Question: Where Do We Draw The Line? As Cecil shuffled through the stack of files on his desk and clicked away on his mouse, his mind

Where Do We Draw The Line?

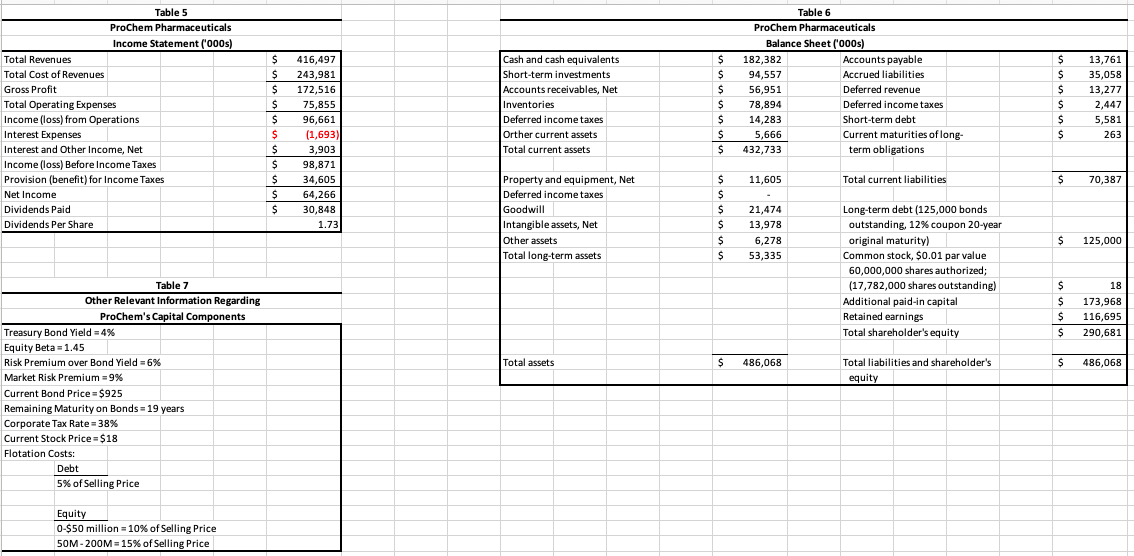

As Cecil shuffled through the stack of files on his desk and clicked away on his mouse, his mind kept racing back to what Jason, his boss, had said to him at the last budget meeting. "We can only fund two or three new projects over the next year," he said, "And up to a maximum capital investment of around $275 million. You've got to be highly selective," he cautioned. "The analysts have been rather critical of our last two product acquisitions, and our stock price does not need any further jolts!" Cecil Nazareth was the business development manager for ProChem Pharmaceuticals, a fairly large company with manufacturing facilities in four countries and sales and research and development centers all over the world. He had seen the firm go through two major restructurings during his 20-year career with ProChem and was instrumental in making a number of their product acquisition decisions. Cecil reported directly to the chief financial officer, Jason Schmidt, who had been recently moved into that position as a result of their last merger.The firm had gone through a series of "right-sizing" attempts and managerial transformations in recent years. Somehow, Cecil had survived it all. Obviously, his smart decisions and sharp foresight had served him well over the years. Unfortunately, their last merger had taken its toll on the company's stock price. With a number of the firm's patents expiring in the next three years, and most of its products far from getting final FDA approval, there was pressure to expand the product line. As a result, the last couple of product acquisitions were made rather hastily, at the insistence of the prior CFO, Bill Piper, despite Cecil's negative comments and concerns. One thing that Cecil had consistently warned against was the use of an arbitrary hurdle rate when deciding on new product acquisitions. Cecil was a firm believer in the use of the weighted average cost of capital (WACC) when evaluating project cash flows. Bill, on the other hand, preferred to use a baseline rate of 13% and would begin negotiations at a discount rate of 20%. While this strategy had resulted in a few good acquisitions, Cecil, was aware that sooner or later it would come back to haunt them. Their last two acquisitions, an anti-inflammatory drug, BruPain, and an anti-allergy medication, Immunol, were made using a discount rate assumption of 14%. Cecil was highly skeptical because he felt that with their 20-year bonds selling to yield 12.69% at that time, 14% would be too low to cover the 6% risk premium that analysts had typically required on the firm's equity. "We'll get by with debt financing on these two acquisitions," was Bill's way of justifying the decision, paying little heed to Cecil's concerns. "We have to get some more products in our portfolio," he remarked. After the announcement of ProChem's last merger with Standard Chemicals, Bill Piper took early retirement, and was replaced by Jason Schmidt, who had been serving as Standard Chemicals' VP of finance. Unlike Bill, Jason preferred to be more objective and selective when evaluating new product acquisitions. He had heard about Bill's arbitrary investment decision rule and had made it a point to tell Cecil that he disagreed with it. "I would rather that you estimate the firm's marginal cost of capital using market value weights and flotation costs," he had said to Cecil during one of their earlier discussions. "It has worked really well for us at Standard Chemicals," he said with pride. "I totally agree," Cecil had replied, "I have been trying to convince Bill for years, but he would not buy it," he said shrugging his shoulders. At Jason's request, Cecil had set up a project team and asked them to come up with some proposals for acquisitions. "Use a 10-year forecast," he recommended, "and figure out what the residual value will be after 10 years." After careful analysis, the project team had come up with four recommendations: an ophthalmology product, an antiviral drug, an anticancer medication, and an antibiotic. The detailed projections and other relevant information are shown in Tables 1-7 below. All four products had fairly good projections and looked profitable over the 10-year horizon, but having been burned the last two times, Cecil couldn't help wondering, "Where do we draw the line?"

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts