Question: explain and show the calculations for part (e) please. the answer for all parts are provided A new plant to produce tractor gears requires an

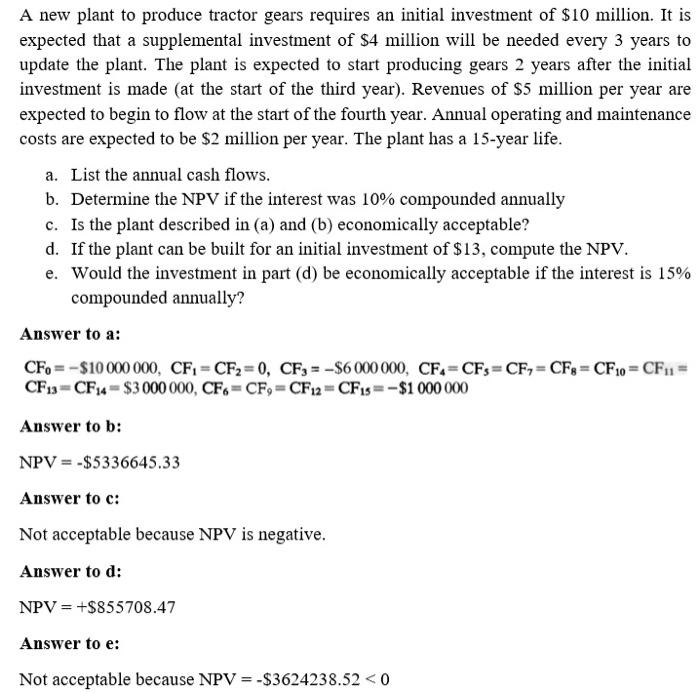

A new plant to produce tractor gears requires an initial investment of $10 million. It is expected that a supplemental investment of $4 million will be needed every 3 years to update the plant. The plant is expected to start producing gears 2 years after the initial investment is made (at the start of the third year). Revenues of $5 million per year are expected to begin to flow at the start of the fourth year. Annual operating and maintenance costs are expected to be $2 million per year. The plant has a 15-year life. a. List the annual cash flows. b. Determine the NPV if the interest was 10% compounded annually c. Is the plant described in (a) and (b) economically acceptable? d. If the plant can be built for an initial investment of $13, compute the NPV. e. Would the investment in part (d) be economically acceptable if the interest is 15% compounded annually? Answer to a: CFo=-$10 000 000, CF, CF2=0, CF, = -$6 000 000, CF.CFs=CF, CF8=CF10=CF = CF13=CF 14 = $3 000 000, CF = CF,=CF12 = CF1s =-$1 000 000 Answer to b: NPV = -$5336645.33 Answer to c: Not acceptable because NPV is negative. Answer to d: NPV = +$855708.47 Answer to e: Not acceptable because NPV = -$3624238.52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts