Question: explain in detail from where we found FTC allowed in the U.S ( why did we take the foreign taxes paid 17,000 for year 1

explain in detail from where we found FTC allowed in the U.S ( why did we take the foreign taxes paid 17,000 for year 1 and the U.S tax before FTC in years 2 and 3 )?

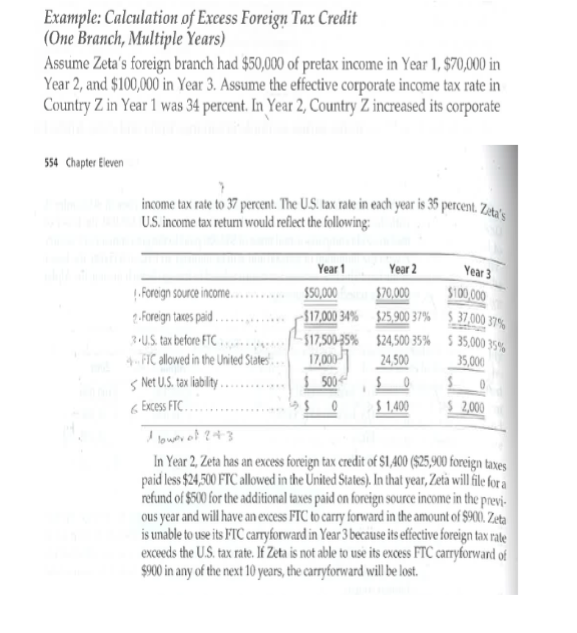

Example: Calculation of Excess Foreign Tax Credit (One Branch, Multiple Years) Assume Zeta's foreign branch had $50,000 of pretax income in Year 1, $70,000 in Year 2, and $100,000 in Year 3. Assume the effective corporate income tax rate in Country Z in Year 1 was 34 percent. In Year 2, Country Z increased its corporate 554 Chapter Eleven income tax rate to 37 percent. The U.S. tax rate in each year is 35 percent. Zetar U.S. income tax return would reflect the following: Year 2 Year 1 Year 3 .Foreign source income. . $50,000 2.Foreign taces paid.. . 117,000 34% 3US. tax before FTC ... 4. FIC allowed in the United States.. s Net U.S. tax liabity.. $100,00 $70,000 $ 37,000 379 $ 35,000 35% 35,000 $25,900 37% $17,500-35% 17,000 $24,500 35% ....... 24,500 $ 1,400 $ 2,000 Excess FTC. ...... I lower of ? t3 In Year 2, Zeta has an excess foreign tax credit of $1,400 ($25,900 foreign taxes paid less $24,500 FTC allowed in the United States). In that year, Zet will fle fora refund of $500 for the additional taxes paid on foreign source income in the previ- ous year and will have an excess FTC to carry forward in the amount of $90. Zeta is unable to use its FTC carryforward in Year 3 because its effective foreign tax rate exceeds the U.S. tax rate. If Zeta is not able to use its excess FTC carryforward of $900 in any of the next 10 years, the carryforward will e lost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts