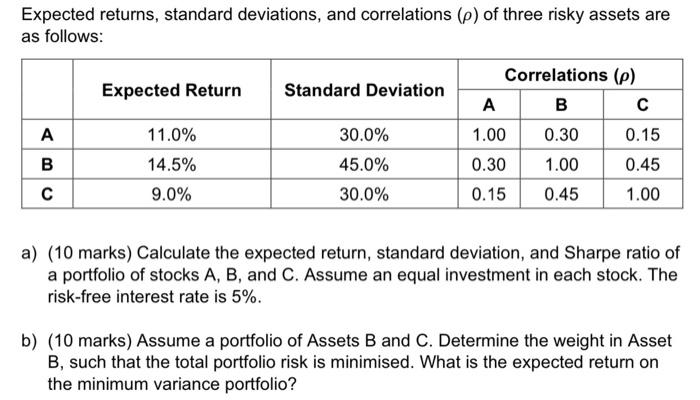

Question: Expected returns, standard deviations, and correlations (p) of three risky assets are as follows: Expected Return Standard Deviation A A 11.0% 14.5% 9.0% B Correlations

Expected returns, standard deviations, and correlations (p) of three risky assets are as follows: Expected Return Standard Deviation A A 11.0% 14.5% 9.0% B Correlations (p) B 1.00 0.30 0.15 0.30 1.00 0.45 0.15 0.45 1.00 30.0% 45.0% 30.0% a) (10 marks) Calculate the expected return, standard deviation, and Sharpe ratio of a portfolio of stocks A, B, and C. Assume an equal investment in each stock. The risk-free interest rate is 5%. b) (10 marks) Assume a portfolio of Assets B and C. Determine the weight in Asset B, such that the total portfolio risk is minimised. What is the expected return on the minimum variance portfolio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock