Question: Katrina is a one - third partner in the KYR partnership ( calendar year - end ) . Katrina decides she wants to exit the

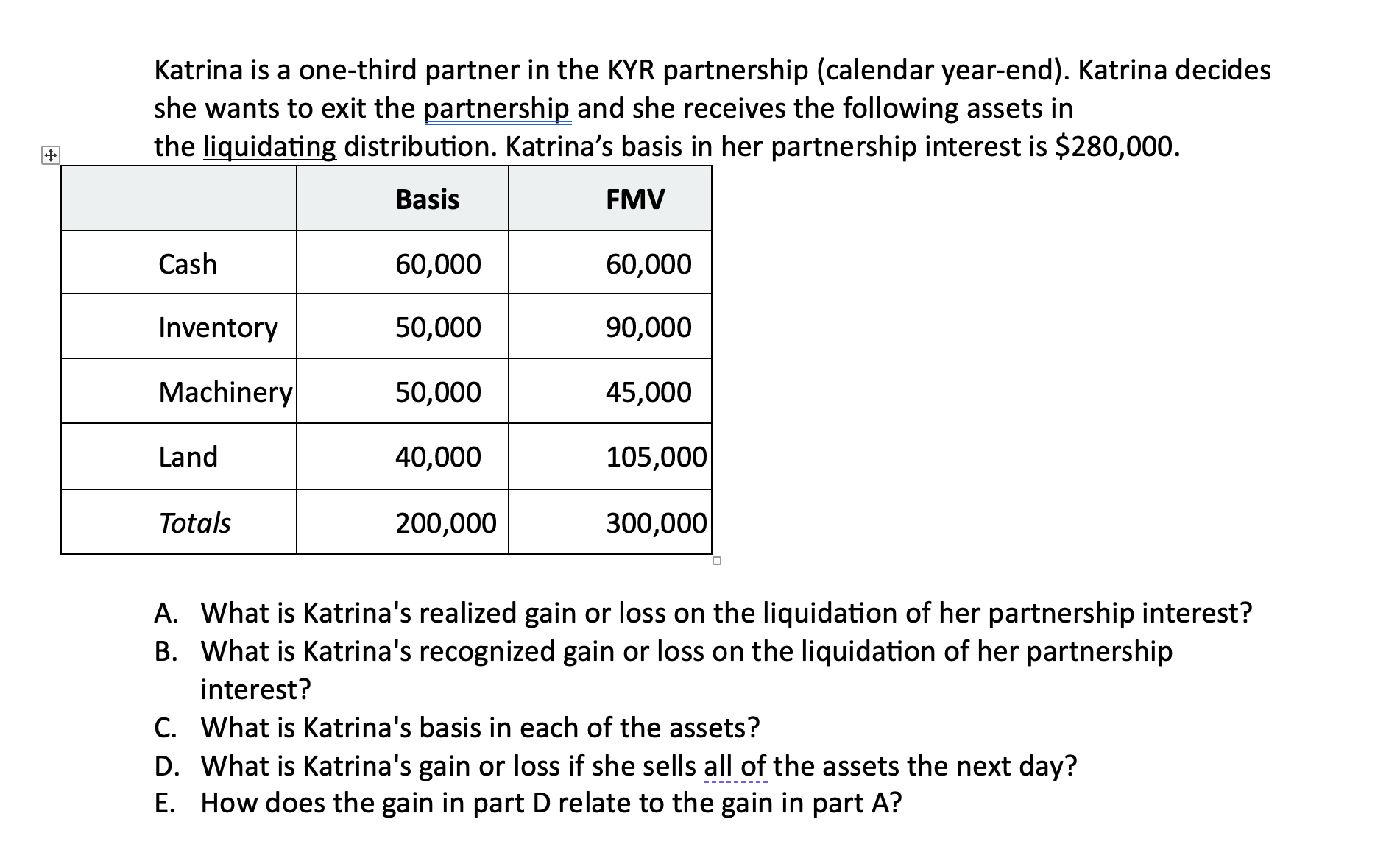

Katrina is a onethird partner in the KYR partnership calendar yearend Katrina decides she wants to exit the partnership and she receives the following assets in the liquidating distribution. Katrina's basis in her partnership interest is mathbf$

A What is Katrina's realized gain or loss on the liquidation of her partnership interest?

B What is Katrina's recognized gain or loss on the liquidation of her partnership interest?

C What is Katrina's basis in each of the assets?

D What is Katrina's gain or loss if she sells all of the assets the next day?

E How does the gain in part D relate to the gain in part A

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock