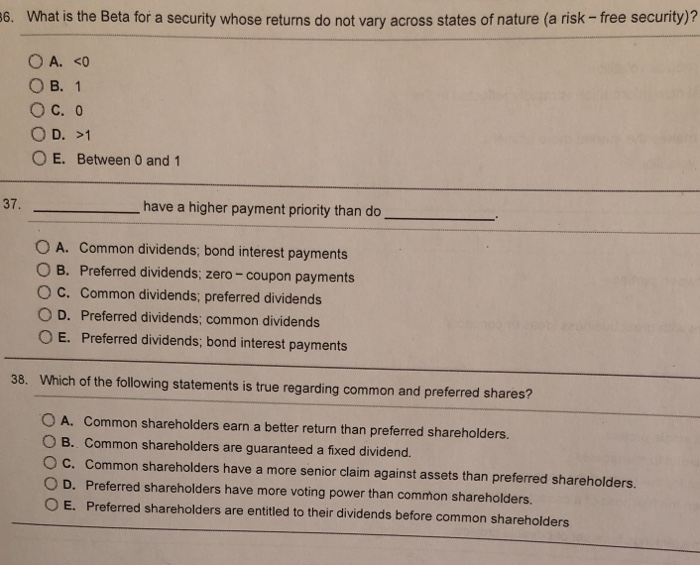

Question: explain it What is the Beta for a security whose returns do not vary across states of nature (a risk-free security)? 6. O B. 1

What is the Beta for a security whose returns do not vary across states of nature (a risk-free security)? 6. O B. 1 Oc.0 O E. Between 0 and 1 have a higher payment priority than do 37 . O A. Common dividends; bond interest payments O B. Preferred dividends; zero-coupon payments O C. Common dividends; preferred dividends O D. Preferred dividends; common dividends O E. Preferred dividends; bond interest payments 38. Which of the following statements is true regarding common and preferred shares? O A. Common shareholders earn a better return than preferred shareholders. O B. Common shareholders are guaranteed a fixed dividend. C. Common shareholders have a more senior claim against assets than preferred shareholders. OD. Preferred shareholders have more voting power than common shareholders. O E. Preferred shareholders are entitled to their dividends before common shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts