Question: Explain how your IT investment project idea will be funded based on the company's Financial Fact Sheet. Include the following calculations in your explanation: a

Explain how your IT investment project idea will be funded based on the company's "Financial Fact Sheet." Include the following calculations in your explanation:

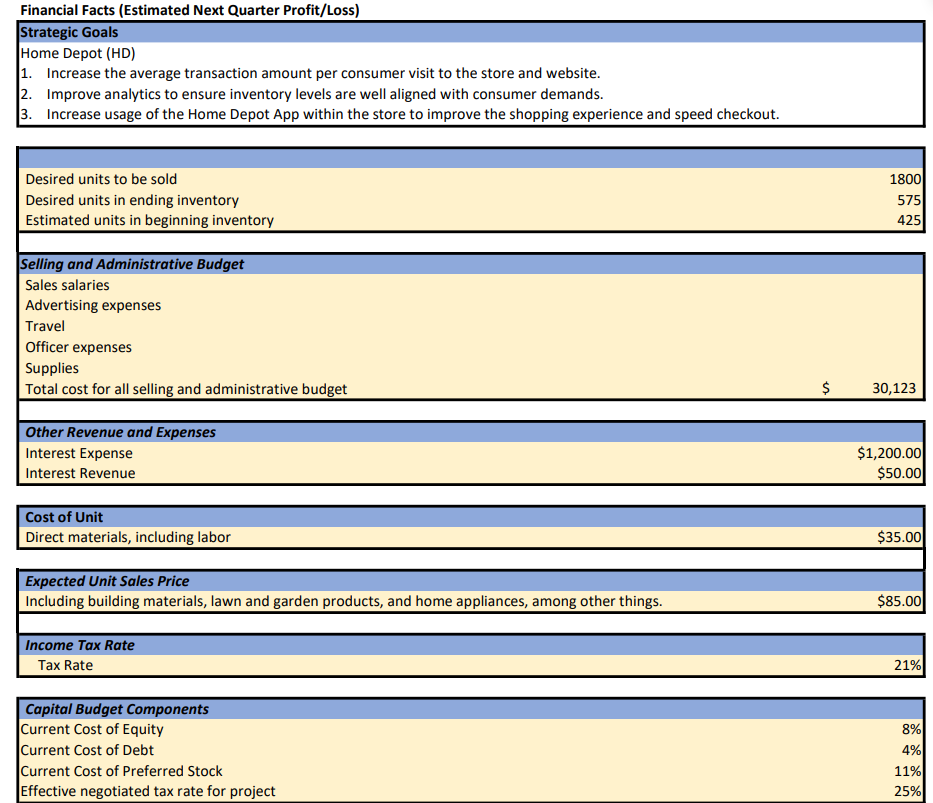

a detailed discussion of the marginal cost of capital (MCC) that supports your project proposal

weighted average cost of capital (WACC)

average rate of return (ARR)

net present value (NPV)

Please note: calculations and values for the MCC, WACC, ARR, and NPV is require

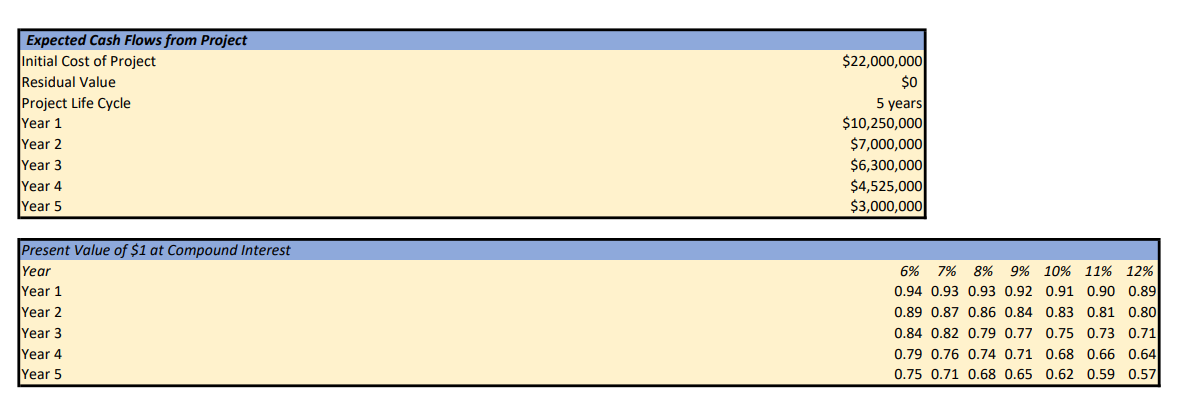

Expected Cash Flows from Project Initial Cost of Project Residual Value Project Life Cycle $22,000,000 $0 5 years Year 1 Year 2 Year 3 Year 4 $10,250,000 $7,000,000 $6,300,000 $4,525,000 Year 5 Present Value of $1 at Compound Interest Year $3,000,000 Year 1 Year 2 Year 3 Year 4 Year 5 6% 7% 8% 9% 10% 11% 12% 0.94 0.93 0.93 0.92 0.91 0.90 0.89 0.89 0.87 0.86 0.84 0.83 0.81 0.80 0.84 0.82 0.79 0.77 0.75 0.73 0.71 0.79 0.76 0.74 0.71 0.68 0.66 0.64 0.75 0.71 0.68 0.65 0.62 0.59 0.57

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts