Question: Explain and carry out all the instructions. Identify debit and credit P15-1B On June 1, 2015, Weller Corp. issued $3,000,000, 9%, 5-year bonds at face

Explain and carry out all the instructions. Identify debit and credit

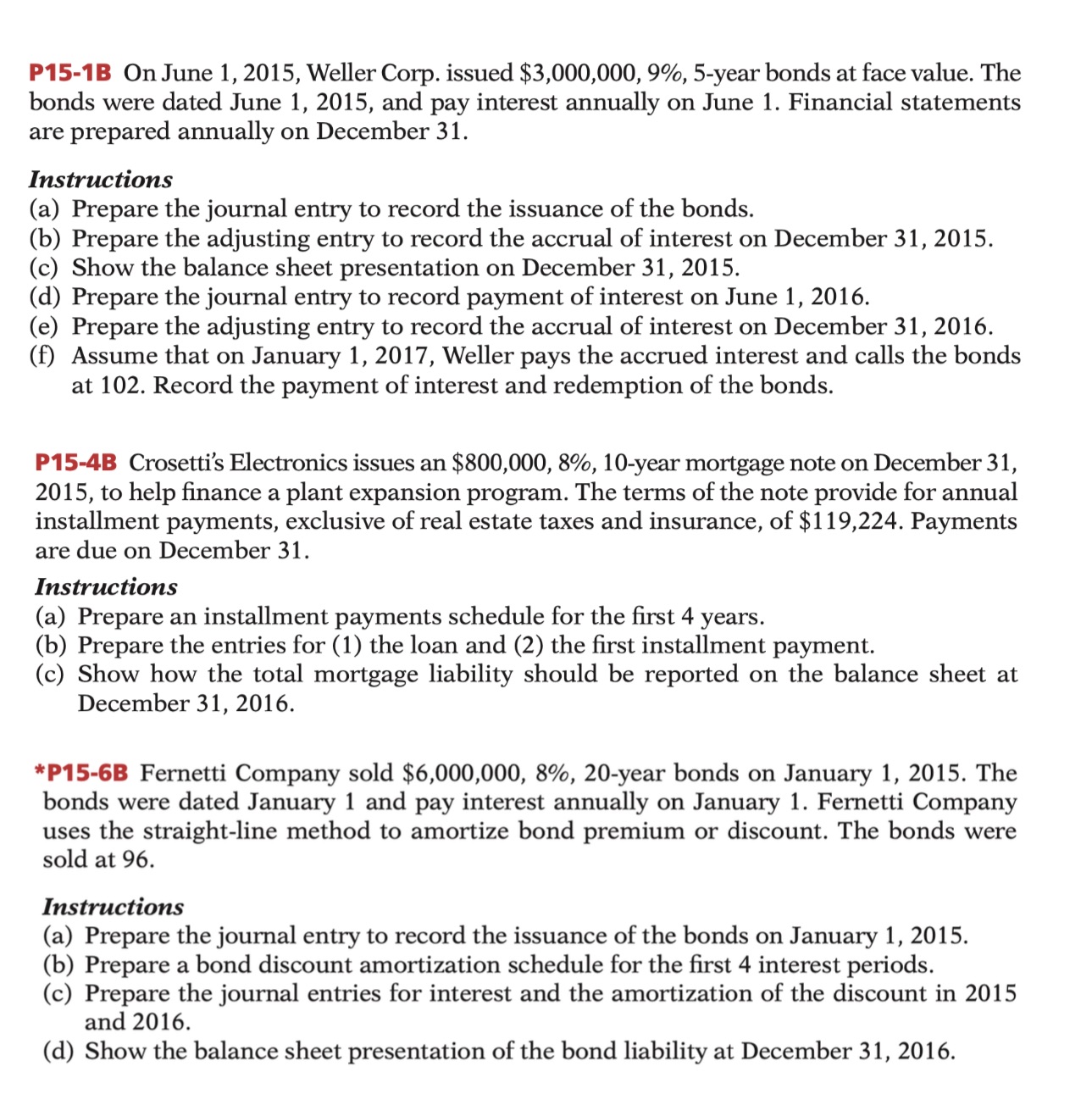

P15-1B On June 1, 2015, Weller Corp. issued $3,000,000, 9%, 5-year bonds at face value. The bonds were dated June 1, 2015, and pay interest annually on June 1. Financial statements are prepared annually on December 31. Instructions (a) Prepare the journal entry to record the issuance of the bonds. (b) Prepare the adjusting entry to record the accrual of interest on December 31, 2015. (c) Show the balance sheet presentation on December 31, 2015. (d) Prepare the journal entry to record payment of interest on June 1, 2016. (e) Prepare the adjusting entry to record the accrual of interest on December 31, 2016. (f) Assume that on January 1, 2017, Weller pays the accrued interest and calls the bonds at 102. Record the payment of interest and redemption of the bonds. P1 543 Crosetti's Electronics issues an $800,000, 8%, 10-year mortgage note on December 31, 2015, to help nance a plant expansion program. The terms of the note provide for annual installment payments, exclusive of real estate taxes and insurance, of $119,224. Payments are due on December 31. Instructions (a) Prepare an installment payments schedule for the rst 4 years. (b) Prepare the entries for (1) the loan and (2) the first installment payment. (c) Show how the total mortgage liability should be reported on the balance sheet at December 31, 2016. *P15-GB Fernetti Company sold $6,000,000, 8%, 20-year bonds on January 1, 2015. The bonds were dated January 1 and pay interest annually on January 1. Femetti Company uses the straight-line method to amortize bond premium or discount. The bonds were sold at 96. Instructions (a) Prepare the journal entry to record the issuance of the bonds on January 1, 2015. (b) Prepare a bond discount amortization schedule for the rst 4 interest periods. (c) Prepare the journal entries for interest and the amortization of the discount in 2015 and 2016. (d) Show the balance sheet presentation of the bond liability at December 31, 2016