Question: expectation. Use outside ery document your sources using APA style in-text references and a reference list. Robertson Real Estate Recapitalization Founded 25 years ago by

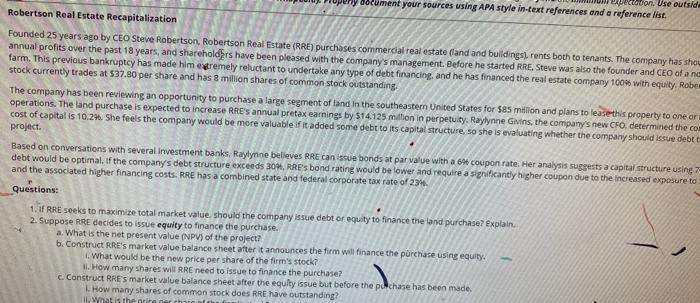

expectation. Use outside ery document your sources using APA style in-text references and a reference list. Robertson Real Estate Recapitalization Founded 25 years ago by CEO Steve Robertson, Robertson Real Estate (RRE) purchases commercial real estate and and buildings, rents both to tenants. The company has show annual profits over the past 18 years, and shareholders have been pleased with the company's management. Before he started RRE. Steve was also the founder and CEO of a no farm. This previous bankruptcy has made him egremely reluctant to undertake any type of debt financing, and he has financed the real estate company 100% with equity, Robe stock currently trades at $37.80 per share and has 8 million shares of common stock outstanding The company has been reviewing an opportunity to purchase a large segment of land in the southeastern United States for $85 milion and plans to lease this property to one or operations. The land purchase is expected to increase RRES annual pretax earnings by $14.125 million in perpetuity. Raylynne Givins, the company's new CFO, determined the com cost of capital is 10:24. She feels the company would be more valuable if it added some debt to its capital structure, so she is evaluating whether the company should issue debt project. Based on conversations with several investment banks. Raylynne believes RRE can issue bonds at par value with a 6 coupon rate. Her analysis suggests a capital structure using 7 debt would be optimal. If the company's debt structure exceeds 30M, RRES bond rating would be lower and require a significantly higher coupon due to the increased exposure to and the associated higher financing costs. RRE has a combined state and federal corporate tax rate of 234 Questions: 1. If RRE seeks to maximize total market value, should the company issue debt or equity to finance the land purchase? Explain 2. Suppose RRE decides to issue equity to finance the purchase. a. What is the net present value (NPV) of the project? b. Construct RRE's market value balance sheet after it announces the firm will finance the purchase using equity. What would be the new price per share of the firm's stock? II. How many shares willRRE need to issue to finance the purchase? c. Construct RRE'S market value balance sheet after the equity issue but before the purchase has been made. How many shares of common stock does RRE have outstanding? il What is the orire march expectation. Use outside ery document your sources using APA style in-text references and a reference list. Robertson Real Estate Recapitalization Founded 25 years ago by CEO Steve Robertson, Robertson Real Estate (RRE) purchases commercial real estate and and buildings, rents both to tenants. The company has show annual profits over the past 18 years, and shareholders have been pleased with the company's management. Before he started RRE. Steve was also the founder and CEO of a no farm. This previous bankruptcy has made him egremely reluctant to undertake any type of debt financing, and he has financed the real estate company 100% with equity, Robe stock currently trades at $37.80 per share and has 8 million shares of common stock outstanding The company has been reviewing an opportunity to purchase a large segment of land in the southeastern United States for $85 milion and plans to lease this property to one or operations. The land purchase is expected to increase RRES annual pretax earnings by $14.125 million in perpetuity. Raylynne Givins, the company's new CFO, determined the com cost of capital is 10:24. She feels the company would be more valuable if it added some debt to its capital structure, so she is evaluating whether the company should issue debt project. Based on conversations with several investment banks. Raylynne believes RRE can issue bonds at par value with a 6 coupon rate. Her analysis suggests a capital structure using 7 debt would be optimal. If the company's debt structure exceeds 30M, RRES bond rating would be lower and require a significantly higher coupon due to the increased exposure to and the associated higher financing costs. RRE has a combined state and federal corporate tax rate of 234 Questions: 1. If RRE seeks to maximize total market value, should the company issue debt or equity to finance the land purchase? Explain 2. Suppose RRE decides to issue equity to finance the purchase. a. What is the net present value (NPV) of the project? b. Construct RRE's market value balance sheet after it announces the firm will finance the purchase using equity. What would be the new price per share of the firm's stock? II. How many shares willRRE need to issue to finance the purchase? c. Construct RRE'S market value balance sheet after the equity issue but before the purchase has been made. How many shares of common stock does RRE have outstanding? il What is the orire march

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts