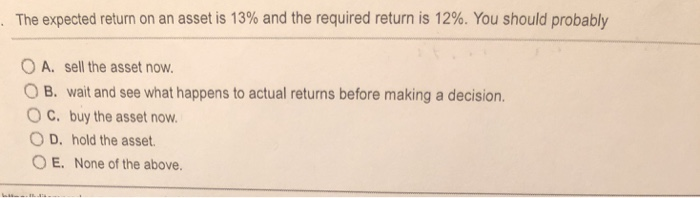

Question: explain it The expected return on an asset is 13% and the required return is 12%. You should probably O A. sell the asset now.

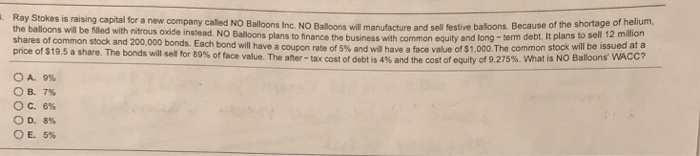

The expected return on an asset is 13% and the required return is 12%. You should probably O A. sell the asset now. O B. wait and see what happens to actual returns before making a decision. O C. buy the asset now. O D. hold the asset O E. None of the above a new company called NO Balloons Inc. NO Balloons will manufacture and sell festive balloons. Because of the shortage of helium, 1,000 The common stock will be issuedata cost of debt is 4% and the cost of equity of 9.275%. What is NO Baloons. WACC? Ray Stokes is raising capital for company the ballons will be illed with nitrous oxide insead NO Balloons plans to finance the business with common equity and lon The common t plansto s shares of common stock and 200,000 bonds. Each bond will have a coupon rate of 5% and wil have a face value os price of S19.5 a share. The bonds will sell for 89% of face v alue. The after-tax OA, 9% .7% Oc.6% OD, 8% OE, 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts