Question: Expected return for average company project Avalon Corp. has several new projects that look attractive, but some are riskier than the fim's past projects. Avalon

Expected return for "average" company project

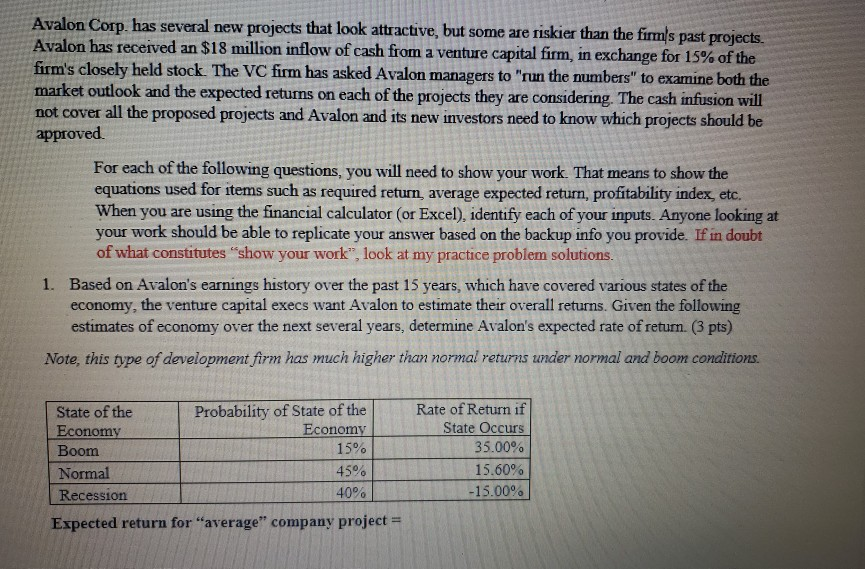

Avalon Corp. has several new projects that look attractive, but some are riskier than the fim's past projects. Avalon has received an $18 million inflow of cash from a venture capital firm, in exchange for 15% of the firm's closely held stock. The VC firm has asked Avalon managers to run the numbers" to examine both the market outlook and the expected returns on each of the projects they are considering. The cash infusion will not cover all the proposed projects and Avalon and its new investors need to know which projects should be approved For each of the following questions, you will need to show your work. That means to show the equations used for items such as required return average expected return, profitability index, etc. When you are using the financial calculator (or Excel), identify each of your inputs. Anyone looking at your work should be able to replicate your answer based on the backup info you provide. If in doubt of what constitutes "show your work", look at my practice problem solutions 1. Based on Avalon's earnings history over the past 15 years, which have covered various states of the economy, the venture capital execs want Avalon to estimate their overall returns. Given the following estimates of economy over the next several years, determine Avalon's expected rate of return. (3 pts) Note, this type of development firm has much higher than normal returns under normal and boom conditions. State of the Probability of State of the Economy Economy Boom 15% Normal 45% Recession 40% Expected return for "average" company project = Rate of Return if State Occurs 35.00% 15.60% -15.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts