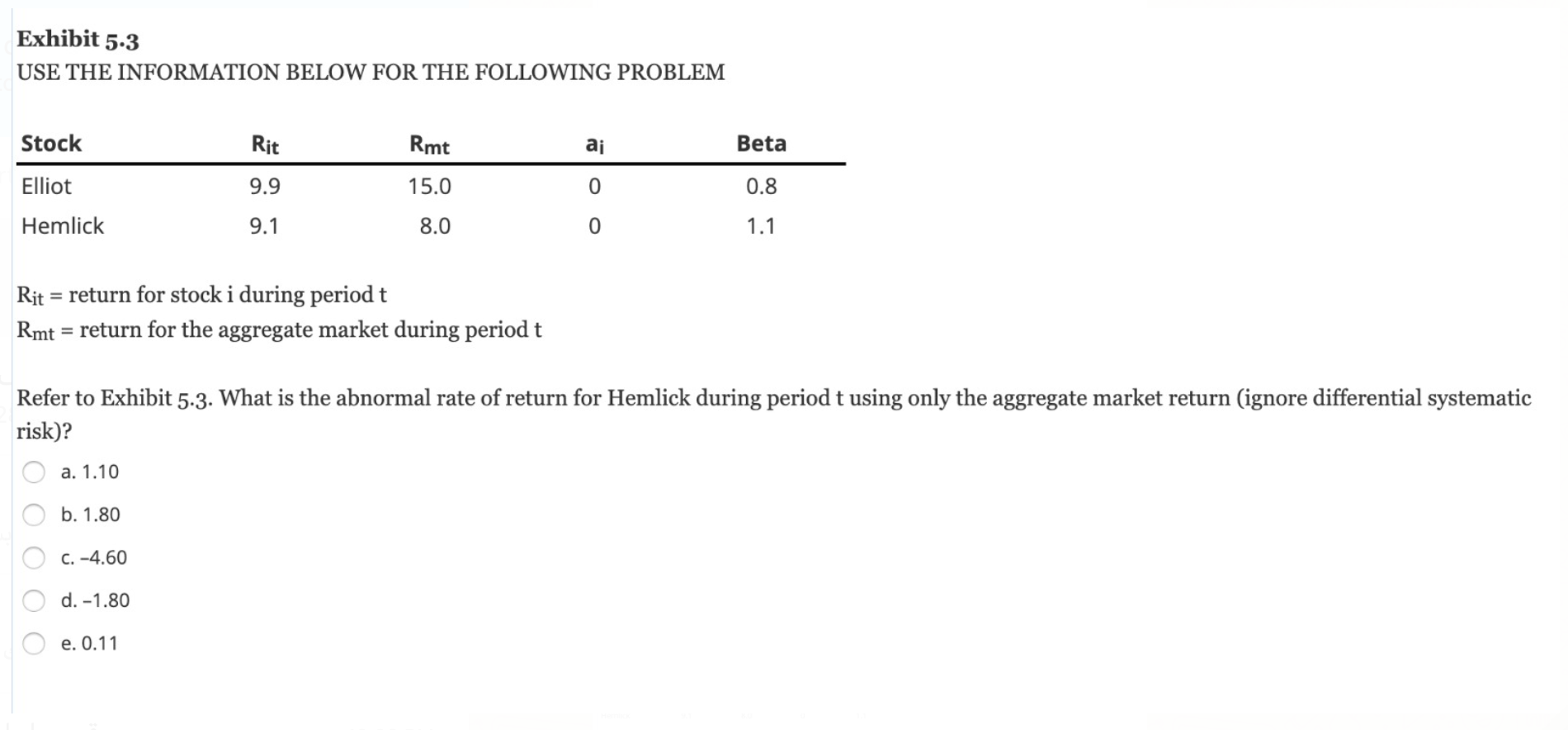

Question: Exhibit 5.3 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM Stock Rit Rmt ai Beta 9.9 15.0 0 0.8 Elliot Hemlick 9.1 8.0 0 1.1

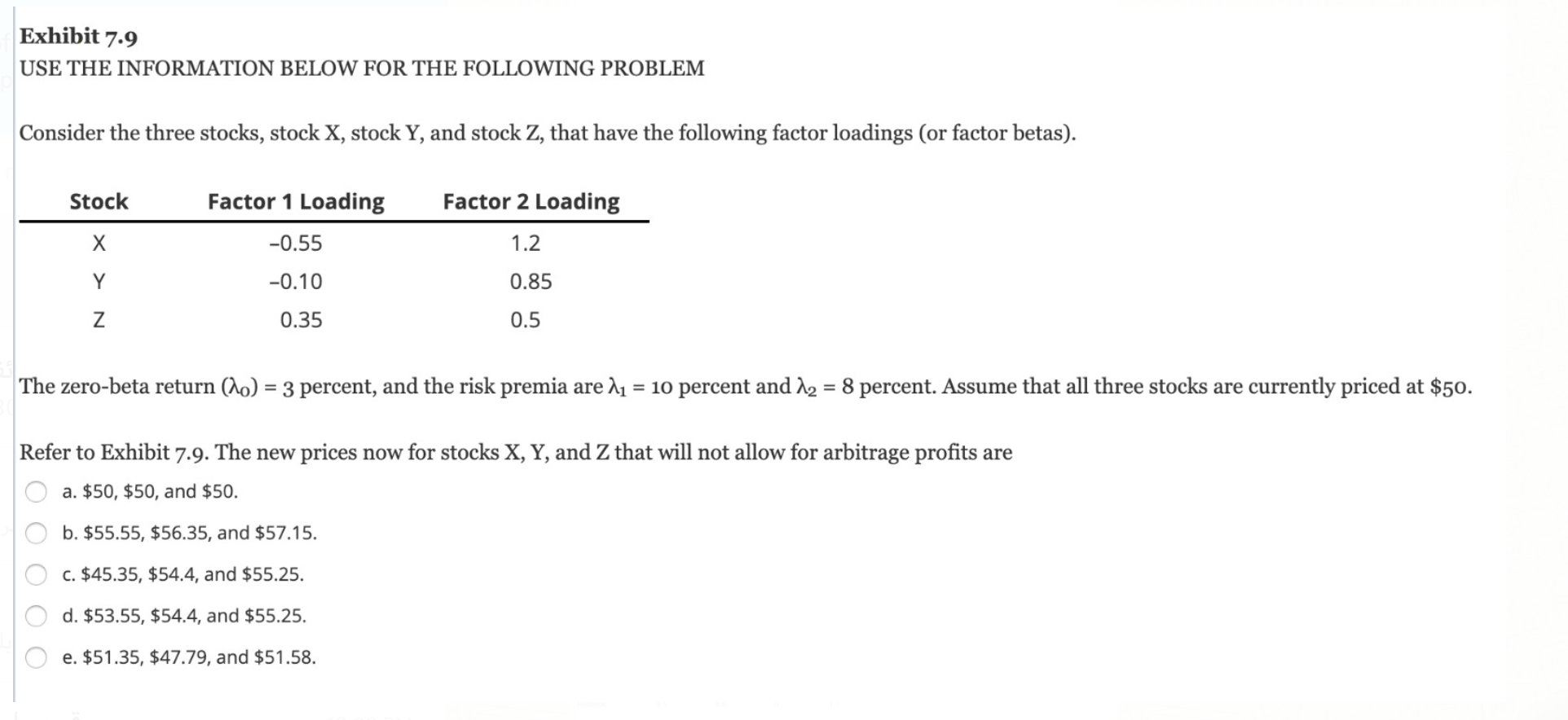

Exhibit 5.3 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM Stock Rit Rmt ai Beta 9.9 15.0 0 0.8 Elliot Hemlick 9.1 8.0 0 1.1 Rit = return for stock i during period t Rmt = return for the aggregate market during period t Refer to Exhibit 5.3. What is the abnormal rate of return for Hemlick during period t using only the aggregate market return (ignore differential systematic risk)? a. 1.10 b. 1.80 C. -4.60 d. -1.80 e. 0.11 Exhibit 7.9 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas). Stock Factor 1 Loading -0.55 x Factor 2 Loading 1.2 0.85 Y -0.10 z 0.35 0.5 The zero-beta return (20) = 3 percent, and the risk premia are 11 = 10 percent and 12 = 8 percent. Assume that all three stocks are currently priced at $50. Refer to Exhibit 7.9. The new prices now for stocks X, Y, and Z that will not allow for arbitrage profits are a. $50, $50, and $50. b. $55.55, $56.35, and $57.15. C. $45.35, $54.4, and $55.25. d. $53.55, $54.4, and $55.25. e. $51.35, $47.79, and $51.58. Exhibit 5.3 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM Stock Rit Rmt ai Beta 9.9 15.0 0 0.8 Elliot Hemlick 9.1 8.0 0 1.1 Rit = return for stock i during period t Rmt = return for the aggregate market during period t Refer to Exhibit 5.3. What is the abnormal rate of return for Hemlick during period t using only the aggregate market return (ignore differential systematic risk)? a. 1.10 b. 1.80 C. -4.60 d. -1.80 e. 0.11 Exhibit 7.9 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas). Stock Factor 1 Loading -0.55 x Factor 2 Loading 1.2 0.85 Y -0.10 z 0.35 0.5 The zero-beta return (20) = 3 percent, and the risk premia are 11 = 10 percent and 12 = 8 percent. Assume that all three stocks are currently priced at $50. Refer to Exhibit 7.9. The new prices now for stocks X, Y, and Z that will not allow for arbitrage profits are a. $50, $50, and $50. b. $55.55, $56.35, and $57.15. C. $45.35, $54.4, and $55.25. d. $53.55, $54.4, and $55.25. e. $51.35, $47.79, and $51.58

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts