Question: Portfolio Problem: Part 1 Formulate the appropriate linear program for this situation. Portfolio Problem: Part 2 Using Excel's Solver: What is the optimal portfolio that

Portfolio Problem: Part 1

Formulate the appropriate linear program for this situation.

Portfolio Problem: Part 2

Using Excel's Solver: What is the optimal portfolio that achieves the objective? What is the return of this portfolio?

Portfolio Problem: Part 3

Upload a screenshot of the spreadsheet that you used to solve this problem.

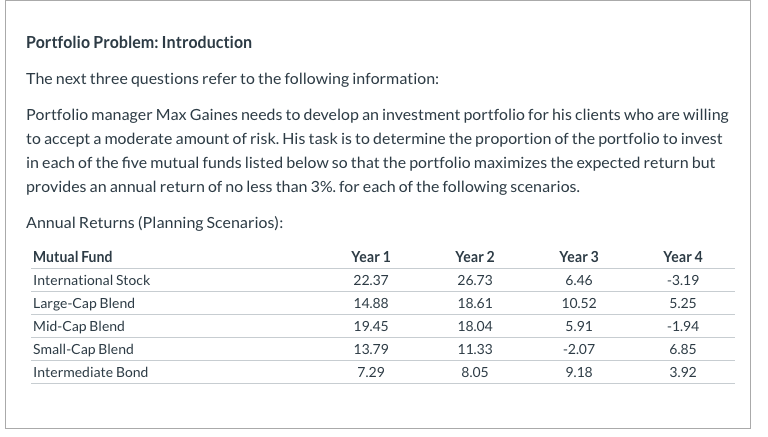

Portfolio Problem: Introduction The next three questions refer to the following information: Portfolio manager Max Gaines needs to develop an investment portfolio for his clients who are willing to accept a moderate amount of risk. His task is to determine the proportion of the portfolio to invest in each of the five mutual funds listed below so that the portfolio maximizes the expected return but provides an annual return of no less than 3%. for each of the following scenarios. Annual Returns (Planning Scenarios): Year 3 Mutual Fund International Stock Large-Cap Blend Mid-Cap Blend Small-Cap Blend Intermediate Bond Year 1 22.37 14.88 19.45 13.79 7.29 Year 2 26.73 18.61 18.04 11.33 8.05 6.46 10.52 5.91 -2.07 9.18 Year 4 -3.19 5.25 -1.94 6.85 3.92Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts