Question: Explain to me with detail calculation. Please 91) Katrina is a one-third partner in the KYR Partnership (calendar year-end). Katrina decides she wants to exit

Explain to me with detail calculation. Please

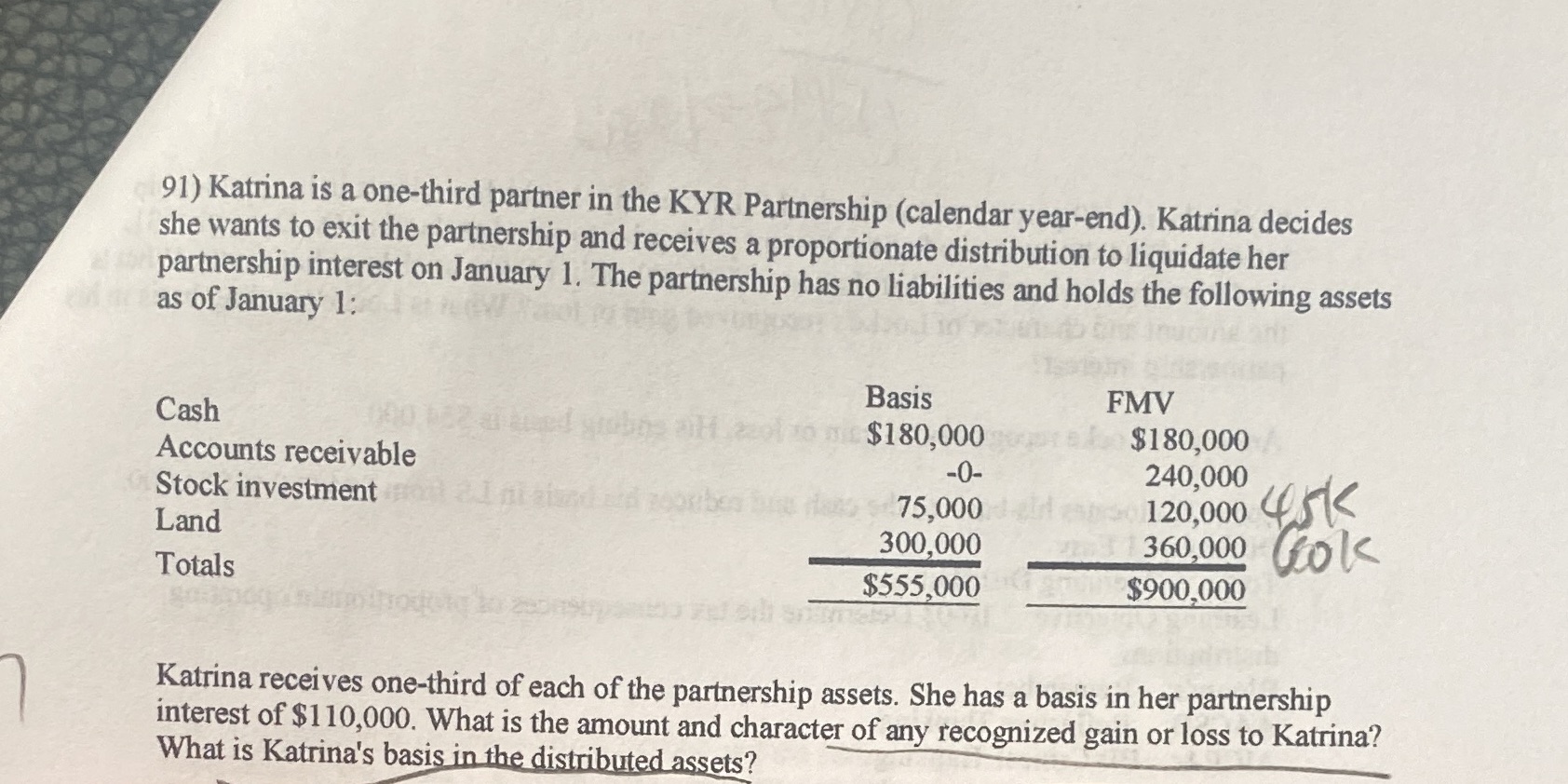

91) Katrina is a one-third partner in the KYR Partnership (calendar year-end). Katrina decides she wants to exit the partnership and receives a proportionate distribution to liquidate her partnership interest on January 1. The partnership has no liabilities and holds the following assets as of January 1: Basis FMV Cash 20 10 m$180,000 $180,000 Accounts receivable -0- 240,000 Stock investment 75,000 120,000 45k Land 300,000 360,000 Gok Totals $555,000 $900,000 Katrina receives one-third of each of the partnership assets. She has a basis in her partnership interest of $1 10,000. What is the amount and character of any recognized gain or loss to Katrina? What is Katrina's basis in the distributed assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts