Question: EXPLAIN THE FINANCIAL ANALYSIS FOR LULULEMON USING THE FOLLOWING DATA Description The information in Exhibit 1.1 till Exhibit 1.5 is extracted from the annual report

EXPLAIN THE FINANCIAL ANALYSIS FOR LULULEMON USING THE FOLLOWING DATA

Description

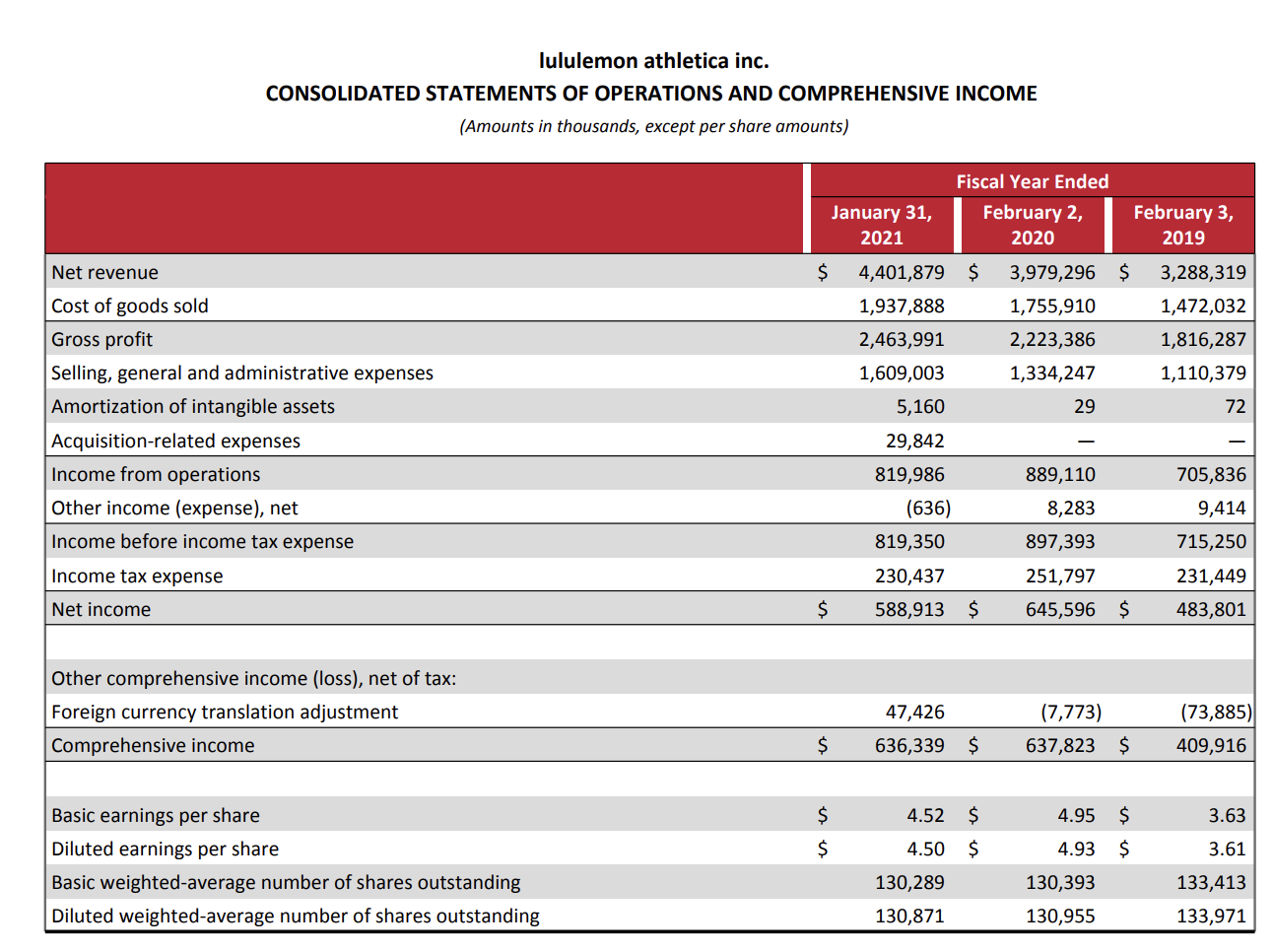

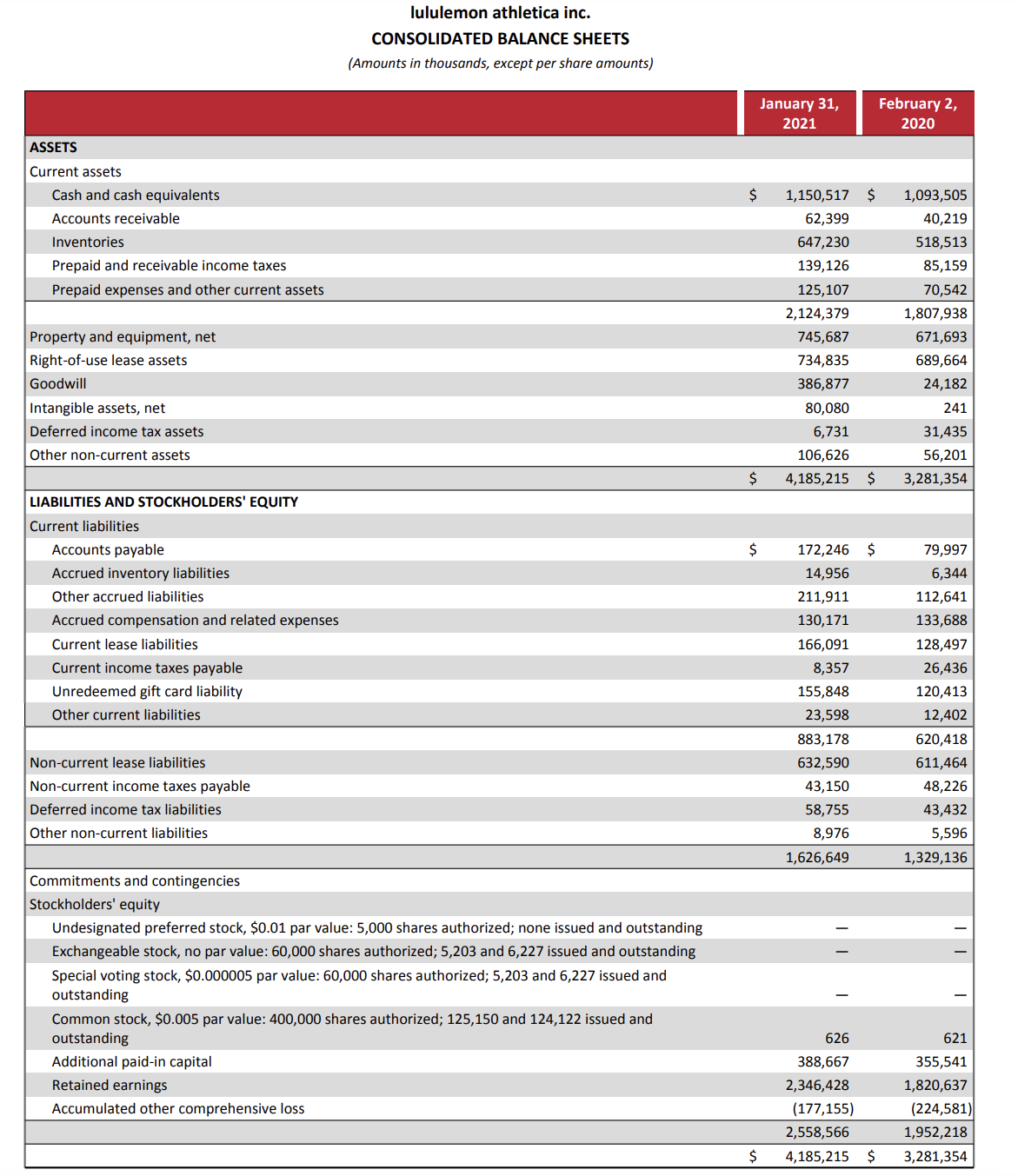

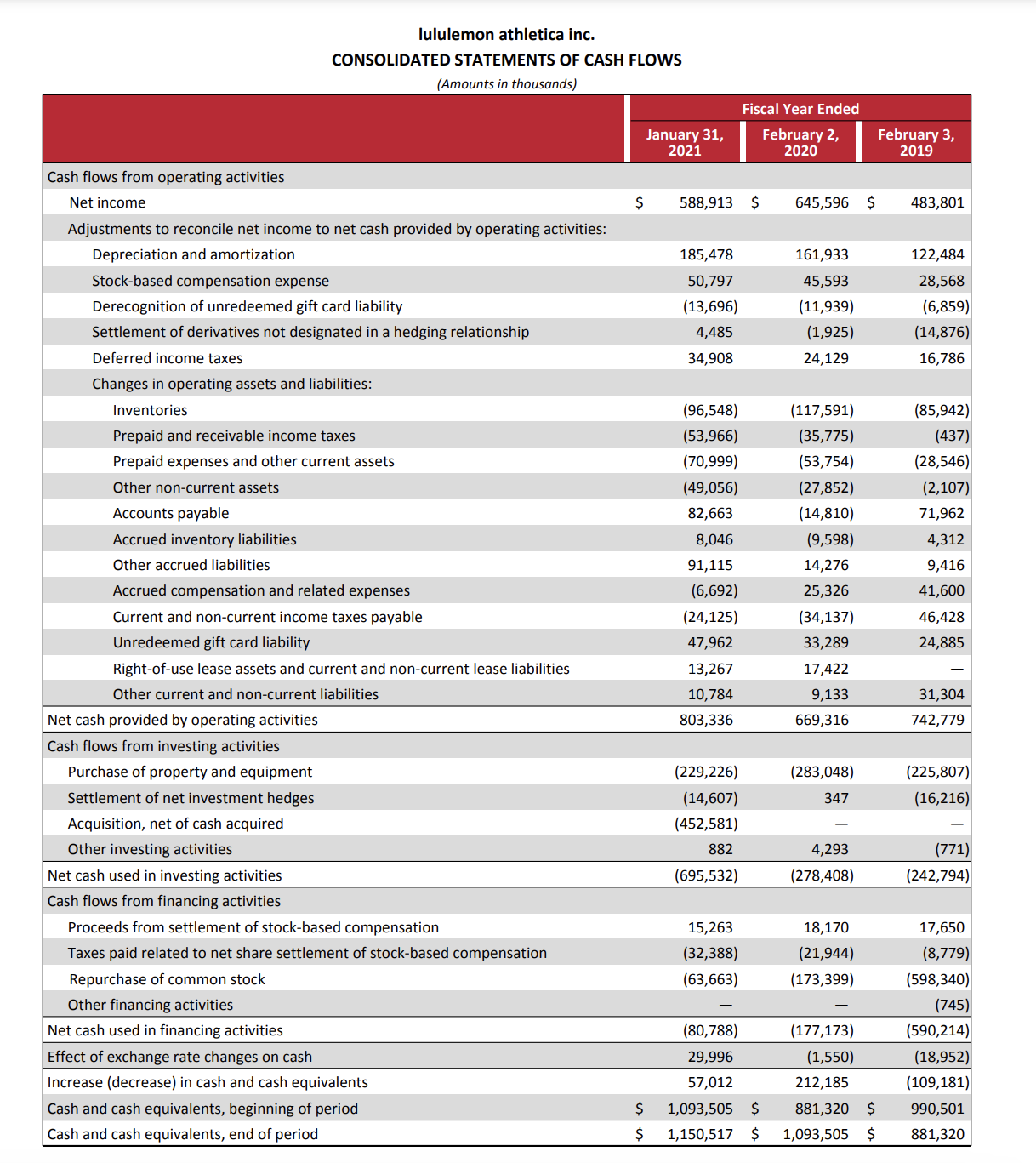

The information in Exhibit 1.1 till Exhibit 1.5 is extracted from the annual report of Lululemon athletic inc. for the years ended 2020 and 2021. A few important ratios are being calculated to come up with the position of the company in comparison to other competitors.

Ratios

The profitability Ratio includes a few important ratios, profit Margin, return on assets, return on equity, return on investment, operating ratio, gross profit ratio and net profit ratio.

Profit Margin:

Profit Margin was calculated as the total net income divided by the company's sales to determine its profit stability. Lululemon's Profit Margin for the year ended 2021 is 13.38%, calculated in Exhibit 2.1; by looking into 2020, it was 16.2%, which clearly shows the downfall in 2021.

Return on Asset:

Return on Equity:

Return on Investment:

Operating Ratio:

Gross Profit:

Net Profit Ratio:

Exhibit 1.1Statement of Income for Lululemon athletica inc. (Fiscal Year ended 2019, 2020, 2021)

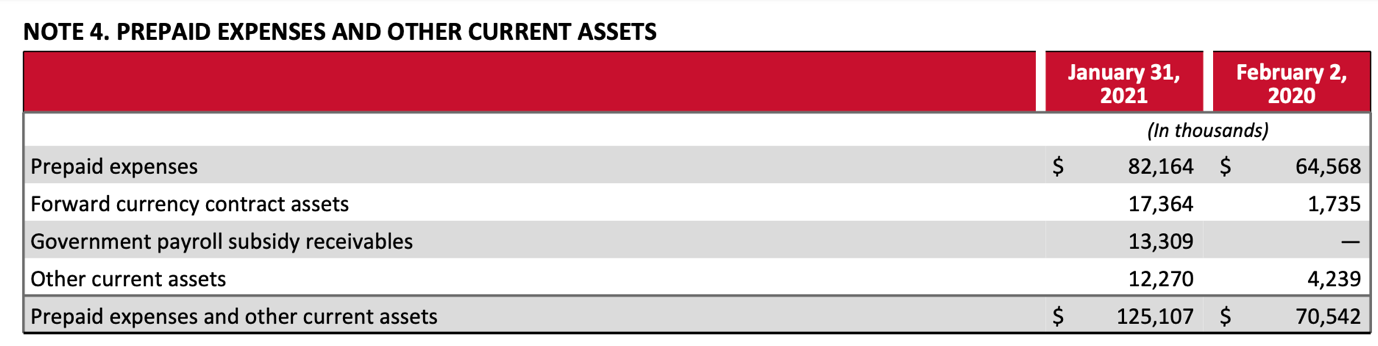

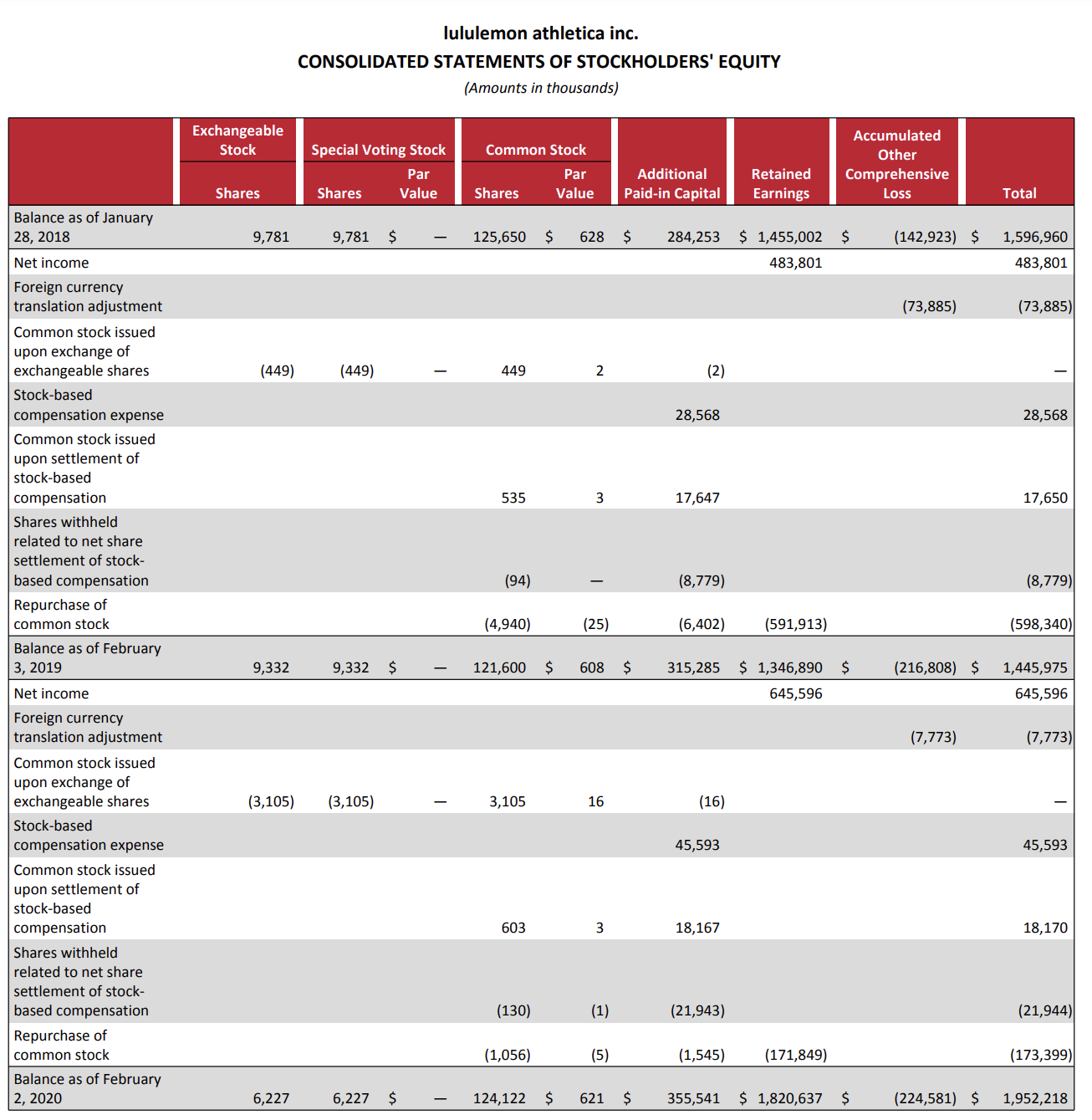

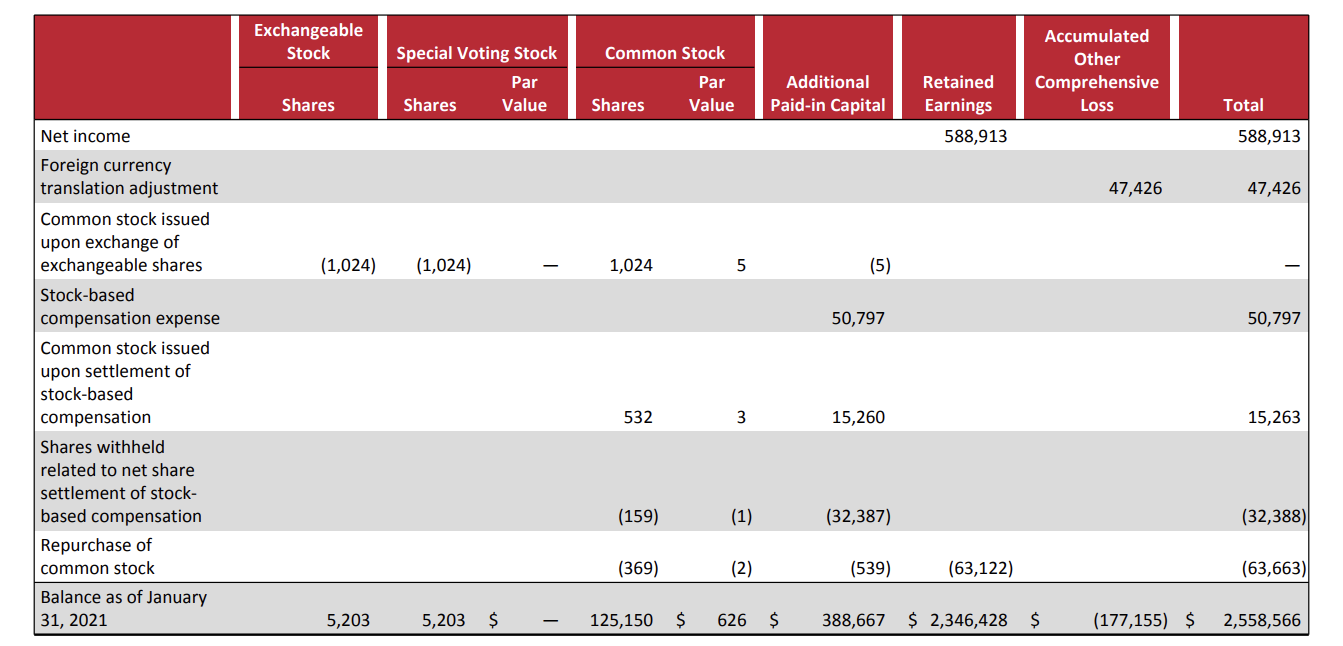

NOTE 4. PREPAID EXPENSES AND OTHER CURRENT ASSETS Prepaid expenses Forward currency contract assets Government payroll subsidy receivables Other current assets Prepaid expenses and other current assets January 31, February 2, 2021 2020 (In thousands) 82,164 5 64,568 17,364 1,735 13,309 12,270 4,239 125,107 5 70,542 lululemon athletica inc. CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (Amounts in thousands, except per share amounts) Fiscal Year Ended January 31, February 2, February 3, 2021 2020 2019 Net revenue 5 4,401,879 S 3,979,296 S 3,288,319 Cost of goods sold 1,937,888 1,755,910 1,472,032 Gross prot 2,463,991 2,223,386 1,816,287 Selling, general and administrative expenses 1,609,003 1,334,247 1,110,379 Amortization of intangible assets 5,160 29 72 Acquisitionrelated expenses 29,842 Income from operations 819,986 889,110 705,836 Other income (expense), net (636] 8,283 9,414 Income before income tax expense 819,350 897,393 715,250 Income tax expense 230,437 251,797 231,449 Net income 588,913 645,596 5 483,801 Other comprehensive income (loss), net of tax: Foreign currency translation adjustment 47,426 (7,773] [73,885] Comprehensive income 636,339 637,823 5 409,916 Basic earnings per share 4.52 4.95 3.63 Diluted earnings per share 4.50 4.93 3.61 Basic weighted-average number of shares outstanding 130,289 130,393 133,413 Diluted weightedaverage number of shares outstanding 130,871 130,955 133,971 lululemon athletica inc. CONSOLIDATED BALANCE SHEETS (Amounts in thousands, except per share amounts) January 31, February 2, 2021 2020 ASSETS Current assets Cash and cash equivalents 1,150,517 5 1,093,505 Accou nts receiya ble 62,399 40,219 Inventories 647,230 518,513 Prepaid and receivable income taxes 139,126 85,159 Prepaid expenses and other current assets 125,107 70,542 2,124,379 1,807,938 Property and equipment, net 745,687 671,693 Rightofuse lease assets 734,835 689,664 Goodwill 386,877 24,182 Intangible assets, net 80,080 241 Deferred income tax assets 6,731 31,435 Other noncurrent assets 106,626 56,201 4,185,215 5 3,281,354 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts payable 172,246 5 79.997 Accrued inventory liabilities 14,956 6,344 Other accrued liabilities 211,911 112,641 Accrued compensation and related expenses 130,171 133,688 Current lease liabilities 166,091 128,497 Current income taxes payable 8,357 26,436 Unredeemed gift card liability 155,848 120,413 Other current liabilities 23,598 12,402 883,178 620,418 Noncu rrent lease liabilities 632,590 611,464 Noncurrent income taxes payable 43,150 48,226 Deferred income tax liabilities 58,755 43,432 Other noncurrent liabilities 8,976 5,596 1,626,649 1,329,135 Commitments and contingencies Stockholders' equity Undesignated preferred stock, $0.01 par value: 5,000 shares authorized; none issued and outstanding Exchangeable stock, no par value: 60,000 shares authorized; 5,203 and 6,227 issued and outstanding Special voting stock, 50.000005 par value: 60,000 shares authorized: 5,203 and 6,227 issued and outstanding Common stock, $0.005 par value: 400,000 shares authorized; 125,150 and 124,122 issued and outstanding 626 621 Additional paidin capital 388,667 355,541 Retained earnings 2,346,428 1,820,637 Accumulated other comprehensive loss {177,155} {224,581} 2,558,566 1,952,218 4,185,215 5 3,281,354 lululemon athletica inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in thousands) Fiscal Year Ended January31, I FebruaryZ, I February3, 2021 2020 2019 Cash flows from operating activities Net income 5 588,913 5 545,596 S 483,801 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 185,478 151,933 122,484 Stockbased compensation expense 50,797 45,593 28,558 Derecognition of unredeemed gift card liability (13,596) (11,939) (5,859) Settlement of derivatives not designated in a hedging relationship 4,485 (1,925) (14,876) Deferred income taxes 34,908 24,129 16,786 Changes in operating assets and liabilities: Inventories (96,548) (117,591) (85,942) Prepaid and receivable income taxes (53,966) (35,775) [437) Prepaid expenses and other current assets (70,999) (53,754) (28,546) Other nOn-current assets (49,056) (27,852) (2,107) Accounts payable 82,553 (14,810) 71,952 Accrued inventory liabilities 8,046 (9,598) 4,312 Other accrued liabilities 91,115 14,276 9,416 Accrued compensation and related expenses (5,592) 25,326 41,500 Current and non-current income taxes payable (24,125) (34,137) 46,428 Unredeemed gift card liability 47,952 33,289 24,885 Right-of-use lease assets and current and non-current lease liabilities 13,257 17,422 Other current and non-current liabilities 10,784 9,133 31,304 Net cash provided by operating activities 803,336 559,316 742,779 Cash flows from investing activities Purchase of property and equipment (229,226) (283,048) (225,807) Settlement of net investment hedges (14,507) 347 (15,216) Acquisition, net of cash acquired (452,581) Other investing activities 882 4,293 (771) Net cash used in investing activities (595,532) (278,408) (242,794) Cash flows from nancing activities Proceeds from settlement of stock-based compensation 15,253 18,170 17,550 Taxes paid related to net share settlement of stock-based compensation (32,388) (21,944) (8,779) Repurchase of common stock (53,553) (173,399) (598,340) Other nancing activities (745) Net cash used in financing activities (80,788) (177,173) (590,214) Effect of exchange rate changes on cash 29,996 (1,550) (18,952) Increase (decrease) in cash and cash equivalents 57,012 212,185 (109,181) Cash and cash equivalents, beginning of period 5 1,093,505 S 881,320 5 990,501 Cash and cash equivalents, end of period 5 1,150,513l 5 1,093,505 S 881,320 lululemon athletica inc. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (Amounts in thousands Exchangeable Accumulated Stock Special Voting Stock Common Stock Other Par Par Additional Retained Comprehensive Shares Shares Value Shares Value Paid-in Capital Earnings Loss Total Balance as of January 28, 2018 9,781 9,781 $ 125,650 $ 628 $ 284,253 $ 1,455,002 $ (142,923) 1,596,960 Net income 483,801 483,801 Foreign currency translation adjustment (73,885) (73,885) Common stock issued upon exchange of exchangeable shares (449) (449) 449 2 (2) Stock-based compensation expense 28,568 28,568 Common stock issued upon settlement stock-based compensation 535 3 17,647 17,650 Shares withheld related to net share settlement of stock- based compensation (94) (8,779) (8,779) Repurchase of common stock (4,940) (25) (6,402) (591,913) (598,340) Balance as of February 3, 2019 9,332 9,332 $ 121,600 $ 608 $ 315,285 $ 1,346,890 $ (216,808) $ 1,445,975 Net income 645,596 645,596 Foreign currency translation adjustment (7, 773 ) (7,773) Common stock issued upon exchange of exchangeable shares (3,105) (3,105) 3,105 16 (16) Stock-based compensation expense 45,593 45,593 Common stock issued upon settlement of stock-based compensation 603 3 18,167 18,170 Shares withheld related to net share settlement of stock- based compensation (130) (1) (21,943) (21,944) Repurchase of common stock 1,056) (5) 1,545) (171,849) (173,399) Balance as of February 2, 2020 6,227 6,227 $ - 124,122 $ 621 $ 355,541 $ 1,820,637 $ (224,581) $ 1,952,218Net income Foreign currency translation adjustment Common stock issued upon exchange of exchangeable shares Stock-based compensation expense Common stock issued upon settlement of stock-based compensation Shares withheld related to net share settlement of stock- based compensation Repurchase of common stock Balance as ofJanuaryr 31, 2021 Exchangeable Stock Special Voting Stock Par Shares Shares Value [1,024] {1,024} 5,203 5, 203 S Common Stock Shares (159) (369) 125,150 5 Par (1! (2] 626 S Accumulated Other Additional Retained Comprehensive Value Paid-in Capital Earnings 583,913 (32,337) {539) {63,122} 388.667 5 2,346,428 3 Loss (177,155) 3 588,913 47,426 2,558,566