Question: Explain the solution to question e. DealHouse Ltd is a large retailer with six stores throughout Auckland. Like many brick and mortar retailers, it has

Explain the solution to question e.

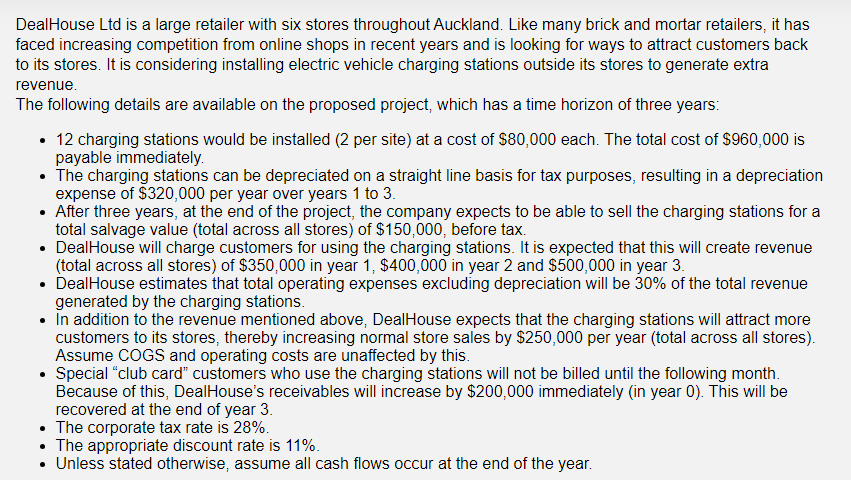

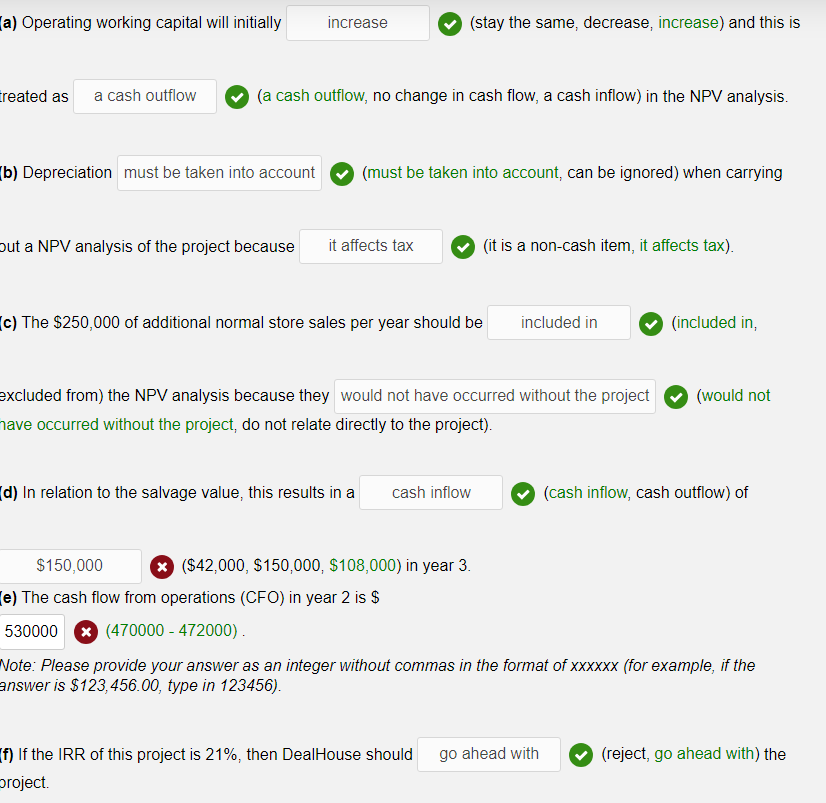

DealHouse Ltd is a large retailer with six stores throughout Auckland. Like many brick and mortar retailers, it has faced increasing competition from online shops in recent years and is looking for ways to attract customers back to its stores. It is considering installing electric vehicle charging stations outside its stores to generate extra revenue, The following details are available on the proposed project, which has a time horizon of three years: - 12 charging stations would be installed (2 per site) at a cost of $80,000 each. The total cost of $960,000 is payable immediately. - The charging stations can be depreciated on a straight line basis for tax purposes, resulting in a depreciation expense of $320,000 per year over years 1 to 3 . - After three years, at the end of the project, the company expects to be able to sell the charging stations for a total salvage value (total across all stores) of $150,000, before tax. - DealHouse will charge customers for using the charging stations. It is expected that this will create revenue (total across all stores) of $350,000 in year 1,$400,000 in year 2 and $500,000 in year 3 . - DealHouse estimates that total operating expenses excluding depreciation will be 30% of the total revenue generated by the charging stations. - In addition to the revenue mentioned above, DealHouse expects that the charging stations will attract more customers to its stores, thereby increasing normal store sales by $250,000 per year (total across all stores). Assume COGS and operating costs are unaffected by this. - Special "club card" customers who use the charging stations will not be billed until the following month. Because of this, DealHouse's receivables will increase by $200,000 immediately (in year 0 ). This will be recovered at the end of year 3 . - The corporate tax rate is 28%. - The appropriate discount rate is 11%. - Unless stated otherwise, assume all cash flows occur at the end of the year. (a) Operating working capital will initially (stay the same, decrease, increase) and this is reated as (a cash outflow, no change in cash flow, a cash inflow) in the NPV analysis. b) Depreciation (must be taken into account, can be ignored) when carrying out a NPV analysis of the project because (it is a non-cash item, it affects tax). c) The $250,000 of additional normal store sales per year should be (included in, excluded from) the NPV analysis because they (would not have occurred without the project, do not relate directly to the project). d) In relation to the salvage value, this results in a (cash inflow, cash outflow) of * ($42,000,$150,000,$108,000) in year 3 . e) The cash flow from operations (CFO) in year 2 is $ (470000 - 472000). Vote: Please provide your answer as an integer without commas in the format of xxxxxx (for example, if the answer is $123,456.00, type in 123456 ). f) If the IRR of this project is 21%, then DealHouse should (reject, go ahead with) the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts