Question: Explain and calculate the differences resulting from a $ 5 0 0 tax credit versus a $ 5 0 0 tax deduction for a single

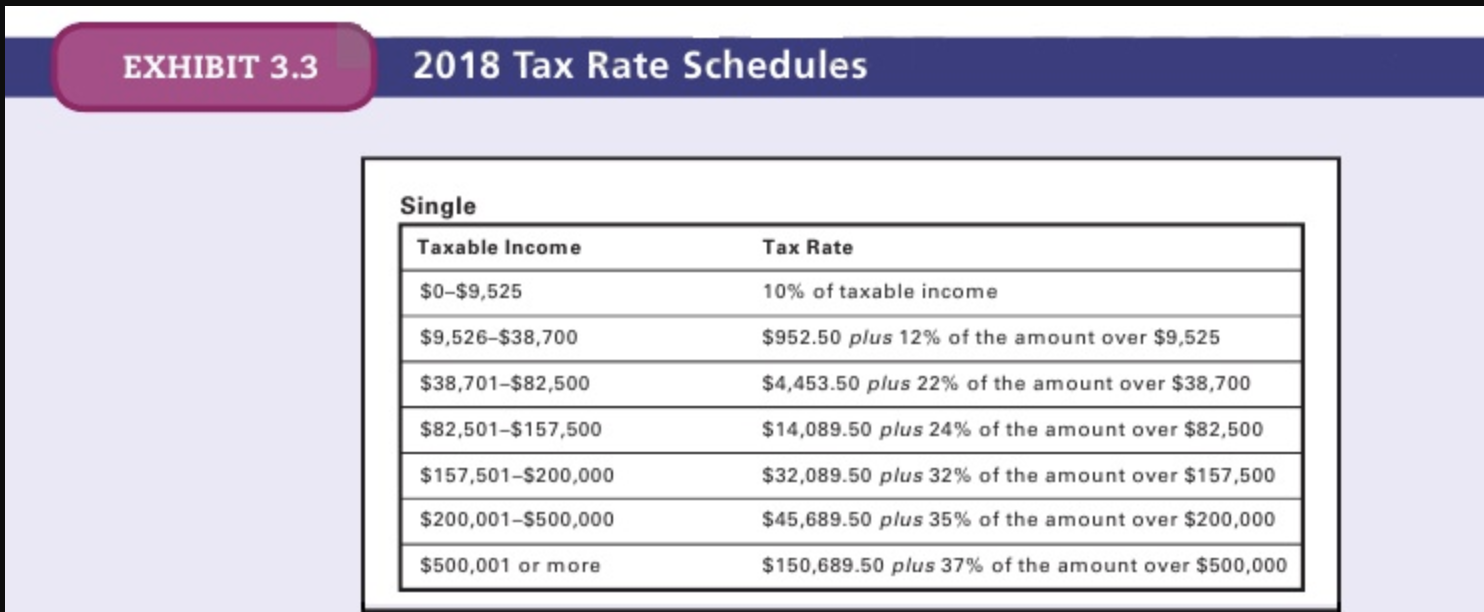

Explain and calculate the differences resulting from a $ tax credit versus a $ tax deduction for a single taxpayer with $ of pretax income. The standard deduction in was $ for single. Note that personal exemptions were suspended for Use Exhibit to determine the corresponding tax rate. Round the answers to the nearest cent.

Aftertax Income Tax Deduction

Aftertax Income Tax Credit Tax Rate Schedules

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock