Question: Explain and discusss each round separately please. No need to do the math, just need to discuss how the company is doing. Its for presentation.

Explain and discusss each round separately please. No need to do the math, just need to discuss how the company is doing. Its for presentation.

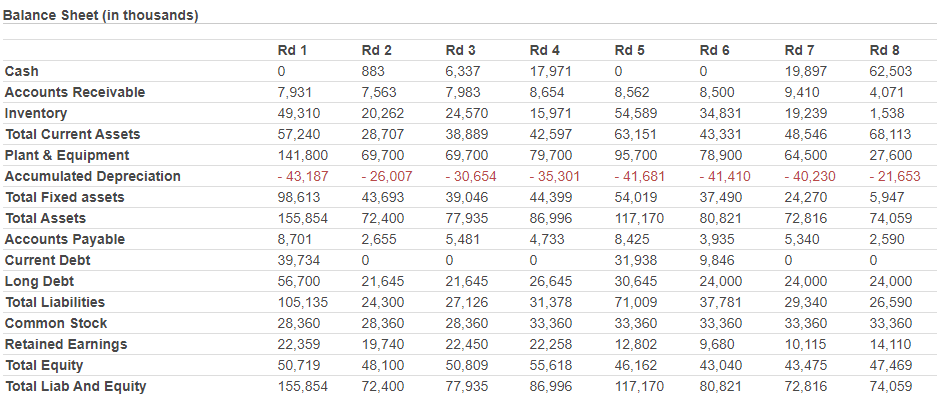

Balance Sheet (in thousands) Rd 1 Rd 5 Rd 6 0 0 0 Cash Accounts Receivable Inventory Total Current Assets Plant & Equipment Accumulated Depreciation Total Fixed assets Total Assets Accounts Payable Current Debt Long Debt Total Liabilities Common Stock Retained Earnings Total Equity Total Liab And Equity 7,931 49,310 57,240 141,800 - 43,187 98,613 155,854 8,701 39,734 56,700 105,135 28,360 22,359 50,719 155,854 Rd 2 883 7,563 20,262 28,707 69,700 - 26,007 43,693 72,400 2,655 Rd 3 6,337 7,983 24,570 38,889 69,700 - 30,654 39,046 77,935 5,481 Rd 4 17,971 8,654 15,971 42,597 79,700 - 35,301 44,399 86,996 4,733 0 26,645 31,378 33,360 22,258 55,618 86,996 8,562 54,589 63,151 95,700 - 41,681 54,019 117,170 8,425 31,938 30,645 71,009 33,360 12,802 46,162 117,170 8,500 34,831 43,331 78,900 - 41,410 37,490 80,821 3,935 9,846 24,000 37,781 33,360 9,680 43,040 80,821 Rd 7 19,897 9,410 19,239 48,546 64,500 - 40,230 24,270 72,816 5,340 0 24,000 29,340 33,360 10,115 43,475 72,816 Rd 8 62,503 4,071 1,538 68,113 27,600 - 21,653 5,947 74,059 2,590 0 0 0 21,645 24,300 28,360 19,740 48, 100 72,400 21,645 27,126 28,360 22,450 50,809 77,935 24,000 26,590 33,360 14,110 47,469 74,059 Balance Sheet (in thousands) Rd 1 Rd 5 Rd 6 0 0 0 Cash Accounts Receivable Inventory Total Current Assets Plant & Equipment Accumulated Depreciation Total Fixed assets Total Assets Accounts Payable Current Debt Long Debt Total Liabilities Common Stock Retained Earnings Total Equity Total Liab And Equity 7,931 49,310 57,240 141,800 - 43,187 98,613 155,854 8,701 39,734 56,700 105,135 28,360 22,359 50,719 155,854 Rd 2 883 7,563 20,262 28,707 69,700 - 26,007 43,693 72,400 2,655 Rd 3 6,337 7,983 24,570 38,889 69,700 - 30,654 39,046 77,935 5,481 Rd 4 17,971 8,654 15,971 42,597 79,700 - 35,301 44,399 86,996 4,733 0 26,645 31,378 33,360 22,258 55,618 86,996 8,562 54,589 63,151 95,700 - 41,681 54,019 117,170 8,425 31,938 30,645 71,009 33,360 12,802 46,162 117,170 8,500 34,831 43,331 78,900 - 41,410 37,490 80,821 3,935 9,846 24,000 37,781 33,360 9,680 43,040 80,821 Rd 7 19,897 9,410 19,239 48,546 64,500 - 40,230 24,270 72,816 5,340 0 24,000 29,340 33,360 10,115 43,475 72,816 Rd 8 62,503 4,071 1,538 68,113 27,600 - 21,653 5,947 74,059 2,590 0 0 0 21,645 24,300 28,360 19,740 48, 100 72,400 21,645 27,126 28,360 22,450 50,809 77,935 24,000 26,590 33,360 14,110 47,469 74,059

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts