Question: Please solve all questions with full work and explanation (a) Consider a portfolio consisting of the following stocks: Stock Portfolio Weight Standard Deviation Correlation with

Please solve all questions with full work and explanation

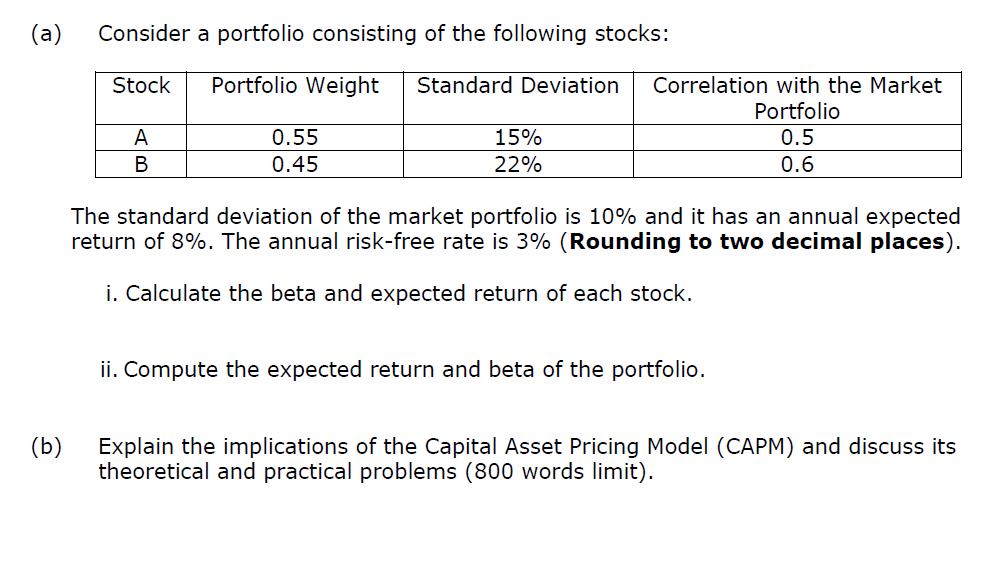

(a) Consider a portfolio consisting of the following stocks: Stock Portfolio Weight Standard Deviation Correlation with the Market Portfolio 0.5 0.6 A B 0.55 0.45 15% 22% The standard deviation of the market portfolio is 10% and it has an annual expected return of 8%. The annual risk-free rate is 3% (Rounding to two decimal places). i. Calculate the beta and expected return of each stock. ii. Compute the expected return and beta of the portfolio. (b) Explain the implications of the Capital Asset Pricing Model (CAPM) and discuss its theoretical and practical problems (800 words limit)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts