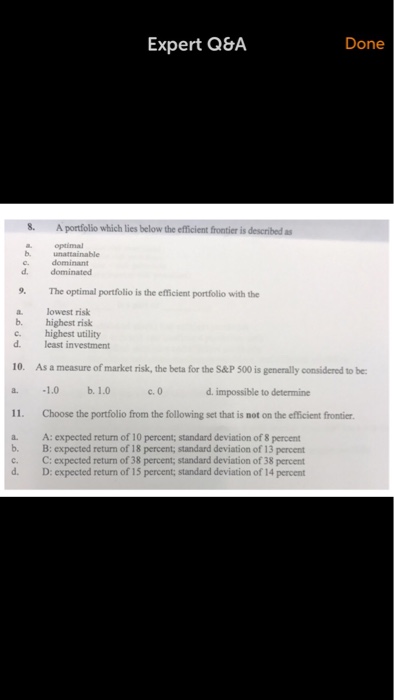

Question: Expert Q&A Done 8. A portfolio which lies below the efficient frontier is described as optimal unattainable dominant dominated a. e. d- 9. The optimal

Expert Q&A Done 8. A portfolio which lies below the efficient frontier is described as optimal unattainable dominant dominated a. e. d- 9. The optimal portfolio is the efficient portfolio with the a. lowest risk b. highest risk c. highest utility d. least investment 10. As a measure of market risk, the beta for the S&P 500 is generally considered to be a. 1.0 b. 1.0 11. Choose the portfolio from the following set that is not on the efficient frontier c. 0 d. impossible to determine a. A:expected return of 10 percent; standard deviation of 8 percent b. B: expected return of 18 percent, standard deviation of 13 percent c. C: expected return of 38 percent, standard deviation of 38 percent d. D: expected return of 15 percent; standard deviation of 14 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts