Question: Explain Answer Show Work Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top-right

Explain Answer Show Work

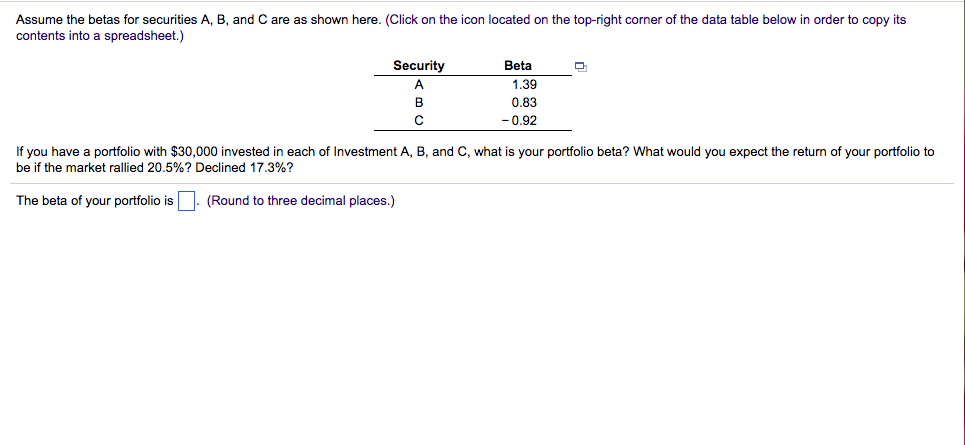

Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) SecurityBeta 1.39 0.83 0.92 If you have a portfolio with $30,000 invested in each of Investment A, B, and C, what is your portfolio beta? What would you expect the return of your portfolio to be if the market rallied 20.5%? Declined 17.3%? The beta of your portfolio is(Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock