Question: explain what method is used and why with each step. especially on why we pick one alternative over the other. 8-33 The owner of a

explain what method is used and why with each step. especially on why we pick one alternative over the other.

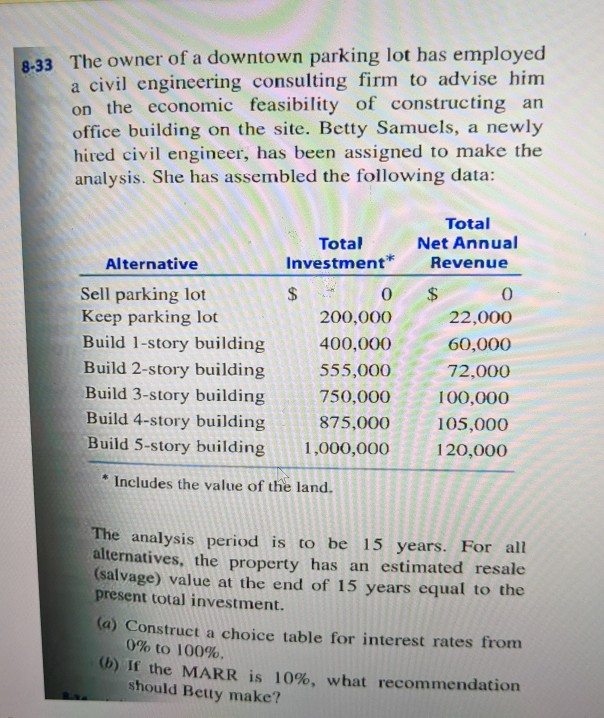

8-33 The owner of a downtown parking lot has employed a civil engineering consulting firm to advise him on the economic feasibility of constructing an office building on the site. Betty Samuels, a newly hired civil engineer, has been assigned to make the analysis. She has assembled the following data: Alternative Sell parking lot Keep parking lot Build 1-story building Build 2-story building Build 3-story building Build 4-story building Build 5-story building Total Investment* 0 200,000 400,000 555,000 750,000 875,000 1,000,000 Total Net Annual Revenue $ 0 22,000 60,000 72,000 100,000 105,000 120,000 * Includes the value of the land. The analysis period is to be 15 years. For all alternatives, the property has an estimated resale (salvage) value at the end of 15 years equal to the present total investment. a) Construct a choice table for interest rates from 0% to 100% (b) If the MARR is 10%, what recommendation should Betty make? 8-33 The owner of a downtown parking lot has employed a civil engineering consulting firm to advise him on the economic feasibility of constructing an office building on the site. Betty Samuels, a newly hired civil engineer, has been assigned to make the analysis. She has assembled the following data: Alternative Sell parking lot Keep parking lot Build 1-story building Build 2-story building Build 3-story building Build 4-story building Build 5-story building Total Investment* 0 200,000 400,000 555,000 750,000 875,000 1,000,000 Total Net Annual Revenue $ 0 22,000 60,000 72,000 100,000 105,000 120,000 * Includes the value of the land. The analysis period is to be 15 years. For all alternatives, the property has an estimated resale (salvage) value at the end of 15 years equal to the present total investment. a) Construct a choice table for interest rates from 0% to 100% (b) If the MARR is 10%, what recommendation should Betty make

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts