Question: Explain the micro factors and macro factors which affect the cost of money? What are the conclusions of Beta stability tests and Tests based on

- Explain the micro factors and macro factors which affect the cost of money?

- What are the conclusions of Beta stability tests and Tests based on the slope of the SML?

- Suppose Asset A has an expected return of 10 percent and a standard deviation of 20 percent. Asset B has an expected return of 16 percent and a standard deviation of 40 percent. If the correlation between A and B is 0.35, what are the expected return and standard deviation for a portfolio comprised of 40 percent Asset A and 60 percent Asset B?

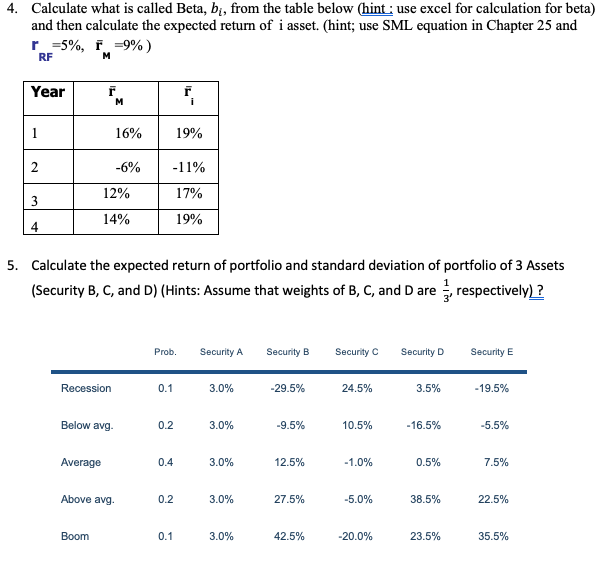

4. Calculate what is called Beta, bi, from the table below (hint : use excel for calculation for beta) and then calculate the expected return of i asset. (hint; use SML equation in Chapter 25 and RF 3%, FM=9%) Year 16% 19% -6% -11% 12% 17% 14% 19% 5. Calculate the expected return of portfolio and standard deviation of portfolio of 3 Assets (Security B, C, and D) (Hints: Assume that weights of B, C, and D are respectively) ? Prob. Security A Security B Security Security D Security E Recession 0.1 3.0% -29.5% 24.5% 3.5% -19.5% Below avg. 0.2 3.0% -9.5% 10.5% -16.5% -5.5% Average 3.0% 12.5% -1.0% 0.5% 7.5% Above avg. 0.2 3.0% 27.5% -5.0% 38.5% 22.5% Boom 3.0% 42.5% -20.0% 23.5% 35.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts