Question: Expected Net Cash Flows Time Project A Project B 0 ($375) ($575) 1 ($300) $190 2 ($200) $190 3 ($100) $190 4 $600 $190 5

| Expected Net Cash Flows | ||

| Time | Project A | Project B |

| 0 | ($375) | ($575) |

| 1 | ($300) | $190 |

| 2 | ($200) | $190 |

| 3 | ($100) | $190 |

| 4 | $600 | $190 |

| 5 | $600 | $190 |

| 6 | $926 | $190 |

| 7 | ($200) | $0 |

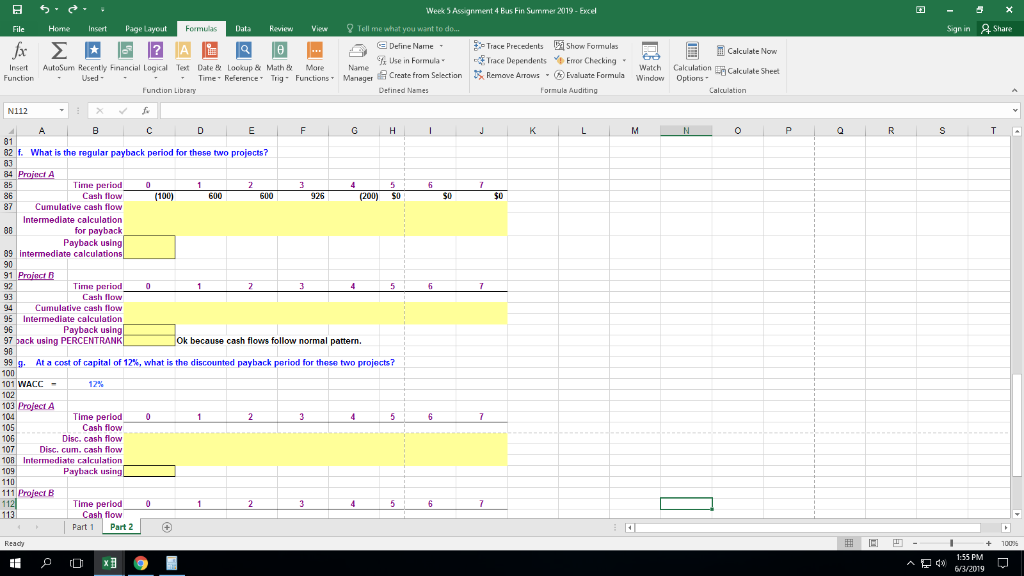

Week 5 Assignment 4 Bus Fin Summer 2019-Excel Share Tell me what you want to do.. Page Layout Formulas File Home Insert Data Review View Sign in Show Formulas Enor Checking* Define Name Trace Precedents Trace Dependents Remove Arrows fx A Calculate Now Use in Formula Financial Logical Text AutoSum Calculste Sheet Wincgw Maneger Create from Selection Evaluate Formula O Functions Ti-- Defined Names Formula Auditing Function Library Calculation N112 A B G H J K N C P S T 1 82 f. What is the reqular payback period for these two projects? 84 Project A Time period 5 30 60C 600 926 (200) $0 S0 (100) Cumuletive cesh flw Intermediate calculation 80 for payback 89 intermediato.caluls 90 Project B Time period 0 93 Cash flow 95 Jntormmediote cnluc 96 Payback using back using PERCENTRANK Ok because cash flows follow normal pattern. At a cost of capital of 12% , what is the discounted payback period t these two projects? 99 g. 404 WACC 12% ... 103 Project A Time period Cash flow 5 1 2 3 6 100 106 Disc. cash flow 108 Intormediate calculation 109 Payback using 110 Project B Time period Cash flow 0 112 1 113 Part 2 Part t Reacy 100% 1-55 PM a 63/2019 Week 5 Assignment 4 Bus Fin Summer 2019-Excel Share Tell me what you want to do.. Page Layout Formulas File Home Insert Data Review View Sign in Show Formulas Enor Checking* Define Name Trace Precedents Trace Dependents Remove Arrows fx A Calculate Now Use in Formula Financial Logical Text AutoSum Calculste Sheet Wincgw Maneger Create from Selection Evaluate Formula O Functions Ti-- Defined Names Formula Auditing Function Library Calculation N112 A B G H J K N C P S T 1 82 f. What is the reqular payback period for these two projects? 84 Project A Time period 5 30 60C 600 926 (200) $0 S0 (100) Cumuletive cesh flw Intermediate calculation 80 for payback 89 intermediato.caluls 90 Project B Time period 0 93 Cash flow 95 Jntormmediote cnluc 96 Payback using back using PERCENTRANK Ok because cash flows follow normal pattern. At a cost of capital of 12% , what is the discounted payback period t these two projects? 99 g. 404 WACC 12% ... 103 Project A Time period Cash flow 5 1 2 3 6 100 106 Disc. cash flow 108 Intormediate calculation 109 Payback using 110 Project B Time period Cash flow 0 112 1 113 Part 2 Part t Reacy 100% 1-55 PM a 63/2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts