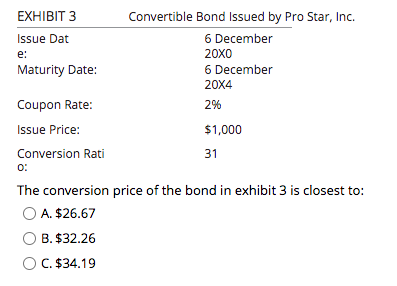

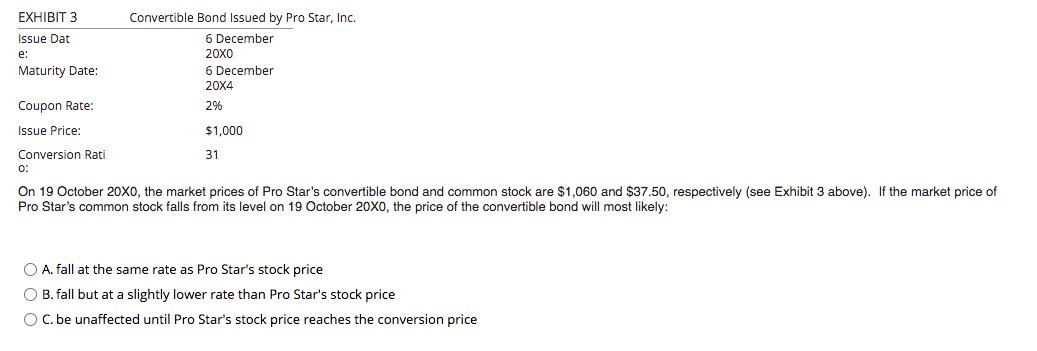

Question: EXHIBIT Issue Dat e: Maturity Date: Convertible Bond Issued by Pro Star, Inc. 6 December 20x0 6 December 20X4 2% Coupon Rate: Issue Price: Conversion

EXHIBIT Issue Dat e: Maturity Date: Convertible Bond Issued by Pro Star, Inc. 6 December 20x0 6 December 20X4 2% Coupon Rate: Issue Price: Conversion Rati 0: $1,000 31 The conversion price of the bond in exhibit 3 is closest to: O A. $26.67 B. $32.26 C. $34.19 EXHIBIT 3 Issue Dat e: Maturity Date: Convertible Bond Issued by Pro Star, Inc. 6 December 20x0 6 December 20X4 2% Coupon Rate: Issue Price: $1,000 Conversion Rati 31 0: On 19 October 20X0, the market prices of Pro Star's convertible bond and common stock are $1,060 and $37.50, respectively (see Exhibit 3 above). If the market price of Pro Star's common stock falls from its level on 19 October 20X0, the price of the convertible bond will most likely: O A. fall at the same rate as Pro Star's stock price O B. fall but at a slightly lower rate than Pro Star's stock price OC.be unaffected until Pro Star's stock price reaches the conversion price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts