Question: i need the answer for #17 with calculation not excel A new plant to produce tractor gears requires an initial investment of $10 million. It

i need the answer for #17 with calculation not excel

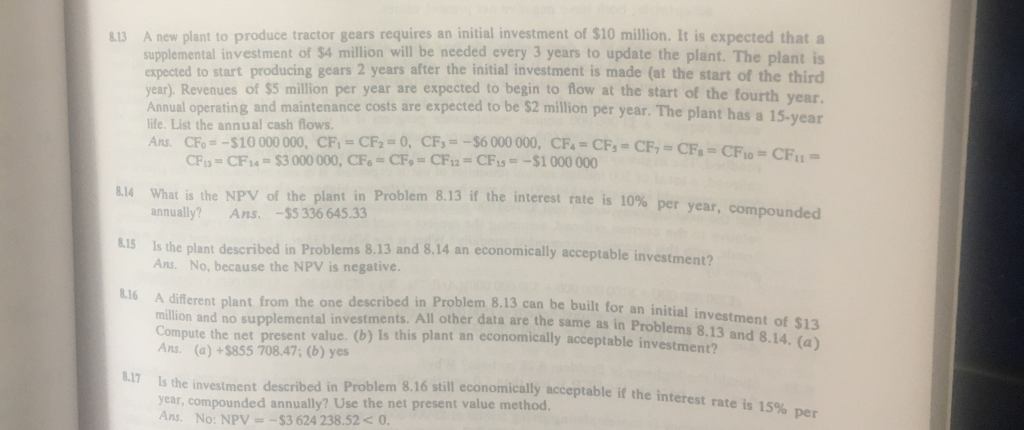

A new plant to produce tractor gears requires an initial investment of $10 million. It is expected that a supplemental investment of $4 million will be needed every 3 years to update the plant. The plant is expected to start producing gears 2 years after the initial investment is made (at the start of the third year). Revenues of $5 million per year are expected to begin to flow at the start of the fourth year Annual operating and maintenance costs are expected to be $2 million per year. The plant has a 15.year life. List the annual cash flows Ans. CR7-510 000 000. CA+CF2=0, CF,--$6000000, cF.-CB+CB+CE 13 CF13 = CF14-S3 000 000, CF.-CF,-CF12 = CF,,--$1 000 000 14 what is the NPV of the plant in Problem 8.13 i f the interest rate is 10% per year, compounded annually? Ans. -$5 336 645.33 L1S Is the plant described in Problems 8.13 and 8.14 an economically acceptable inves Ans. No, because the NPV is negative the one described in Problem 8.13 can be built for an initial investment of $13 mental investments. All other data are the same as in Problems 8.13 and 8.14. (a sent value. (b) Is this plant an economically acceptable investment? A different plant from Compute the net pre Ans. (a)+$855 708.47: (b) yes 8.17 still economically acceptable if the interest rate is 15% per Problem 8.16 Is the investment described in year, compounded annually? Use the net present value method Ans, No: NPV =-$3624238.52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts