Question: explain the table how we get it, and is there is another way to solve it. In 2012 Kabir Inc paid $1.25 as dividend. In

explain the table how we get it, and is there is another way to solve it.

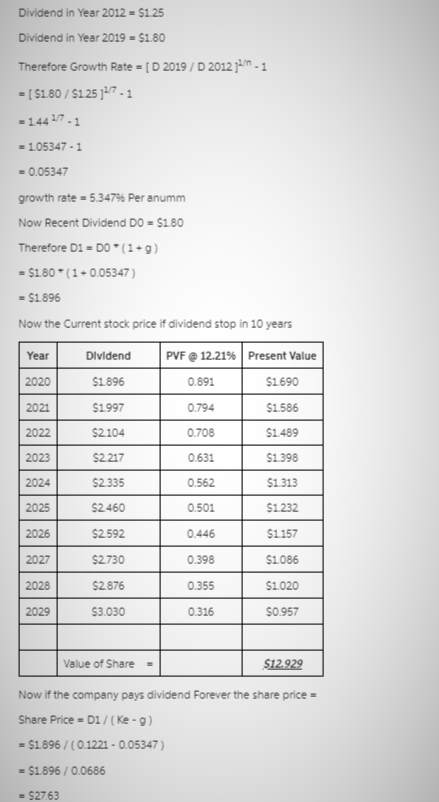

In 2012 Kabir Inc paid $1.25 as dividend. In the most recent dividend in 2019 the dividend was$1.80. The number of years between these two dividends (n) is 7 years. If the required return of 12.21%. What is the current stock price if we anticipate dividends stopping in 10 years (because the company will go bankrupt)? B) if the company pays the dividends forever (does not go bankrupt) what is the current stock price?

Dividend in Year 2012-$1.25 Dividend in Year 2019 = $1.80 Therefore Growth Rate = [D 2019 / D 2012 1 - 1 = [$1.80 / $1.25 14/7 - 1 -1441/7-1 - 105347-1 = 0.05347 growth rate = 5.347% Per anumm Now Recent Dividend DO = $1.80 Therefore D1 = DO*(1+g) = $1.80*(1+0.05347) = $1.896 Now the Current stock price if dividend stop in 10 years Year Dividend PVF @ 12.21% Present Value 2020 $1.896 0.891 $1.690 2021 $1.997 0.794 $1.586 2022 $2.104 0.708 $1.489 2023 $2.217 0.631 $1.398 2024 $2.335 0.562 $1.313 2025 $2.460 0.501 $1.232 2026 $2.592 0.446 $1.157 2027 $2.730 0.398 $1.086 2028 $2.876 0.355 $1.020 2029 $3.030 0.316 $0.957 Value of Share $12.929 Now if the company pays dividend Forever the share price = Share Price D1/(Ke-g) = $1.896 / (0.1221 -0.05347) = $1.896 / 0.0686 - $27.63

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we need to follow these steps 1 Calculate the growth rate of the dividend The ... View full answer

Get step-by-step solutions from verified subject matter experts