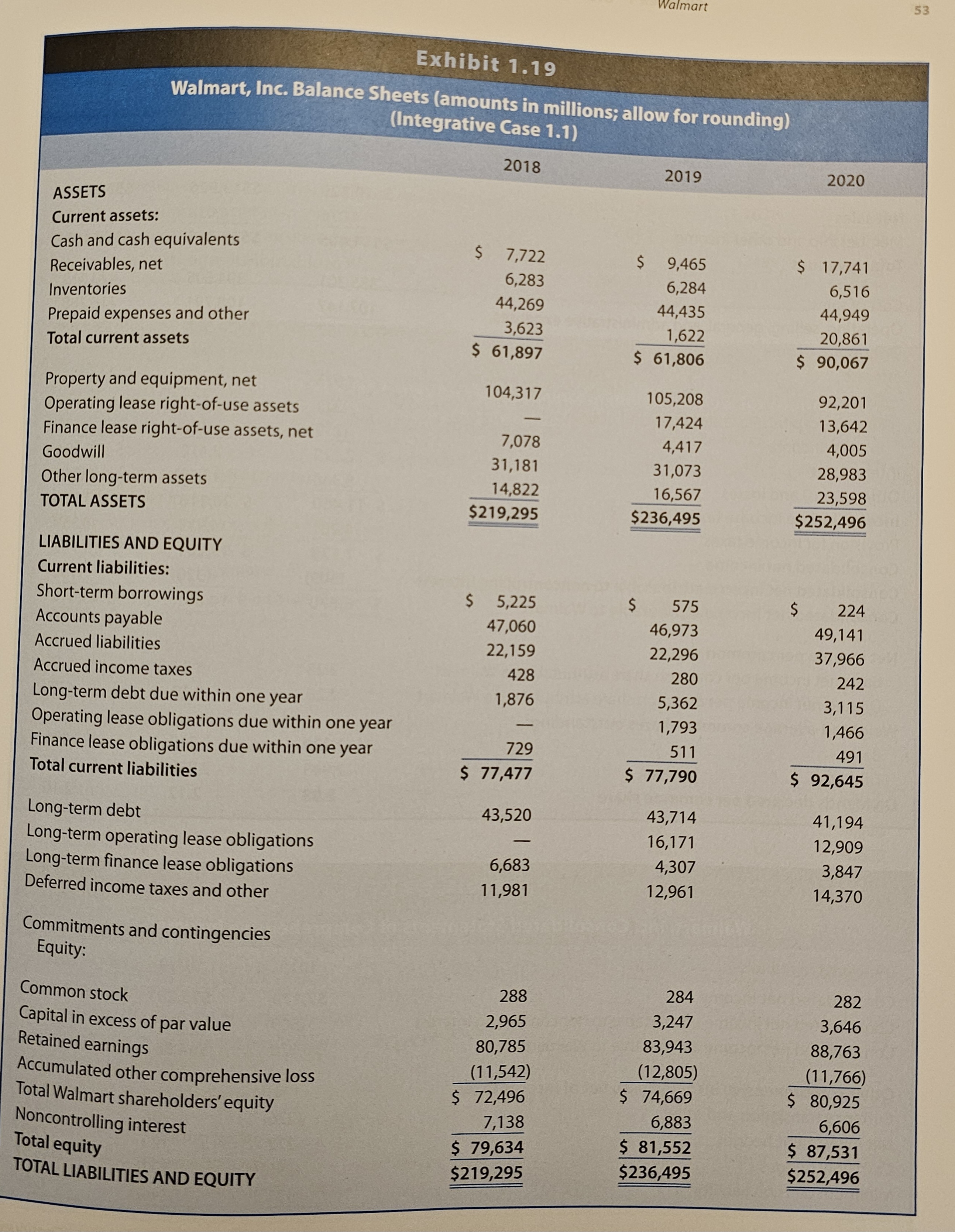

Question: Exhibits 1 . 1 9 - 1 . 2 2 of Integrative Case 1 . 1 ( Chapter 1 ) present the financial statements for

Exhibits of Integrative Case Chapter present the financial statements for Walmart for In addition, the website for this text contains Walmart's January Form KUse this information, especially Note Taxes to answer the following questions:

aAssuming that Walmart had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for the year ending January hereafterfiscal as months of this fiscal year fall in calendar Explain

bAssuming all current taxes are paid in cash, will the adjustment to net income for deferred taxes to compute cash flow from operations in the statement of cash flows result in an addition or subtraction for fiscal

cIn Note of the financial statements, Walmart describes deferred revenue for sales of gift certificates and for Sam's Club membership fees. These amounts are taxed when collected, but not recognized in financial reporting income until tendered at a store. Why does the tax effect of deferred revenue appear as a deferred tax asset?

dWalmart recognizes a valuation allowance on its deferred tax assets, primarily related to loss and tax credit carryforwards. The valuation allowance increased over the previous year. What effect does this have on net income in the most recent year fiscal

eWalmart uses the straightline depreciation method for financial reporting and accelerated depreciation for income tax reporting. Like most firms, the largest deferred tax liability is for property, plant, and equipment depreciationExplain how depreciation leads to a deferred tax liability. Suggest possible reasons why the amount of the deferred tax liability related to depreciation decreased over the last year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock