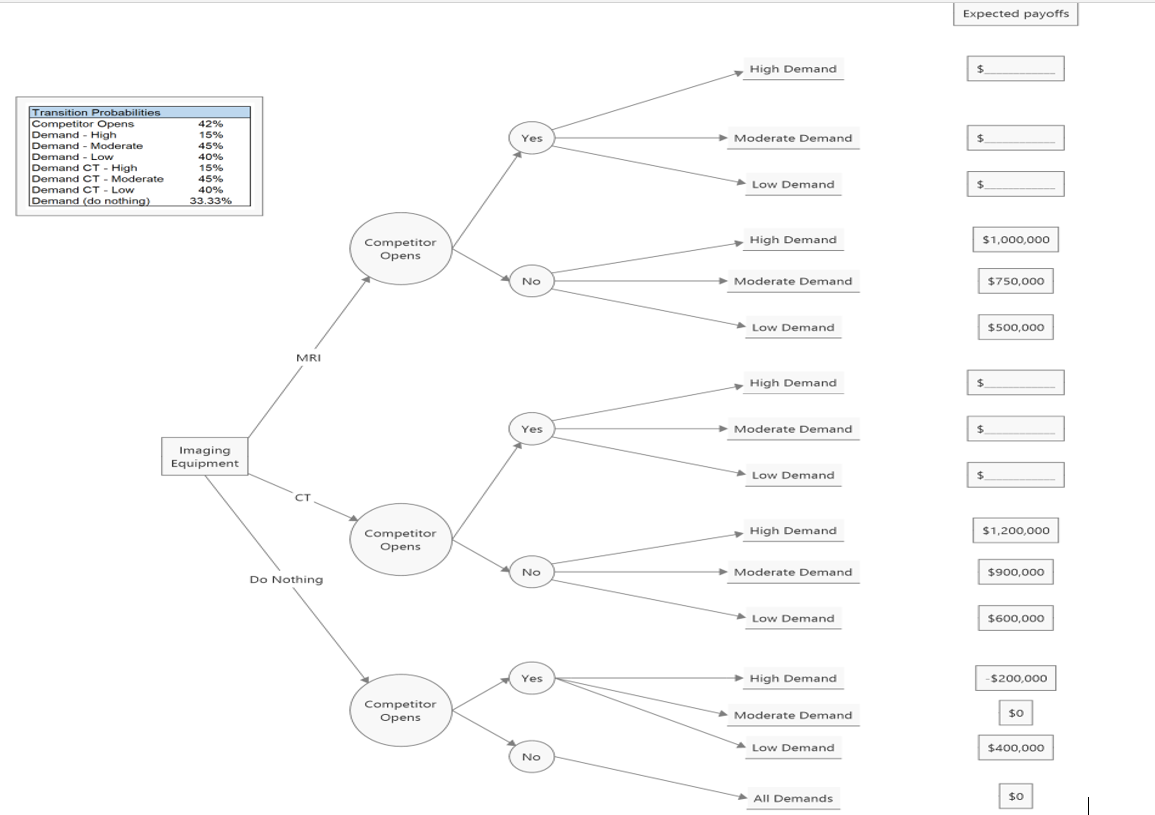

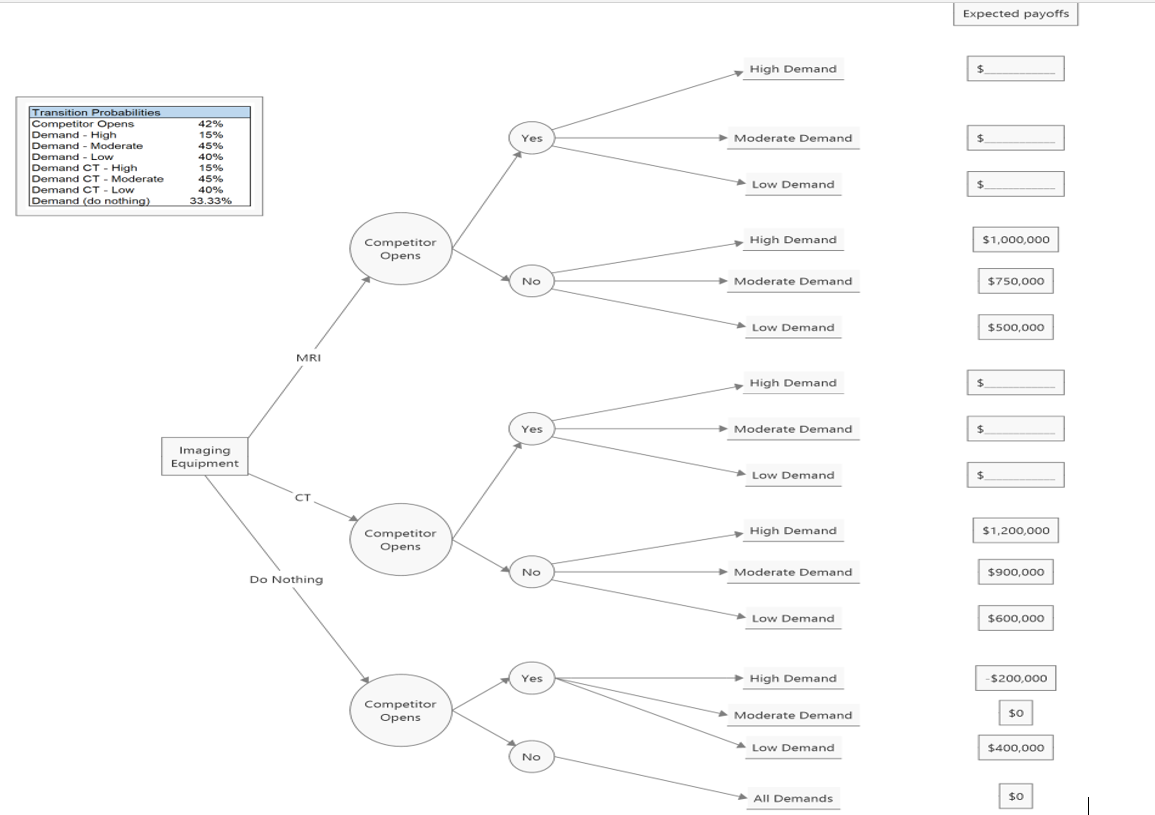

Question: Expected payoffs High Demand $ Yes Moderate Demand $ Transition Probabilities Competitor Opens Demand - High Demand - Moderate Demand - Low Demand CT -

Expected payoffs High Demand $ Yes Moderate Demand $ Transition Probabilities Competitor Opens Demand - High Demand - Moderate Demand - Low Demand CT - High Demand CT - Moderate Demand CT-LOW Demand (do nothing) 42% % 15% 45% 40% 15% 45% 40% 33.33% Low Demand $ High Demand $1,000,000 Competitor Opens No Moderate Demand $750,000 Low Demand $500,000 MRI High Demand $ Yes Moderate Demand $ Imaging Equipment Low Demand $ Competitor Opens High Demand $1,200,000 Do Nothing No Moderate Demand $900,000 Low Demand $600,000 Yes High Demand -$200,000 Competitor Opens Moderate Demand $0 Low Demand $400,000 No All Demands $0 You are the administrator for a small, locally - owned emergent care facility. You are exploring the options for increasing services, with a likely need for expanding your clinic imaging capabilities. After hiring a consulting firm, you have been given some expected annual payoffs (in dollars) of each of the decision alternatives. Unfortunately, since the last analysis you have learned that a competitor may be expanding their services as well. Complete the decision tree below. Of note, the expected payoffs for high/moderate/low demand are 50% of what they would be if a competitor decided not to open. Identify the expected payoff for each alternative. 1. What is the expected payoff for an MRI? 2. What is the expected payoff for a CT? 3. What is the expected payoff for doing nothing? 4. Which alternative would you choose to maximize revenue? Thankfully, the competitor is now projected less likely to openwhich is believed to now be 20%. However, now the demand projections for CT imaging has changed to 5% for high demand, 15% for moderate demand, and 80% for low demand. Use this updated information to update your estimates. 5. What is the expected payoff of an MRI? 6. What is the expected payoff of a CT? 7. What is the expected payoff for doing nothing? 8. Which alternative would you choose to maximize revenue