Question: Explain how to solve and show work for each question please 11. Projects A and B have identical expected lives and identical initial cash outflows

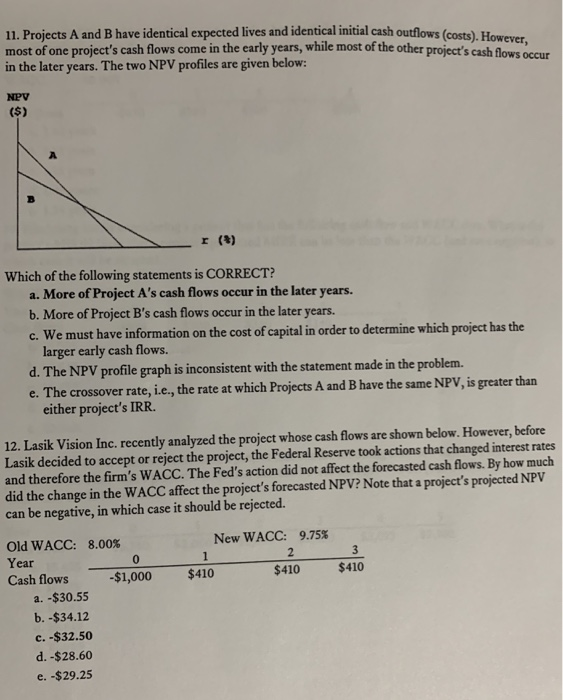

11. Projects A and B have identical expected lives and identical initial cash outflows (costs).However, most of one project's cash flows come in the early years, while most of the other project's cash flows occur in the later years. The two NPV profiles are given below: NPV A. r (a) Which of the following statements is CORRECT? a. More of Project A's cash flows occur in the later years. b. More of Project B's cash flows occur in the later years. c. We must have information on the cost of capital in order to determine which project has the larger early cash flows. d. The NPV profile graph is inconsistent with the statement made in the problem. e. The crossover rate, i.e., the rate at which Projects A and B have the same NPV, is greater than either project's IRR. 12. Lasik Vision Inc. recently analyzed the project whose cash flows are shown below. However, before Lasik decided to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's WACC. The Fed's action did not affect the forecasted cash flows. By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's projected NPV can be negative, in which case it should be rejected. New WACC: 9.75% Old WACC: 8.00% Year Cash flows 1,000 $410 0 2 $410 $410 a. -$30.55 b.-$34.12 c.-$32.50 d. -$28.60 e. -$29.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts