Question: . Explain and calculate the differences resulting from a $1,000 tax credit versus a $1,000 tax deduction for a single taxpayer with $40,000 of pre-tax

. Explain and calculate the differences resulting from a $1,000 tax credit versus a $1,000 tax deduction for a single taxpayer with $40,000 of pre-tax income that takes a standard deduction of $12,000. Be sure to show your work.

. Explain and calculate the differences resulting from a $1,000 tax credit versus a $1,000 tax deduction for a single taxpayer with $40,000 of pre-tax income that takes a standard deduction of $12,000. Be sure to show your work.

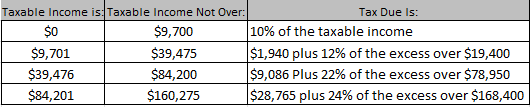

Taxable Income is: Taxable Income Not Over: Tax Due Is: \begin{tabular}{|c|c|l|} \hline$0 & $9,700 & 10% of the taxable income \\ \hline$9,701 & $39,475 & $1,940 plus 12% of the excess over $19,400 \\ \hline$39,476 & $84,200 & $9,086 Plus 22% of the excess over $78,950 \\ \hline$84,201 & $160,275 & $28,765 plus 24% of the excess over $168,400 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts