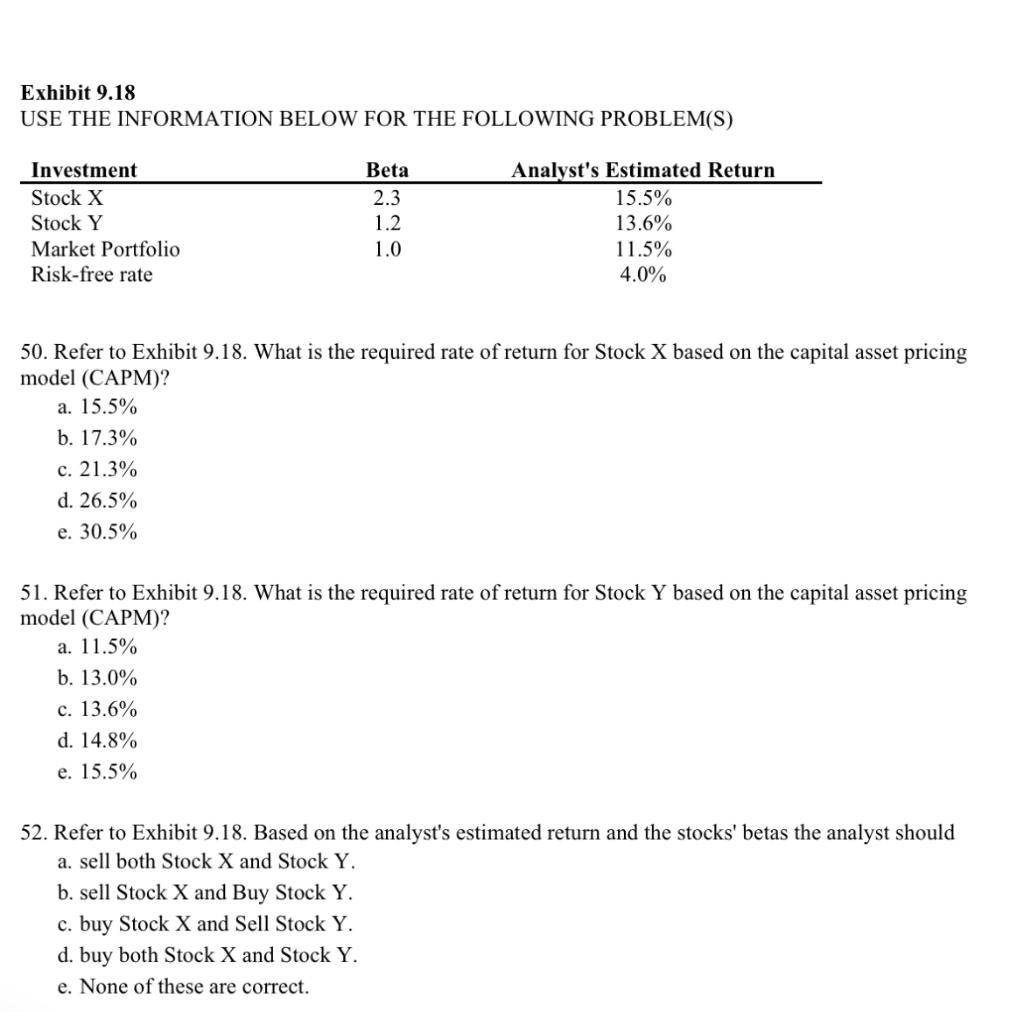

Question: Exhibit 9.18 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Investment Stock X Stock Y Market Portfolio Risk-free rate Beta 2.3 1.2 1.0 Analyst's Estimated

Exhibit 9.18 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Investment Stock X Stock Y Market Portfolio Risk-free rate Beta 2.3 1.2 1.0 Analyst's Estimated Return 15.5% 13.6% 11.5% 4.0% 50. Refer to Exhibit 9.18. What is the required rate of return for Stock X based on the capital asset pricing model (CAPM)? a. 15.5% b. 17.3% c. 21.3% d. 26.5% e. 30.5% 51. Refer to Exhibit 9.18. What is the required rate of return for Stock Y based on the capital asset pricing model (CAPM)? a. 11.5% b. 13.0% c. 13.6% d. 14.8% e. 15.5% 52. Refer to Exhibit 9.18. Based on the analyst's estimated return and the stocks' betas the analyst should a. sell both Stock X and Stock Y. b. sell Stock X and Buy Stock Y. c. buy Stock X and Sell Stock Y. d. buy both Stock X and Stock Y. e. None of these are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts