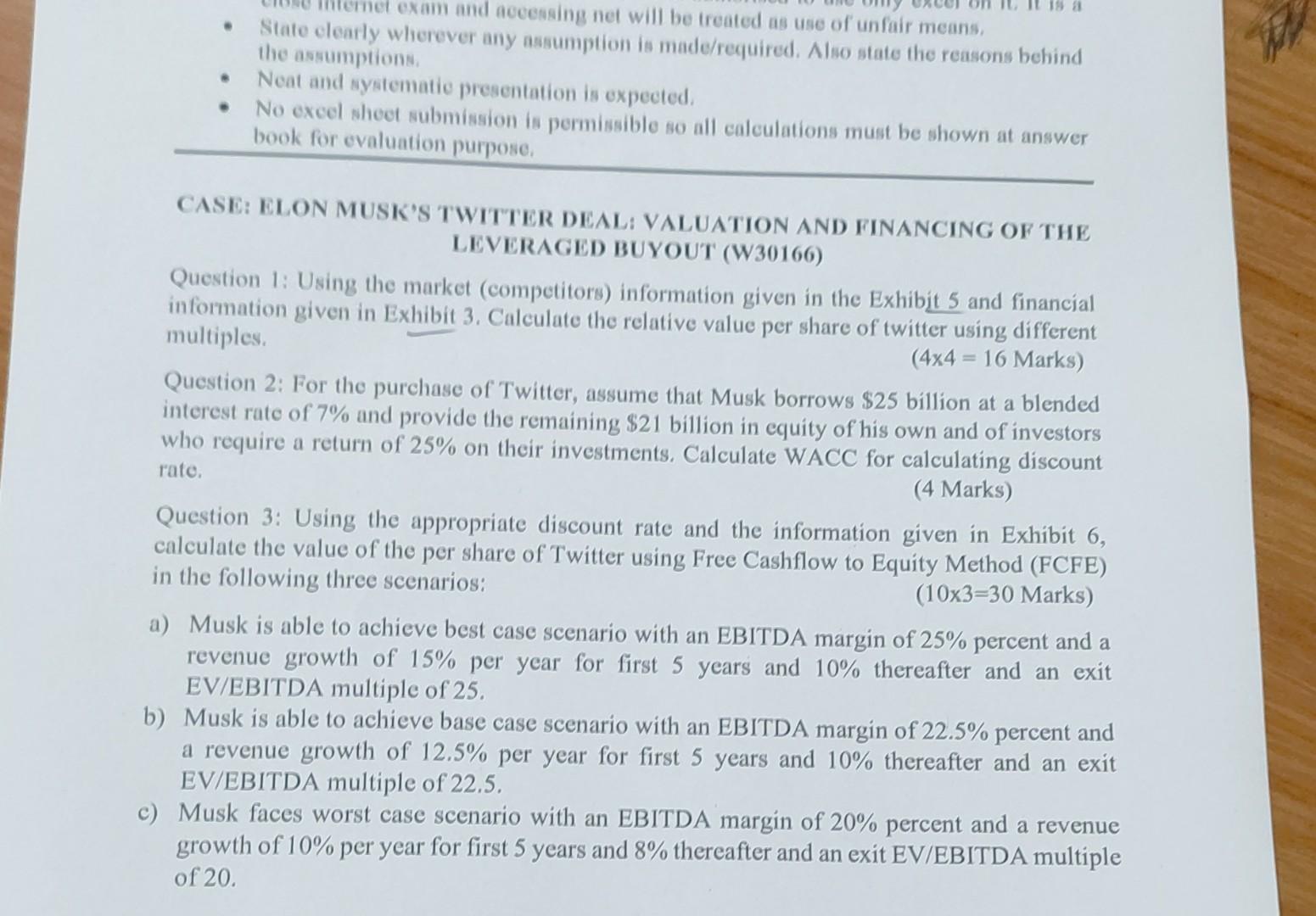

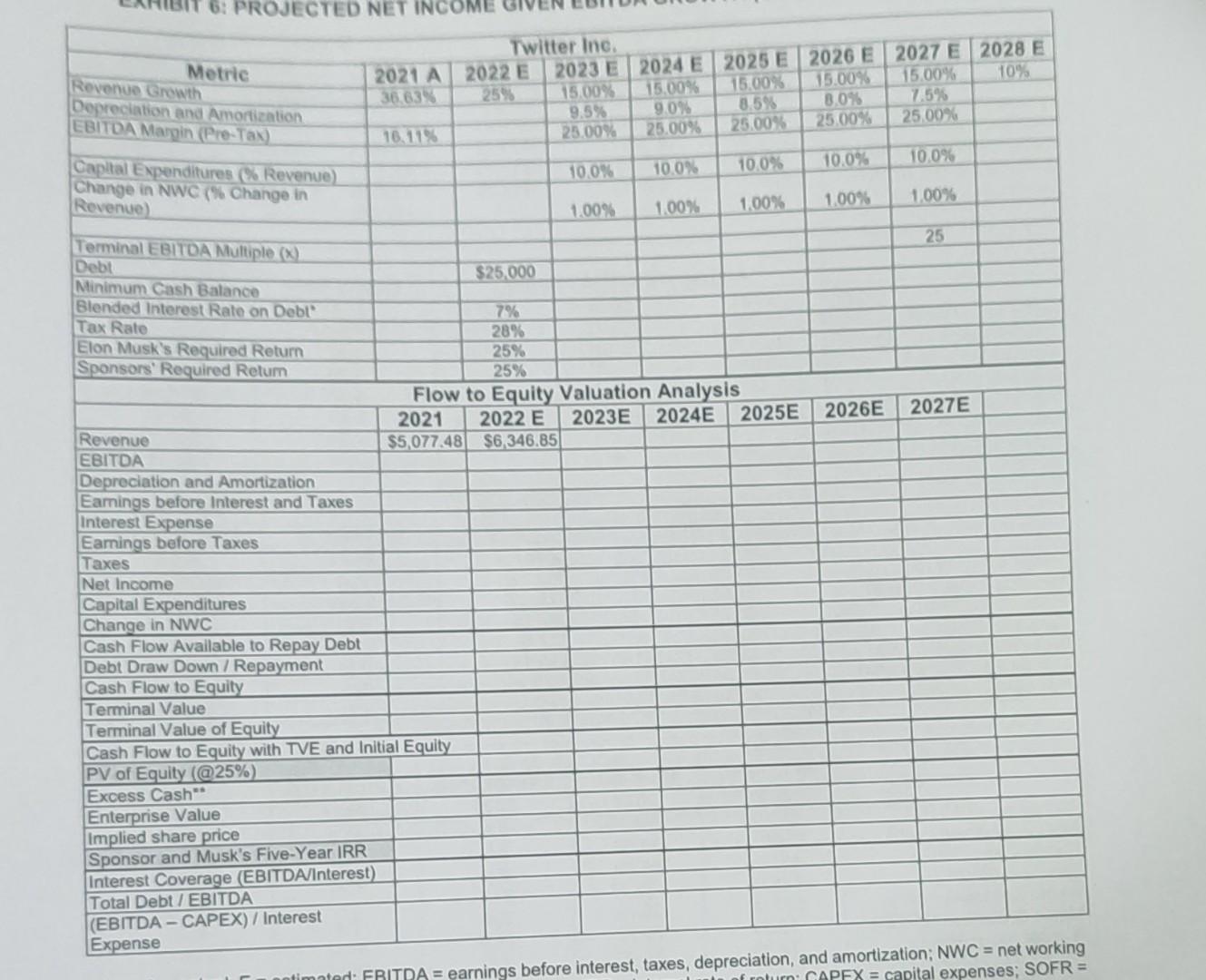

EXHIBIT 5: COMPARABLE COMPANY FINANCIAL BENCHMARKS Note: EB ITDA = earnings before interest, taxes, depreciation, ana ain accounts for irregular oi un: EV= enterprise value value = market value of debt estimated using book value; adjusted active users; PE= price-to-earnings; Source; Adapted by the case authors from Yaheol FineV; Finbox, accessed April 27, W30160 EXHIBIT 3: HISTREina. Note: D&A= depreciation and amortization; EBITDA= earnings before interest, taxes, depreciation, and amortization. Source: United States Securities and Exchange Commission, Twitter, Inc: Fiscal Year 2019 Annual Report, accessed Soptember 13, 2022, hitps://s22.q4cdn.com/826641620/files/doc_financials/2019/FiscalYR2019_Twitter_Annual_-Report(3).pdi; United States Securitios and Exchange Commission, Twitter, Inc: Fiscal Year 2020 Annual Report, accessed September 13, 2022, https://www.sec.gov/Archives/edgar/data/1418091/000141809121000031/twtr-20201231.htm; United States Securities and Exchange Commission, Twittor, Inc: Fiscal Yoar 2021 Annual Report, accessed September 13, 2022, https://www.sec,gov/Archives/edgar/data/1418091/000141809122000029/twtr-20211231.htm. be treated as use of means. the dearly wherever any assumptiton for madefrequired. Also state the reasons behind - Neat and systematie presentation is expected. - No excel sheet submission is permissible so all calculations must be shown at answer book for evaluation purpose. CASE: ELON MUSK'S TWITTER DEAL: VALUATION AND FINANCING OF THE LEVERAGED BUYOUT (W30166) Question 1: Using the market (competitors) information given in the Exhibit 5 and financial information given in Exhibit 3. Calculate the relative value per share of twitter using different multiples. (44=16Marks) Question 2: For the purchase of Twitter, assume that Musk borrows $25 billion at a blended interest rate of 7% and provide the remaining $21 billion in equity of his own and of investors who require a return of 25% on their investments. Calculate WACC for calculating discount rate. (4 Marks) Question 3: Using the appropriate discount rate and the information given in Exhibit 6 , calculate the value of the per share of Twitter using Free Cashflow to Equity Method (FCFE) in the following three scenarios: (103=30 Marks) a) Musk is able to achieve best case scenario with an EBITDA margin of 25% percent and a revenue growth of 15% per year for first 5 years and 10% thereafter and an exit EV/EBITDA multiple of 25. b) Musk is able to achieve base case scenario with an EBITDA margin of 22.5% percent and a revenue growth of 12.5% per year for first 5 years and 10% thereafter and an exit EV/EBITDA multiple of 22.5. c) Musk faces worst case scenario with an EBITDA margin of 20% percent and a revenue growth of 10% per year for first 5 years and 8% thereafter and an exit EV/EBITDA multiple \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & & Twi & tter Inc. & & & & 2027E & 2028E \\ \hline Metric & 2021A & 2022E & 2023E & 2024E & 2025E & 15.00%2026E & 15.00%2021 & 10% \\ \hline \begin{tabular}{l} Revenue Growth \\ Deoreciation \end{tabular} & 36.635 & 25% & 1500% & 15.00% & 15.00% & 8.0%15.00% & 7.5% & \\ \hline \begin{tabular}{l} Depreciation and Amortization \\ EBItoAMargin (Pre-Tay) \end{tabular} & & & 9.5% & 90% & 25.00%8.5% & 25.00%8.0% & 25.00% & \\ \hline EBITOA Marpin (Pre-Tax) & 16.11% & & 25.00% & 25.00% & & & & \\ \hline Capltal Expenditures (\& Revenue) & & & 10.0% & 10.0% & 10.0% & 10.0% & 10.0% & \\ \hline \begin{tabular}{l} Change in NWC (\$ Change in \\ Revenue) \end{tabular} & & & & & 100% & 100% & 1.00% & \\ \hline (Revenue) & & & 1.00% & 1.00% & 1.00% & & & \\ \hline Terminal EBITOA Multiple (x) & & & & & & & 25 & \\ \hline & & $25,000 & & & & & & \\ \hline Minimum Cash Balance & & & & & & & & \\ \hline Blended interest Rate on Debl & & 7% & & & & & & \\ \hline Tax Rate & & 28% & & & & & & \\ \hline Elon Musk's Required Return & & 25% & & & & & & \\ \hline Sponsors' Required Retum & & 25% & & & & & & \\ \hline \end{tabular} Flow to Equity Valuation Analysis Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts