Question: Explain it with all excel steps Create an equal-weighted portfolio of the four individual factor portfolios (size, value, quality, momentum). Calculate the annualized average returns,

- Explain it with all excel steps

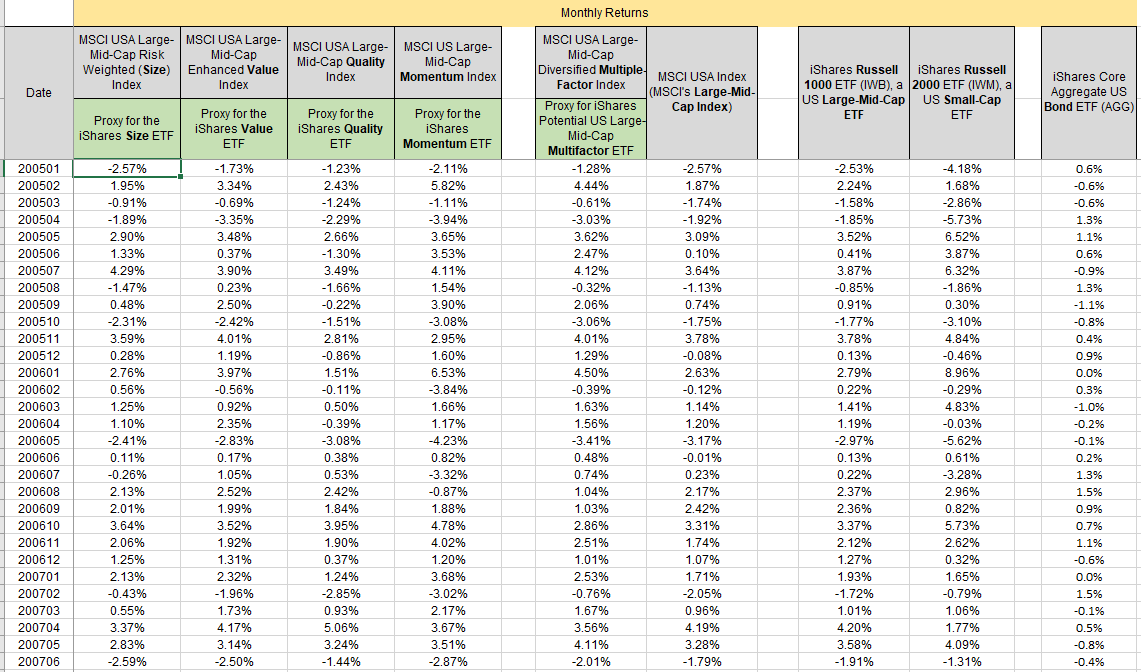

- Create an equal-weighted portfolio of the four individual factor portfolios (size, value, quality, momentum). Calculate the annualized average returns, standard deviations, and the Sharpe ratios for the single factor portfolios, the equal-weighted combination you created, the MSCI Multifactor index, and the MSCI USA index. Take the average risk-free rate as 1.41% (annualized) over this time period.

- Calculate the total cumulative returns (growth of $1) for the same portfolios as above between 2005 and 2014.

- Based on these statistics which portfolio has performed the best? Which single factor portfolios have beaten the market (if any)? Is it better to divide up your money across the four single factor portfolios, or invest in one multifactor portfolio?

Monthly Returns MSCI USA Large- MSCI USA Large MSCI USA Large- Mid-Cap Risk Mid-Cap Mid-Cap Quality Weighted (Size) Enhanced Value Index Index MSCI US Large- Mid-Cap Momentum Index Index Date iShares Russell iShares Russell 1000 ETF (IWB), a 2000 ETF (IWM), a US Large-Mid-Cap US Small-Cap ETF ETF iShares Core Aggregate US Bond ETF (AGG) Proxy for the Proxy for the iShares Size ETF Proxy for the iShares Value ETF Proxy for the iShares Quality ETF iShares Momentum ETF 200501 -2.57% -1.73% -1.23% -2.11% -2.53% -4.18% 0.6% 200502 1.95% 3.34% 2.43% 5.82% 2.24% 1.68% -0.6% 200503 -0.91% -0.69% -1.24% - 1.11% -1.58% -2.86% -0.6% 200504 -1.89% -3.35% -2.29% -3.94% 1.3% 200505 2.90% 3.48% 2.66% 3.65% 1.1% -5.73% 6.52% 3.87% 6.32% 200506 0.37% -1.30% 1.33% 4.29% 0.6% -1.85% 3.52% 0.41% 3.87% -0.85% 3.53% 4.11% 200507 3.90% 3.49% -0.9% 200508 -1.47% 0.23% -1.66% 1.54% MSCI USA Large- Mid-Cap Diversified Multiple MSCI USA Index Factor Index (MSCI's Large-Mid- Proxy for iShares Cap Index) Potential US Large- Mid-Cap Multifactor ETF -1.28% -2.57% 4.44% 1.87% -0.61% -1.74% -3.03% -1.92% 3.62% 3.09% 2.47% 0.10% 4.12% 3.64% -0.32% -1.13% 2.06% 0.74% -3.06% -1.75% 4.01% 3.78% 1.29% -0.08% 4.50% 2.63% -0.39% -0.12% 1.63% 1.14% 1.56% 1.20% -3.41% -3.17% 0.48% -0.01% 0.74% 0.23% 1.04% 2.17% 1.03% 2.42% 2.86% 3.31% 2.51% 1.74% -1.86% 1.3% 200509 0.48% 2.50% 3.90% 0.91% 0.30% -1.1% 200510 -2.31% -2.42% -0.22% -1.51% 2.81% -3.08% -1.77% -3.10% -0.8% 200511 3.59% 4.01% 2.95% 3.78% 4.84% 0.4% 0.28% 1.19% -0.86% 1.60% -0.46% 0.9% 2.76% 3.97% 6.53% 8.96% 0.0% 200512 200601 200602 200603 -0.56% 1.51% -0.11% 0.50% -0.29% 0.3% -3.84% 1.66% 0.13% 2.79% 0.22% 1.41% 1.19% -2.97% 0.92% 4.83% 0.56% 1.25% 1.10% -2.41% -1.0% 200604 2.35% -0.39% 1.17% -0.03% -0.2% 200605 -2.83% -4.23% -5.62% -0.1% -3.08% 0.38% 200606 0.11% 0.17% 0.82% 0.13% 0.61% 0.2% 200607 -0.26% 1.05% 0.53% -3.32% 0.22% -3.28% 1.3% 200608 2.13% 2.52% 2.37% 2.96% 1.5% -0.87% 1.88% 200609 2.01% 2.42% 1.84% 3.95% 1.99% 2.36% 0.82% 0.9% 200610 3.52% 4.78% 3.37% 5.73% 0.7% 3.64% % 2.06% 200611 1.92% 1.90% 4.02% 2.62% 1.1% 1.25% 1.20% 1.01% 0.32% 1.31% 2.32% -0.6% 2.12% 1.27% 1.93% 0.37% 1.24% 1.07% 1.71% 3.68% 1.65% 0.0% 200612 200701 200702 200703 200704 2.13% -0.43% 0.55% 2.53% -0.76% -1.96% -2.85% -3.02% -2.05% -1.72% -0.79% 1.5% 1.73% 2.17% 1.67% 0.96% 1.01% 1.06% -0.1% 0.93% 5.06% 3.37% 4.17% 3.67% 3.56% 4.19% 4.20% 1.77% 0.5% 200705 3.14% 3.24% 3.51% 4.11% 3.28% 3.58% 4.09% -0.8% 2.83% -2.59% 200706 -2.50% -1.44% -2.87% -2.01% -1.79% -1.91% -1.31% -0.4% Monthly Returns MSCI USA Large- MSCI USA Large MSCI USA Large- Mid-Cap Risk Mid-Cap Mid-Cap Quality Weighted (Size) Enhanced Value Index Index MSCI US Large- Mid-Cap Momentum Index Index Date iShares Russell iShares Russell 1000 ETF (IWB), a 2000 ETF (IWM), a US Large-Mid-Cap US Small-Cap ETF ETF iShares Core Aggregate US Bond ETF (AGG) Proxy for the Proxy for the iShares Size ETF Proxy for the iShares Value ETF Proxy for the iShares Quality ETF iShares Momentum ETF 200501 -2.57% -1.73% -1.23% -2.11% -2.53% -4.18% 0.6% 200502 1.95% 3.34% 2.43% 5.82% 2.24% 1.68% -0.6% 200503 -0.91% -0.69% -1.24% - 1.11% -1.58% -2.86% -0.6% 200504 -1.89% -3.35% -2.29% -3.94% 1.3% 200505 2.90% 3.48% 2.66% 3.65% 1.1% -5.73% 6.52% 3.87% 6.32% 200506 0.37% -1.30% 1.33% 4.29% 0.6% -1.85% 3.52% 0.41% 3.87% -0.85% 3.53% 4.11% 200507 3.90% 3.49% -0.9% 200508 -1.47% 0.23% -1.66% 1.54% MSCI USA Large- Mid-Cap Diversified Multiple MSCI USA Index Factor Index (MSCI's Large-Mid- Proxy for iShares Cap Index) Potential US Large- Mid-Cap Multifactor ETF -1.28% -2.57% 4.44% 1.87% -0.61% -1.74% -3.03% -1.92% 3.62% 3.09% 2.47% 0.10% 4.12% 3.64% -0.32% -1.13% 2.06% 0.74% -3.06% -1.75% 4.01% 3.78% 1.29% -0.08% 4.50% 2.63% -0.39% -0.12% 1.63% 1.14% 1.56% 1.20% -3.41% -3.17% 0.48% -0.01% 0.74% 0.23% 1.04% 2.17% 1.03% 2.42% 2.86% 3.31% 2.51% 1.74% -1.86% 1.3% 200509 0.48% 2.50% 3.90% 0.91% 0.30% -1.1% 200510 -2.31% -2.42% -0.22% -1.51% 2.81% -3.08% -1.77% -3.10% -0.8% 200511 3.59% 4.01% 2.95% 3.78% 4.84% 0.4% 0.28% 1.19% -0.86% 1.60% -0.46% 0.9% 2.76% 3.97% 6.53% 8.96% 0.0% 200512 200601 200602 200603 -0.56% 1.51% -0.11% 0.50% -0.29% 0.3% -3.84% 1.66% 0.13% 2.79% 0.22% 1.41% 1.19% -2.97% 0.92% 4.83% 0.56% 1.25% 1.10% -2.41% -1.0% 200604 2.35% -0.39% 1.17% -0.03% -0.2% 200605 -2.83% -4.23% -5.62% -0.1% -3.08% 0.38% 200606 0.11% 0.17% 0.82% 0.13% 0.61% 0.2% 200607 -0.26% 1.05% 0.53% -3.32% 0.22% -3.28% 1.3% 200608 2.13% 2.52% 2.37% 2.96% 1.5% -0.87% 1.88% 200609 2.01% 2.42% 1.84% 3.95% 1.99% 2.36% 0.82% 0.9% 200610 3.52% 4.78% 3.37% 5.73% 0.7% 3.64% % 2.06% 200611 1.92% 1.90% 4.02% 2.62% 1.1% 1.25% 1.20% 1.01% 0.32% 1.31% 2.32% -0.6% 2.12% 1.27% 1.93% 0.37% 1.24% 1.07% 1.71% 3.68% 1.65% 0.0% 200612 200701 200702 200703 200704 2.13% -0.43% 0.55% 2.53% -0.76% -1.96% -2.85% -3.02% -2.05% -1.72% -0.79% 1.5% 1.73% 2.17% 1.67% 0.96% 1.01% 1.06% -0.1% 0.93% 5.06% 3.37% 4.17% 3.67% 3.56% 4.19% 4.20% 1.77% 0.5% 200705 3.14% 3.24% 3.51% 4.11% 3.28% 3.58% 4.09% -0.8% 2.83% -2.59% 200706 -2.50% -1.44% -2.87% -2.01% -1.79% -1.91% -1.31% -0.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts