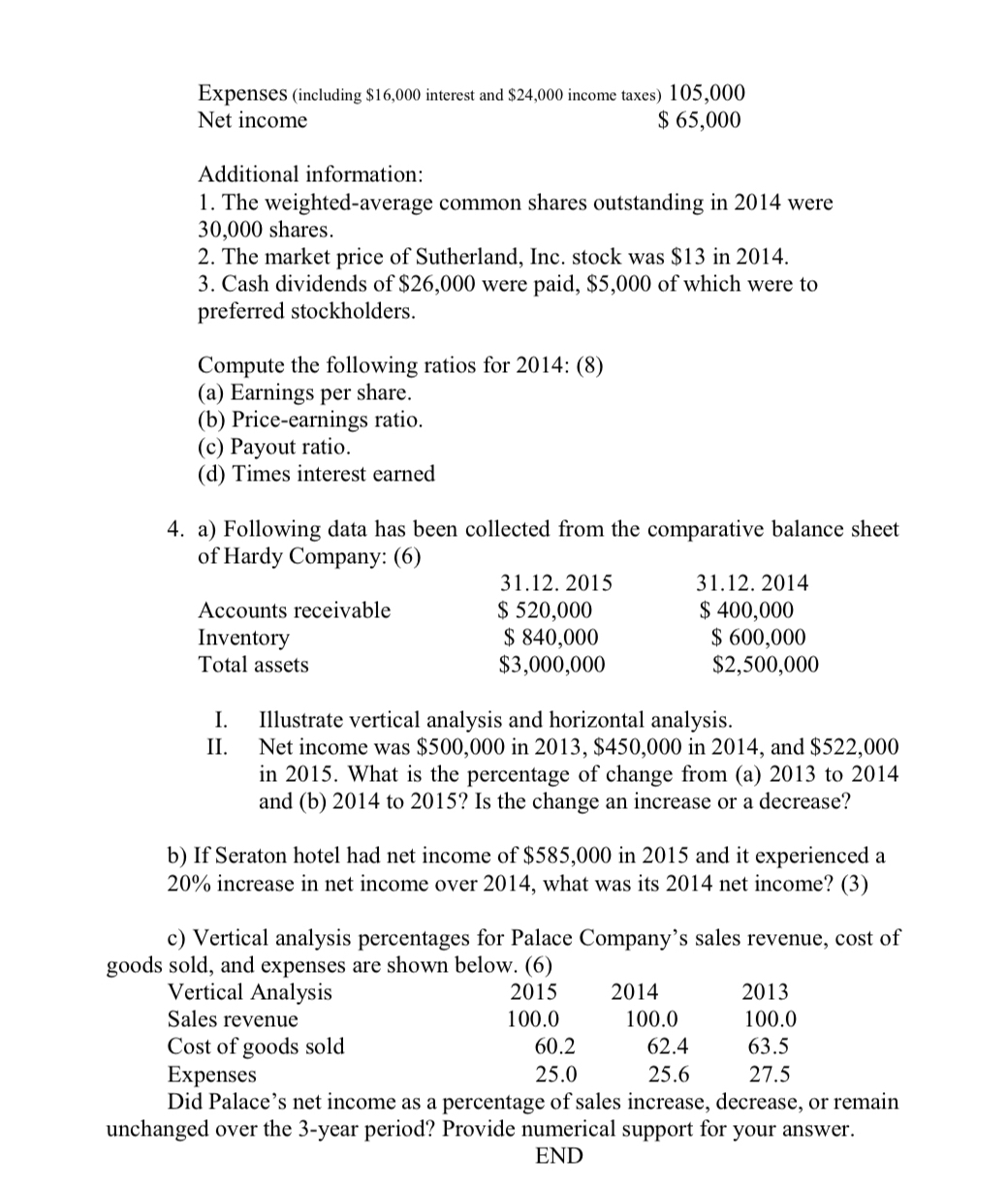

Question: Expenses ( including $ 1 6 , 0 0 0 interest and $ 2 4 , 0 0 0 income taxes ) 1 0 5

Expenses including $ interest and $ income taxes

Net income

$

Additional information:

The weightedaverage common shares outstanding in were

shares.

The market price of Sutherland, Inc. stock was $ in

Cash dividends of $ were paid, $ of which were to

preferred stockholders.

Compute the following ratios for :

a Earnings per share.

b Priceearnings ratio.

c Payout ratio.

d Times interest earned

a Following data has been collected from the comparative balance sheet

of Hardy Company:

I. Illustrate vertical analysis and horizontal analysis.

II Net income was $ in $ in and $

in What is the percentage of change from a to

and b to Is the change an increase or a decrease?

b If Seraton hotel had net income of $ in and it experienced a

increase in net income over what was its net income?

c Vertical analysis percentages for Palace Company's sales revenue, cost of

goods sold, and expenses are shown below.

Vertical Analysis

Sales revenue

Cost of goods sold

Expenses

Did Palace's net income as a percentage of sales increase, decrease, or remain

unchanged over the year period? Provide numerical support for your answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock