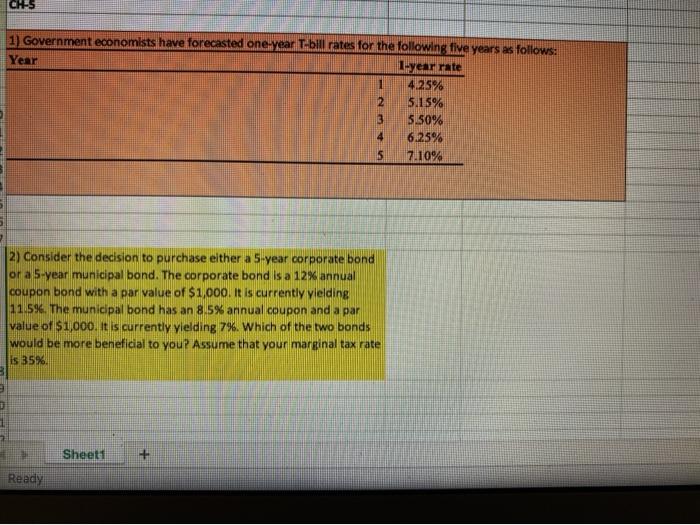

Question: explain this in excel you need any more information? CH-5 1) Government economists have forecasted one year Tbil rates for the following five years as

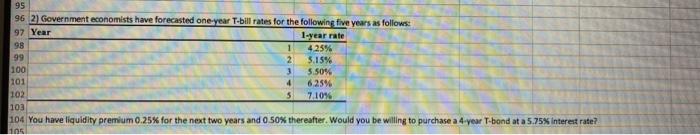

CH-5 1) Government economists have forecasted one year Tbil rates for the following five years as follows: Year L-year rate 4.25% 12 5.15% 3 5.50% 4 6.25% 5 7.10% 2) Consider the decision to purchase either a 5-year corporate bond or a 5-year municipal bond. The corporate bond is a 12% annual coupon bond with a par value of $1,000. It is currently vielding 11.5%. The municipal bond has an 8.5% annual coupon and a par value of $1,000. It is currently vielding 7%. Which of the two bonds would be more beneficial to you? Assume that your marginal tax rate is 35% Sheet1 + Ready 95 96 2) Government economists have forecasted one year T-bill rates for the following five years as follows: 97 Year 1-year rate 98 1 4.25% 99 2 5.15% 100 3 5.50% 101 4 6,25% 102 5 7.10% 103 104 You have liquidity premium 0.25% for the next two years and 0.50% thereafter. Would you be willing to purchase a 4-year T-bond at a 5.75% interest rate? 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts