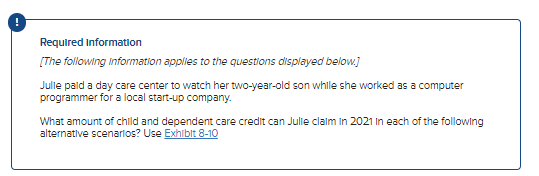

Question: Exhibit 8-10: Parts a - e need an answer: ! Required Information [The following Information applies to the questions displayed below.] Julle paid a day

Exhibit 8-10:

![Information [The following Information applies to the questions displayed below.] Julle paid](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fb8880dae3d_51266fb8880868a8.jpg)

Parts a - e need an answer:

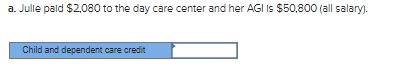

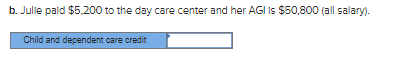

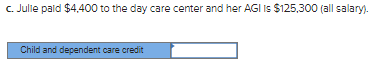

! Required Information [The following Information applies to the questions displayed below.] Julle paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start-up company. What amount of child and dependent care credit can Julie claim in 2021 In each of the following alternative scenarios? Use Exhibit 8-10 EXHIBIT 8-10 Child and Dependent Care Credit Percentage If AGI is over But not over Then the percentage is $0 $125,000 50% 125,000 127,000 49 127,000 129,000 48 129,000 131,000 47 181,000 183,000 21 183,000 400,000 20 400,000 402,000 19 402,000 404,000 18 434,000 436,000 2 436,000 438,000 1 438,000 0 Source: Source: Internal Revenue Code. " 21. Expenses For Household And Dependent Care Services Necessary For Gainful Employment." a. Julle paid $2,080 to the day care center and her AGI is $50,800 (all salary). Child and dependent care credit b. Julle paid $5,200 to the day care center and her AGI is $50,800 (all salary). Child and dependent care credit c. Julle paid $4,400 to the day care center and her AGI is $125,300 (all salary). Child and dependent care credit d. Julle paid $2,400 to the day care center and her AGI is $400,300 (all salary). Child and dependent care credit e. Julle paid $4,400 to the day care center and her AGI IS $14,000 ($2,400 salary and $11,600 unearned Income). Child and dependent care credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts