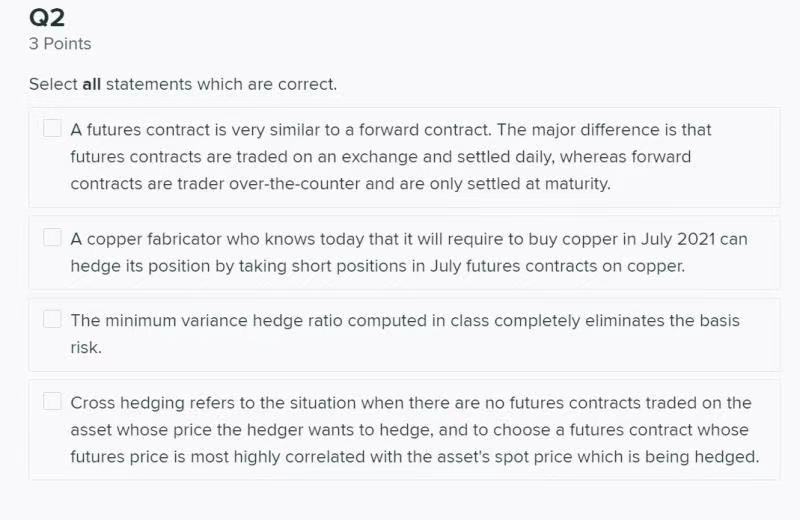

Question: Explain whether option C is correct or not? Minimum Variance Hedge Ratio t = time at which hedge is put in place t = time

Explain whether option C is correct or not?

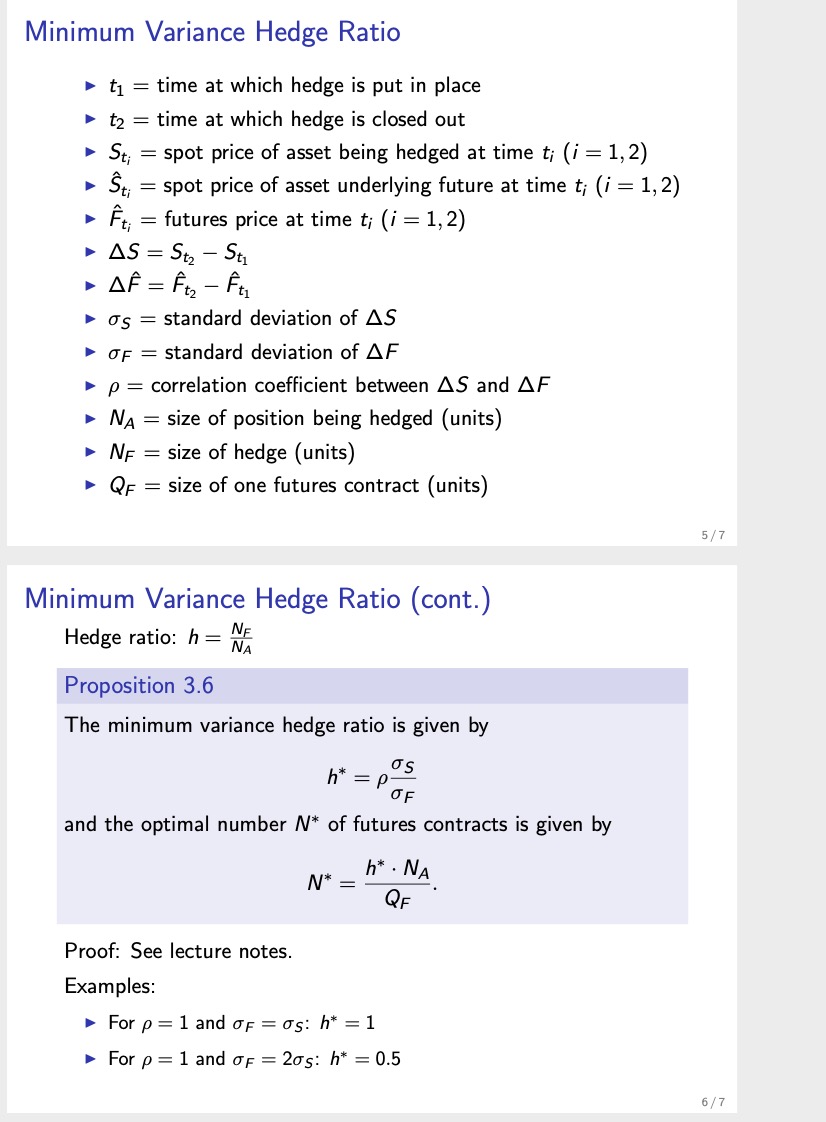

Minimum Variance Hedge Ratio t = time at which hedge is put in place t = time at which hedge is closed out Sti spot price of asset being hedged at time t; (i = 1,2) Sti = spot price of asset underlying future at time t; (i = 1, 2) Ft = futures price at time t; (i = 1,2) AS = St - St AF = Ft - Ft = os standard deviation of AS OF standard deviation of AF p = correlation coefficient between AS and AF NA = size of position being hedged (units) NF = size of hedge (units) QF = size of one futures contract (units) Minimum Variance Hedge Ratio (cont.) NF Hedge ratio: h= NA Proposition 3.6 The minimum variance hedge ratio is given by h* = P- OF and the optimal number N* of futures contracts is given by N* = h*. NA QF Proof: See lecture notes. Examples: For p = 1 and oF = os: h* = 1 For p = 1 and or = 20s: h* = 0.5 5/7 6/7

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Option C The minimum variance hedge ratio computed in class completely eliminates basis risk ... View full answer

Get step-by-step solutions from verified subject matter experts