Question: please show work 1. Explain the micro factors and macro factors which affect the cost of money? 2. What are the conclusions of Beta stability

please show work

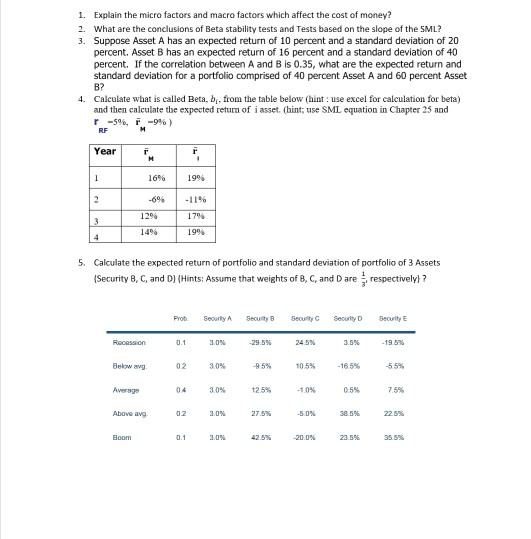

1. Explain the micro factors and macro factors which affect the cost of money? 2. What are the conclusions of Beta stability tests and Tests based on the slope of the SML? 3. Suppose Asset A has an expected return of 10 percent and a standard deviation of 20 percent. Asset B has an expected return of 16 percent and a standard deviation of 40 percent. If the correlation between A and B is 0.35, what are the expected return and standard deviation for a portfolio comprised of 40 percent Asset A and 60 percent Asset B? Calculate what is called Beta, b, from the table below (hint: use excel for calculation for beta) and then calculate the expected return of i asset. (hint; use SML equation in Chapter 25 and r -5%, F.-9%) Year F 1696 12% 5. Calculate the expected return of portfolio and standard deviation of portfolio of Assets (Security B, C, and D) (Hints: Assume that weights of B, C, and D are respectively)? Prob. Security Security Security Security Security Recession 0.1 2.0% 29.5% 24.5% 3.5% -19.8% Below 02 3.0% -95% 105% -16.5 -55% -10% OS 75% Above avg 02 2.0% 27.5% 5.0% 28.8% 23:55 1. Explain the micro factors and macro factors which affect the cost of money? 2. What are the conclusions of Beta stability tests and Tests based on the slope of the SML? 3. Suppose Asset A has an expected return of 10 percent and a standard deviation of 20 percent. Asset B has an expected return of 16 percent and a standard deviation of 40 percent. If the correlation between A and B is 0.35, what are the expected return and standard deviation for a portfolio comprised of 40 percent Asset A and 60 percent Asset B? Calculate what is called Beta, b, from the table below (hint: use excel for calculation for beta) and then calculate the expected return of i asset. (hint; use SML equation in Chapter 25 and r -5%, F.-9%) Year F 1696 12% 5. Calculate the expected return of portfolio and standard deviation of portfolio of Assets (Security B, C, and D) (Hints: Assume that weights of B, C, and D are respectively)? Prob. Security Security Security Security Security Recession 0.1 2.0% 29.5% 24.5% 3.5% -19.8% Below 02 3.0% -95% 105% -16.5 -55% -10% OS 75% Above avg 02 2.0% 27.5% 5.0% 28.8% 23:55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts